China: Expect softer, but not soft trade

Trade likely to be slightly softer, but a strong yuan is not an issue when global demand is rising

Export growth slower, but still good because of rising global demand

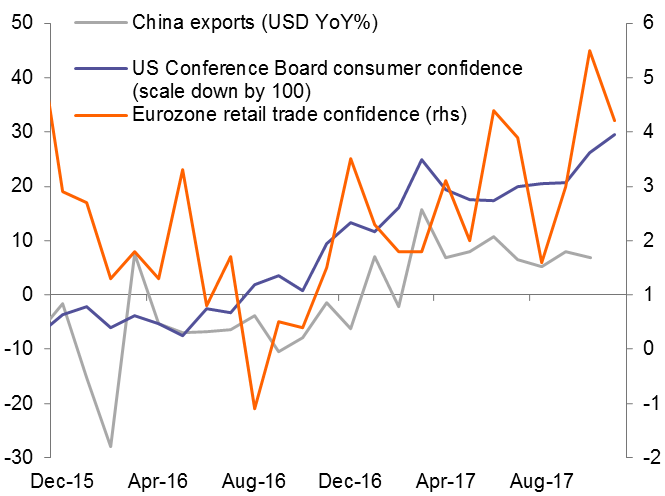

We expect China’s exports to grow 6.5%YoY, slightly slower than previous month. But 6.5% is still a strong number relative to the consensus view (5.3%), and stems from our analysis that a stronger yuan does not hurt export growth as much as the market maybe imagines, because global demand remains strong.

Lowering import tariff should gradually support official import data

We also expect import growth to beat the consensus view, but slow from the previous month (INGf: 14.8%YoY; cons: 12.5%; prior: 17.2%). Even so, double-digit import growth tells the story that imports remain strong. This is partly due to imports of parts for production and partly due to local demand for imported consumer goods.

With a lower import tariff on consumer goods in China commencing from December 2017, we expect import demand for consumables to rise. Though we do not expect the impact to reflect in trade data immediately. The change should be gradual as importers would start to change their import channels, some from parallel imports, which have not been recorded in official import data.

Expect strong yuan in 2018, again that would not hurt trade growth

We continue to expect the yuan to remain strong. Our forecast is for USDCNY to reach 6.50 by the end of 2017 and 6.30 by the end of 2018, ie, a 3% appreciation in 2018.