World trade in free-fall amid coronavirus crisis

As covid-19 causes factory outages and reduces spending across the globe, a wave of declining trade volumes follows the virus. Those volumes in February declined 2.6% year-on-year and we can expect no rebound for many months

World trade volumes published today by the CPB* showed a significant decline in February of -2.6% year on year. All regions were in decline. Factory outages in China reduced that country's export and import volumes, which heavily weighed on the world trade figure. Despite a fierce decline in trade volumes globally, the full extent of the Covid-19 crisis is still not reflected in these numbers. Most ships take about a month to reach western Europe and the US, meaning that the decline in Chinese exports in February won’t affect European and US import figures before March.

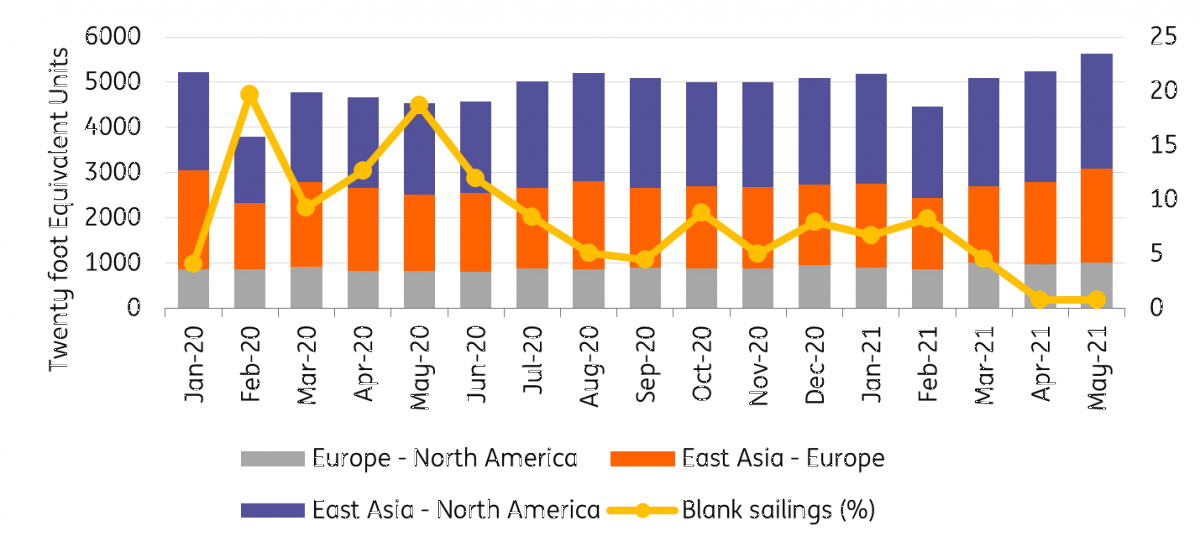

Container ships: share of cancellations in total scheduled departures

Over the last couple of weeks, Factories in China have been reopening but Europe and the US are still being hit hard, depressing demand and pushing down trade volumes even further. The full extent of the crisis is clearly visible in cancelled departures of container ships. The chart below suggests that 20- 30% of scheduled departures have been cancelled until May.

Because the situation is very uncertain, it is hard to tell how this will translate in an annual growth rate for 2020. However, using scenario analysis we offer some guidance on what to expect. Read about these scenarios in our trade outlook.