Czech credit activity slightly weaker in September

Weaker new housing loans for a third consecutive month suggest the tighter central bank measures are affecting the credit market

Total credit dynamics still favourable, mainly for housing loans

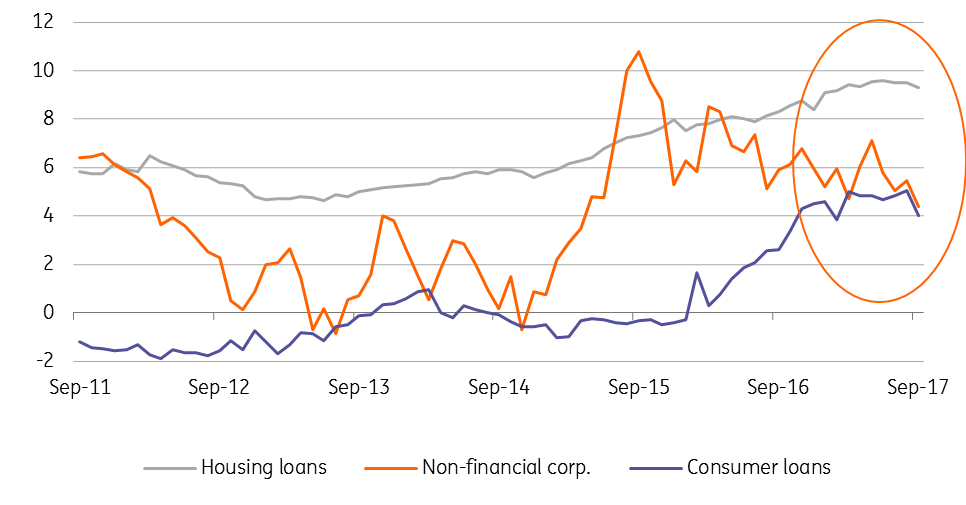

The Czech National Bank (CNB) published September banking statistics yesterday. From the perspective of total loans level, all figures signal reasonable dynamics, though they have slightly slowed down in September compared with the previous month. Consumer loans grew by 4% year-on-year, loans to non-financial corporations by 4.4% YoY, and housing loans by a strong 9.3%.

Banking credit dynamics (%YoY)

New housing loans slow down

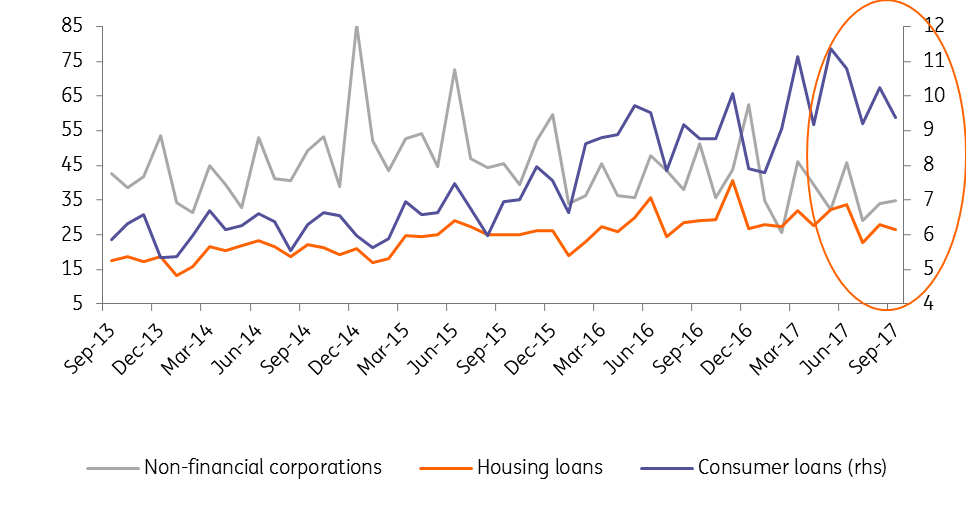

From the point of view of newly granted loans (i.e., the flow of credit in the given month), the September values were weaker mainly for new housing loans and their volume reached CZK26.4bn, which is the second-lowest number since mid-2016 and a 9% YoY decline.

Also, new consumer loans were slightly weaker compared with the previous month, but the September volume of CZK9.3bn was only marginally below the 2017-year average and still represents solid 7% YoY growth. New loans to non-financial corporations amounted to CZK34.7bn, and the figure was also slightly below the year-to-date-average.

New CZK loans (CZKbn)

| -6.3% |

Average 3-month YoY decline in new housing loanssuggests impact of new central bank measures |

Most likely impact of stricter CNB recommendations

The volume of new housing loans continues to slow down, and as the September print suggests the weaker values in July and August were not "holiday" effects only.

According to the latest bank lending survey released by the CNB, banks believe that weaker housing loans in 3Q17 were related to a frontloading of mortgages a quarter earlier due to concerns that credit availability will be reduced given the tighter macroprudential measures of the CNB pushing lower Loan-to-Value limits. Recent figures, however, suggest that weaker housing dynamics are most likely related to the CNB’s stricter recommendations combined with the limited supply of new flats for sale and their higher prices.

Higher rates will keep housing loans activity weaker

As such, we expect that new housing loans will remain slightly weaker and will not repeat the strong volumes observed in the last year (2H16 and 1H17). Demand for housing loans in the forthcoming period will also be reduced by rising interest rates. Although the first historical increase in the official CNB rates in early August has not caused any visible increase in mortgages rates yet, the market is starting to price in the higher chance of a gradual hiking cycle by the CNB. This means that market interest rates of longer maturities are increasing and have already reached the highest levels in the last few years. In this context, interest rate for mortgages are unsustainably low, and their increase is just a matter of the time.

| 2.1% |

Average mortgage rate in Septemberis unsustainably low given curent market rates |

Another reason for a 25bp hike only

Weaker housing credit might provide the CNB Board some comfort not to pull the brakes by a 50bp hike tomorrow. Instead, we expect it to continue with gradual tightening, as suggested in the latest Minutes and expect the traditional 25bp hike.

Download

Download snap