Briefing Romania

A capricious year-end

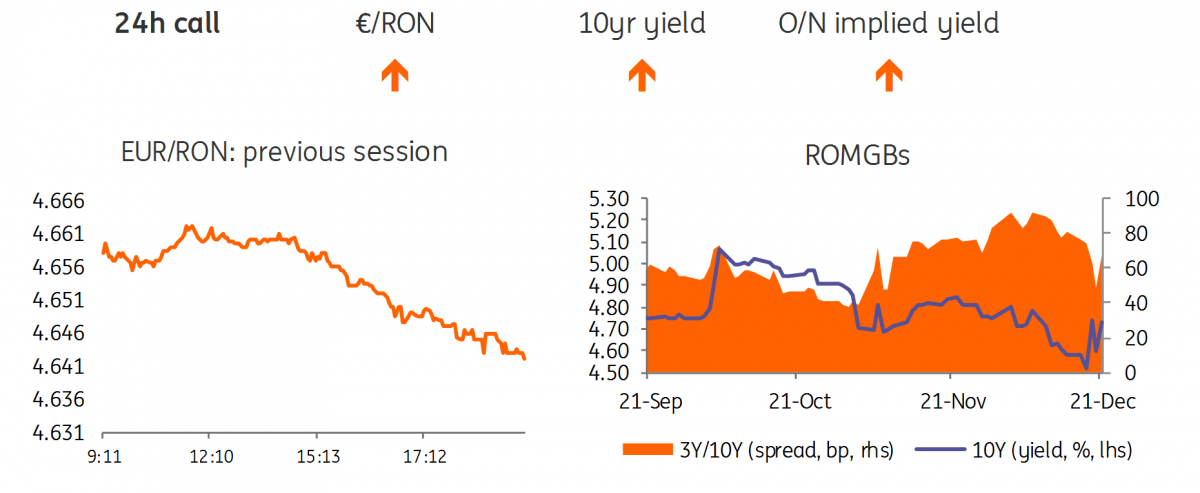

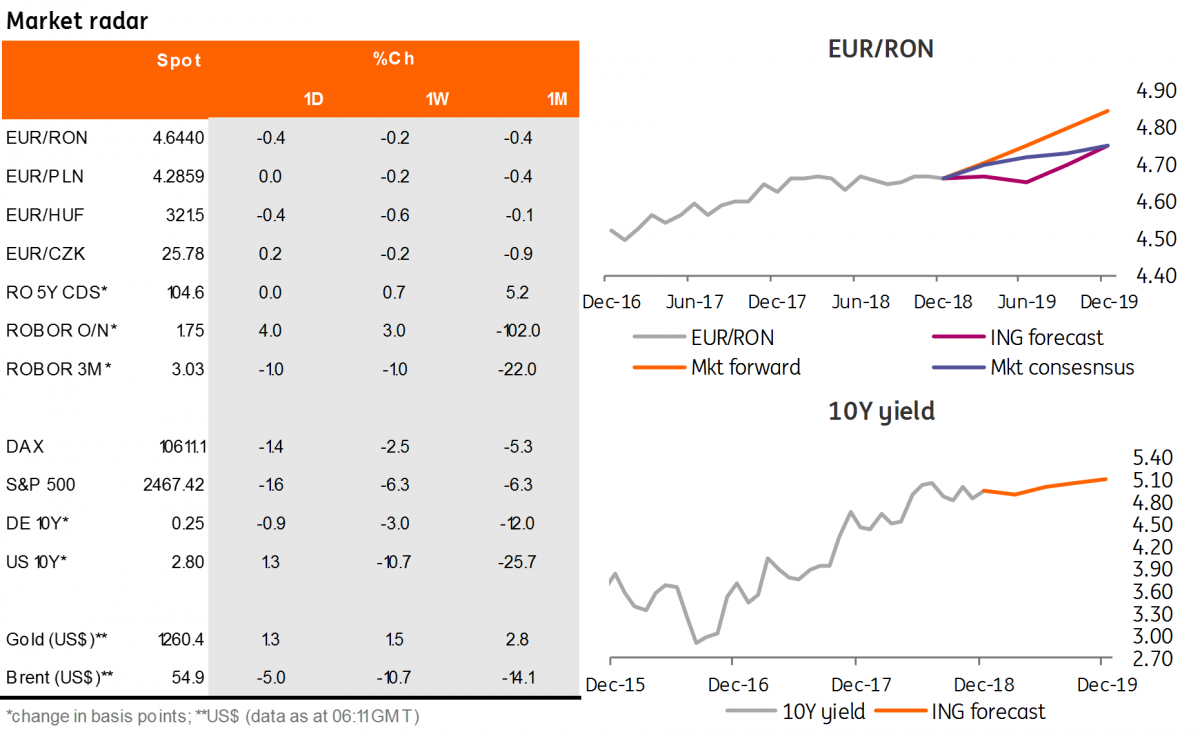

EUR/RON

With the recent solid - and to some extent unexpected - buying interest in ROMGBs, the EUR/RON resumed its downside trend closing the day around 4.6400 and trading even below this level in the after-hours. Some selling interest could still occur today as well for the monthly budget payments, though the bulk of it is probably behind us and 4.6400 looks like a strong support.

Government bonds

After it sold-off post the fiscal package announcement two days ago, with yields spiking c.30bp at some point, the ROMGBs yesterday recovered part of the previous day's heavy losses. The market appears to have concentrated on positives: lower risks for the budget deficit to overshoot the 3% of GDP limit in 2019, fewer, if any, reasons for the central bank to hike rates and talks of altering the pillar II overhaul. Buying interest was concentrated mostly in the mid and long segments of the curve, pushing yields c.8-10 basis points lower. The June 2023 auction came out quite solid, at 4.34%/4.38% average and maximum yields. The Ministry of Finance sold the planned RON600m at a total bid-to-cover ratio of 1.5x. The already announced fiscal package which should come into force on 1 January 2019 will probably be adopted later today.

Money Market

As expected, volatility has returned to the money market and could persist for a few good trading sessions. The monthly budget payments, longer dated carry and turn of the year all add up to create uncertainty and we don’t exclude possible spikes above the Lombard rate again.

Last but not least, given the approaching holiday season we inform our readers that the next Briefing Romania will be published on 3 January 2019. We take this opportunity to wish everyone a Merry Christmas and Happy New Year!

Download

Download snap