Briefing Romania

RON300 million for sale in June 2023 auction

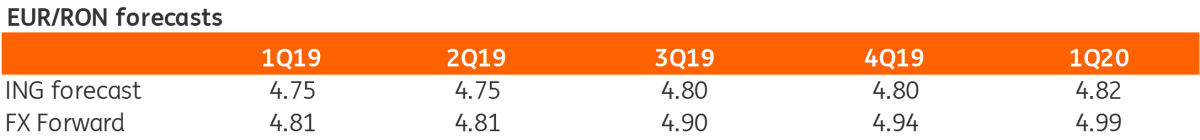

EUR/RON

The EUR/RON inched higher yesterday on increased turnover, closing just below 4.7550. The fact that the pair still inched upwards despite expensive funding rates suggests quite strong fundamental pressures. For today, we expect a test towards 4.7600 and a general trading range of 4.7500-4.7600.

Government bonds

Romanian government bond yields continued to shift upwards yesterday as costly forward yields started to spill over into the longer tenors as well. Today, the Ministry of Finance plans to sell RON300 million in a June 2023 bond auction. The RON5.9 billion redemption on 25 February should generate some rollover interest, but given the persistent high funding and FX depreciation pressures, we don’t expect a blockbuster result for the auction. Hence, we look for a partial allocation in the 4.25% area.

Money Market

Time to throw in the towel on our funding market views. The overnight and tom-next implied yields reached almost 8.00% yesterday and it seems we will end up this reserve period with rates going through the roof. Still, it’s rather impressive that the 9M-1Y segment hasn’t been really following the front end. The 3.75% implied yield in 1Y looks quite reasonable when compared to the rest of the curve.

Download

Download snap