Briefing Romania

Liquidity squeeze

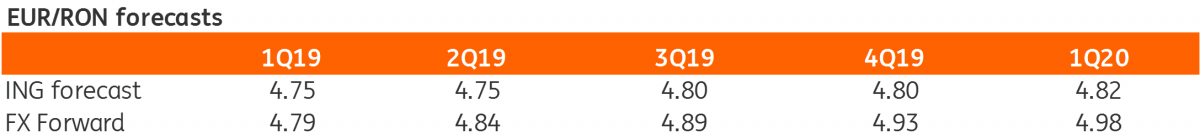

EUR/RON

The Romanian leu remained stable around 4.7400 for most of yesterday’s trading session, only to spike towards 4.7500 in late trading hours. We see the pair trading within 4.7450-4.7550 today.

Government bonds

It was a quiet trading session again for Romanian government bonds which closed the day broadly flat. After pricing in some positive changes to the bank levy, markets are now likely waiting for some clearer signs that these changes will actually happen. The first clarification could come on 18 February when the National Committee for Macroprudential Oversight will convene again. Meanwhile, a working group of the National Bank of Romania and Ministry of Finance is preparing a report, likely including alternative solutions.

At yesterday’s hearing in front of the parliamentary economic commission, NBR Governor Mugur Isarescu reiterated that the NBR's independence is affected by the link between the bank tax level and interbank ROBOR index. This time, Governor Isarescu struck a more direct note by saying that the “bank tax is an attack against central bank independence”. Referring to politicians' desire for lower interest rates, the governor was again pretty direct by connecting the interest rate path with positive developments in inflation, the budget deficit and the country’s external position. During the hearing, a compromise on possible changes to the ROBOR calculation were mentioned. The junior coalition leader was open to eliminate the ROBOR link to the bank levy and exempt government bonds from the tax base.

The European Central Bank sent a letter to the Minister of Finance saying that it was not consulted on the bank levy decree. The ECB concludes that this is "a case of non-compliance by the Romanian authorities with the duty to consult the ECB on draft national legislation, contrary to Articles 127(4) and 282(5) TFEU and Article 2(1) of Council Decision 98/415/EC."

Money Market

Cash rates remain stubbornly high, trading slightly above 4.00% with no sign of resuming the downward trend. The longer dated tenors readjusted higher by 15-20 basis points in the 1M-3M segment as hopes for a sustainable improvement in the system’s liquidity seem to be fading. The lack of a budget bill for 2019 could be a reason behind choppier MinFin spending.

Download

Download snap