Briefing Romania

Very successful 5-year auction

EUR/RON

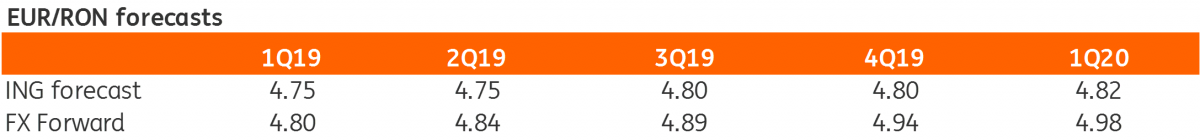

High carry is still keeping the EUR/RON under pressure, but the 4.7400 level seems quite good support. In the minutes of the last NBR Board meeting, an interesting remark was made on import prices, which are anticipated to be “relatively faster in 2019” due to “the likely developments in the leu’s exchange rate”.

Government bonds

The Ministry of Finance yesterday rejected all RON337 million bids for the 11-month Tbills auction. The average of all bids stood at 3.34% - not so bad in our view – but the way the demand was layered was likely unsatisfactory for the MinFin. There was a lot more satisfaction coming from the RON200 million June-2024 auction though. A bid-to-cover of 3.65x and RON320 million allocated at a 4.29% average and maximum yield might have surprised many, at least those rejected bids which have been placed at an average of 4.40%. Otherwise, after a slow trading session in the first part of the day, the auction results triggered some activity in the secondary market which moved c.5-7 basis points lower.

Money Market

The show goes on in the funding market, with carry rates reaching above 6.00% yesterday and the entire curve accentuating its inversion. The shape of the curve (inverted that is) actually shows that the market expects the liquidity squeeze to ease. Nevertheless, the actual levels of 4.60% to 3.60% in the 1M-1Y segment don’t seem to be pricing in an overly generous liquidity backdrop going forward.

Download

Download snap