Copper: China copper trade snapshot

Covid-19 has taken its toll on copper concentrate shipments to China over the past two months and also disrupted the scrap supply chain. That's resulted in reduced scrap imports to the country. However, cathode imports surged in June riding arbitrage opportunities

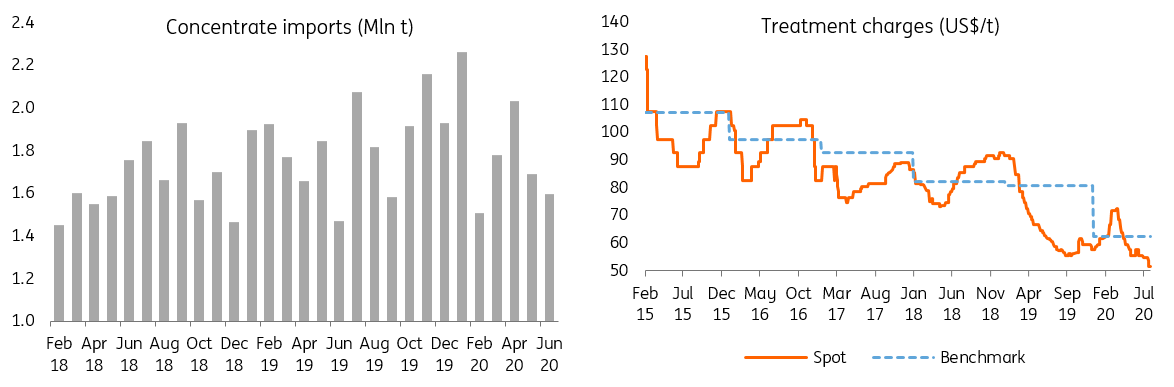

Concentrate imports fall along with spot treatment charges

Copper concentrate imports continued to fall in June, declining by 11% MoM despite total imports over the first half of this year growing by 2.9% YoY. The reduced concentrate imports over the past two months are largely impacted by shipment delays from major mining countries such as Peru and Chile which have lately become Covid-19 hotspots.

This has put pressure on the spot treatment charges (TCs) that Chinese smelters receive and further weighed on their margins. China has also been importing a rising volume of anode, which surged by 15% YoY in 1H20. Presumably, this is in favoured by some secondary producers as an alternative feeding source amid reduced scrap supply.

Concentrate imports fall along with declining spot treatment charges

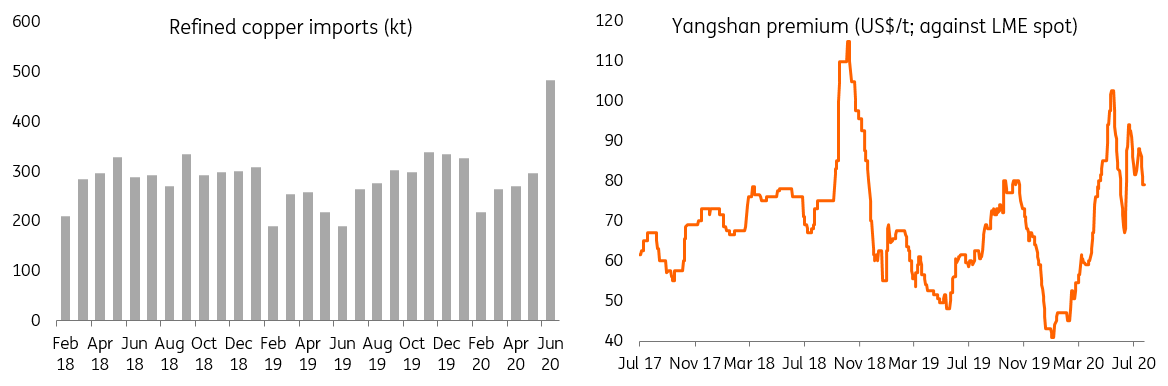

Cathode imports surge riding arbitrage opportunities

Copper cathode imports exploded in June to almost half a million tonnes (+62% MoM) riding arbitrage opportunities and this has also been partially reflected in an elevated Yangshan premium. Total imports during the 1H have increased by 24% YoY.

Cathode imports surge

Falling scrap supply to China has helped fuel the copper market rally

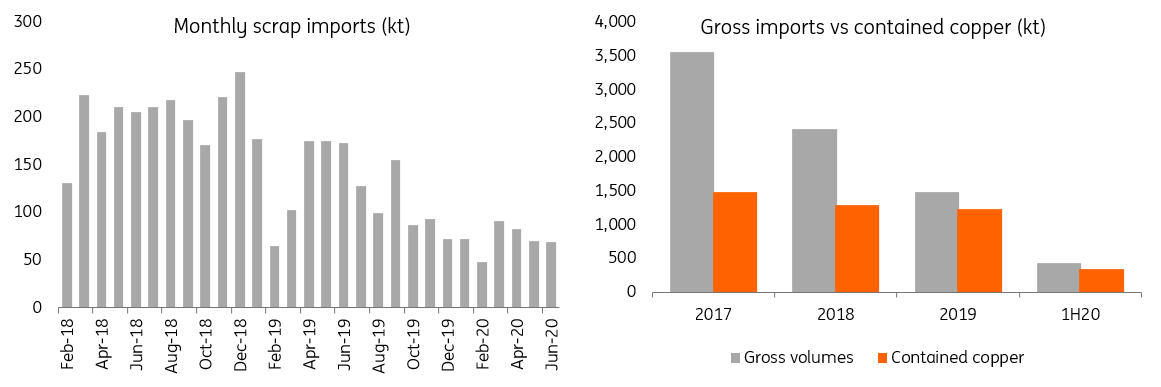

China scrap related policy changes in recent years have redrawn the landscape for copper scrap imports which have continued to fall in terms of gross volume. As high-quality scrap is preferred, the overall volume of copper contained in the scrap has been rather steady over the past two years. Covid-19 has taken its toll on both domestic and imported Chinese supply chains. The fact is that scrap has remained an important part of China's copper demand along with primary sources.

In gross terms, scrap imports halved in the first half of 2020 from a year ago. In addition, the copper contained within scrap imports during 1H20 is only 28% against the total volume imported for the whole of 2019. As we're also seeing in the aluminium market from China, the void created by a reduced scrap supply has led to displacement from primary metals, namely cathode, which is unusual. This has been one of the bull drivers in copper prices during 2Q20.

The questions will remain as to whether scrap imports could grow during 2H as we mentioned here, noting that scrap has become tangled up at ports. However, more recent reports showing that container shipping firms including Hapag-Lloyd and Mediterranean Shipping Co. (MSC) have indicated they will no longer accept scrap metal or paper as cargo to Chinese ports. This has added greater uncertainty to the scrap supply to the country.

For our take on what's happening to the Chinese aluminium market, click here.

Scrap supply: a void to be filled