Czech National Bank preview: No action, with a preference for stability

The Czech National Bank (CNB) will likely keep interest rates at the current level of 7%. The decision will likely be accompanied by a statement that any rate cuts depend on inflation showing a clear trend towards the 2% inflation target

| 7% |

No changeCNB's key rate |

CNB likely to keep interest rates unchanged at 7%

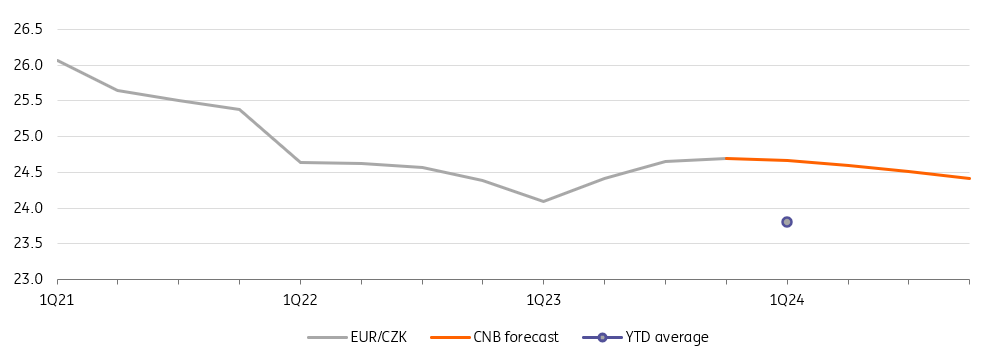

The Czech National Bank’s monetary-policy meeting next week will unlikely bring a change of interest rate. We expect CNB 2W repo rate will remain flat at 7%, where it stays since last hike in June 2022. CNB board members recently reiterated their mantra the current setting of monetary-policy instruments is sufficient to return the inflation back to 2% target in the beginning of 2024. While the CNB forecast suggests the need to hike rates in the first quater 2023 by around 100bp, followed with relatively hefty rate cuts during the remainder of this year, CNB board members advocate rather rate stability at current level until there is a visible and significant decline in CPI below the nominal interest rate. One of the reason CNB mentions is the raising appetite of corporate sector for EUR denominated loans, which provide lower financing costs compared to CZK loans. The CNB officials assume that if CZK interest rates would increase further, the deman of corporate sector for FX loans would strenghten too and hence this would make the transmission of CNB monetary policy less effective. This is the reason why the CNB board in the new composition bets more on the effect of strong currency, which should likely tame the imported inflation from higher commodity prices. The outperformance of Czech koruna since the beginning of the year, compared to CNB forecast, is clearly welcome by CNB as it lowers the need to tighten monetary policy mix via interest rates. So far koruna remains stronger, compared to CNB forecast, by 3.5% in the first quarter, which equals (in the rule of thumb) roughly to the equivalent of 75-100bp hike in interest rate. Therefore, the CNB feels no need to track its winter forecast suggestion to deliver additional sizable hike any time soon.

CNB winter forecast of EUR/CZK vs. actual development

On the contrary, CNB officials stressed several time the opinion they prefer prudent approach in the sence that interest rates should remain at current level for extended period, until there is a visible and sizable decline in inflation back towards the 2% inflation target. In addition, vicegovernor Eva Zamrazilova mentioned earlier that she assumes broader definition of price stability, i.e. embracing not only consumer prices but also real-estate prices. Czech economy experienced several years of double-digit growth of dwellings‘ prices which was – to some extend – alse fuelled by cheap mortgages. Despite the previous tightenig of macroprudential tools, only the sharp increase of interest rate stopped the hefty real-estate price spiral. Therefore, it seems more likely the CNB will keep the interest rate at current level until it sees the risk of real-estate price inflation is not a risk any more. The CNB can also feel more comfort with the core inflation being gradually declining already for five consecutive months in row, as the result of realtively early monetary policy tightening.

Core inflation gradually declining

Our FX and rates call

The Czech koruna was the second most affected currency after the Hungarian forint during the recent financial market turmoil due to its previously very heavy long positioning and sensitivity to energy prices. However, we believe that the factors pushing the koruna to stronger levels still remain. Moreover, potential losses are limited by the central bank's readiness to intervene in the FX market. Thus, in our view, current market conditions i.e. higher EUR/USD, lowering risk aversion, falling gas prices and decent stable carry are the ideal constellation for the koruna to return to its earlier record strong levels. Although the forint is probably more juicy from this perspective, we believe the koruna offers the best risk/reward within the CEE region at the moment.

In the rates space, the drop in core rates led to a significant dovish shift in the CZK market. At this point, the market has fully priced in the first rate cut in the middle of year and roughly 130bps by the end of this year. This is a far from our forecast or the CNB's alternative scenario, which is the board's preferred scenario at the moment. The latter assumes the first rate cut only in the fourth quarter of this year. Thus, overall, we see the largest market mispricing in CZK curve within CEE region and we believe the CNB meeting will be the catalyst to correct these expectations.

In the Czech governmant bonds space (CZGBs), Q1 financing points to a very comfortable situation for MinFin with 28% coverage of issuance needs, which should limit the potential sell-off after the current rally. On the other hand, we see risks on the fiscal policy side in weaker tax revenues and potential additional costs stemming from indexation of old-age pensions. Overall, however, we see a sound story of CZGBs, but also not much potential to rally from current levels compare to other peers within the CEE region, making CZGBs a safe haven if risks materialize at the global level.