China: weaker retail sales is a concern

China's activity data show that infrastructure has finally come to the rescue of the economy. But is it too little, too late? Retail sales growth is slowing.

Infrastructure eventually comes to rescue

It is important to see fiscal money finally entering into infrastructure projects at a time when the government insists on keeping tightening measures on residential property. Fixed asset investment grew 5.7%YoY YTD in October compared to 5.4% in September.

Although infrastructure investment growth is still slow compared to real estate projects, the growth rates of both should converge as more fiscal money goes into infrastructure in the coming months.

Industrial production is holding up well due to the front loading of exports

Industrial production grew 5.9%YoY in October, up from 5.8% in September. Front loading of export activities is helping here. We expect this growth to continue until January when US tariffs on $200 billion goods rise from 10% to 25%.

But weaker than expected retail sales is a concern

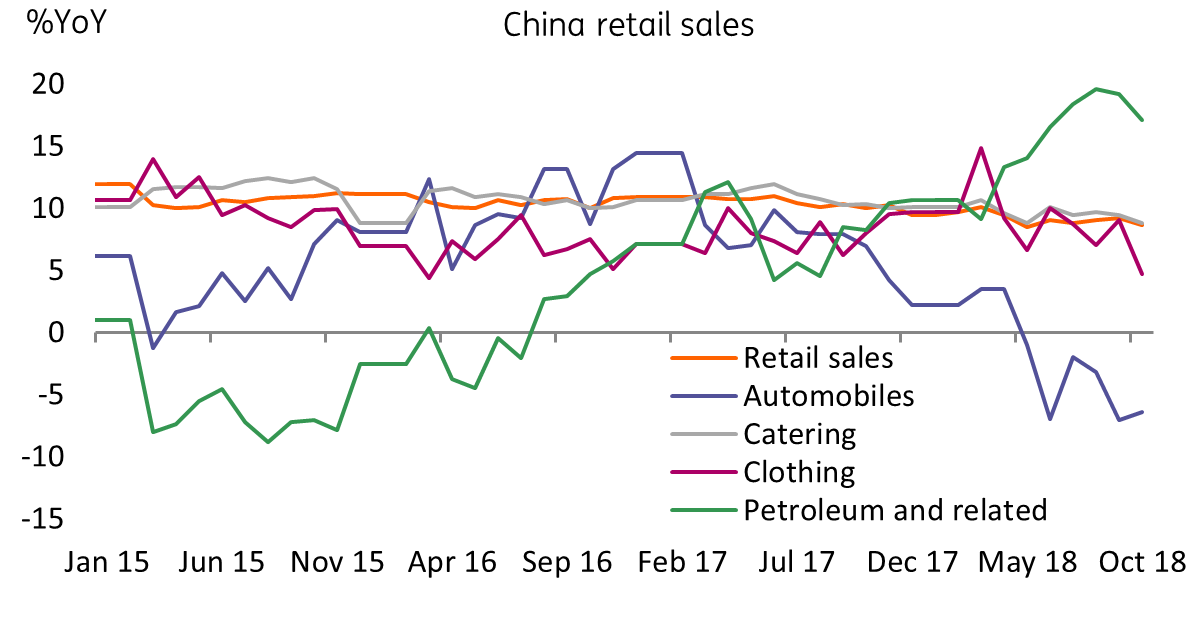

Retail sales growth is important to China as it reflects consumers' appetite for spending. But retail sales grew weaker than expected at 8.6%YoY in October, down from 9.2% in September. The slowdown is a surprise to us as October is a holiday month in China. Inbound tourism should not just bring faster growth of petroleum demand but also catering and other consumption items.

This makes us think that the fiscal stimulus from infrastructure is taking its time in arriving. And in the meantime, consumers have started to worry that the trade war will impact on wage growth and job security.

We hope that this will only be temporary as tax cuts for salary earners in 2019 should support spending sentiment in coming months, and spending on 11th November should indicate consumption is still growing well.

China retail sales weaker than expected

We keep our GDP forecast at 6.3%YoY in 4Q18

Though the slowdown in retail sales is unexpected it is currently outweighed by better industrial production activity. We expect that fiscal stimulus will continue to contribute to a faster pace of growth of fixed asset investment. This will keep most jobs secure, although wage growth could slow slightly. This would then will put pressure on consumer spending.

We are therefore keeping our GDP growth for 4Q18 unchanged at 6.3%YoY, and for the whole of 2018 at 6.6%. We expect GDP growth will slow to 6.3% in 2019 as a result of the trade war's effects on manufacturing activity.

Download

Download snap