Czech apartment price rise continues

Czech apartment prices accelerated in 2H18, most likely due to the frontloading effect motivated by new macroprudential central bank rules. In our view, apartment prices should slow down this year

Strong price growth in 2H18

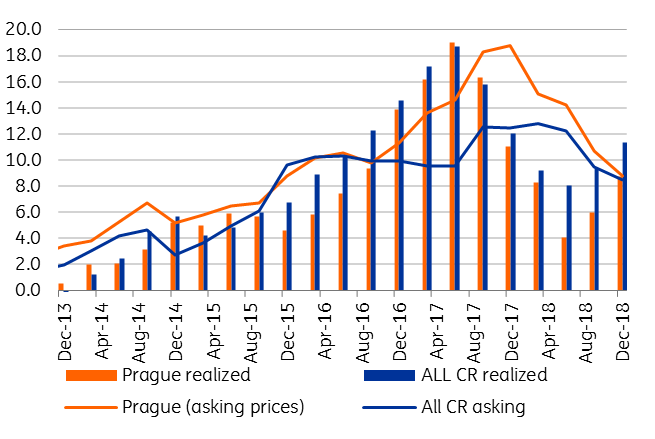

Czech apartment prices grew by 11.4% YoY in 4Q18, after growing by 9.4% in 3Q18 and 8.5% in the first half of 2018. In Prague, the prices of apartments rose by 8.7% YoY, while 1-3Q18 average growth was just 6%, but the prices of new apartments accelerated almost 18% YoY, after 14% average growth in 2017 and 1-3Q18-average.

Driven by frontloading activity on the credit market

The sharp rise in apartment prices in 2H18 is most likely related to strong activity in the Czech property market in 3Q18 and at the beginning of 4Q18, due to the frontloading effect on the back of stricter macroprudential recommendations of the Czech central bank.

The volume of new housing loans accelerated by 30% in September and 50% in October 2018, as many were concerned mortgages might become unavailable to them after the new central bank measures.

Asking and realized prices of flats (% YoY)

Prices to slowdown this year

Given the frontloading effect pushing prices up in 2018, the slightly weaker economic activity expected this year, and mainly new stricter central bank measures limiting access to mortgages, we believe property price growth will significantly slow down this year.

This is also indicated by asking prices, which have been gradually slowing down last year – from 13% in 4Q17 to 8.5% in 4Q18. In Prague, the slowdown was even more pronounced, from 19% to 8.7% in 4Q18, which represents the slowest rise since 3Q15. Though the number of houses that have construction permits grew by 15.3% YoY and completed housing jumped up by 28.2% YoY in January 2019, there is no expectation that supply will continue at this solid pace and the number of available flats will continue to grow. In fact, limited supply will remain the main factor why prices won't decline despite the factors mentioned above which will limit demand this year.