Briefing Romania

RON 400 million up for sale in 10-year auction

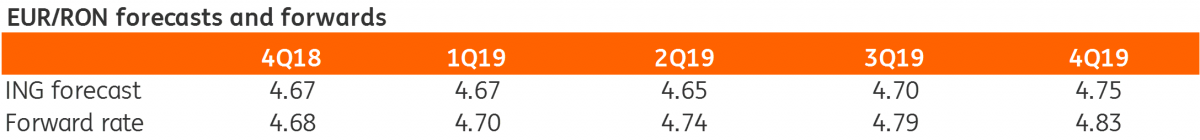

EUR/RON

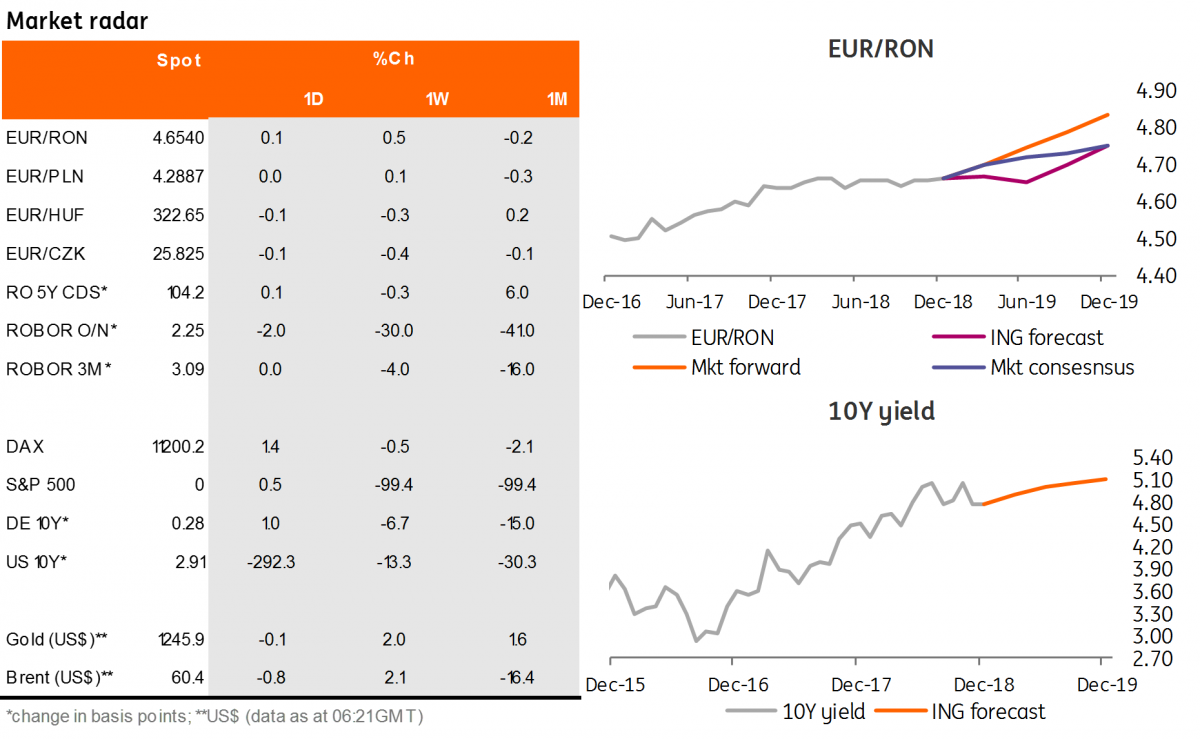

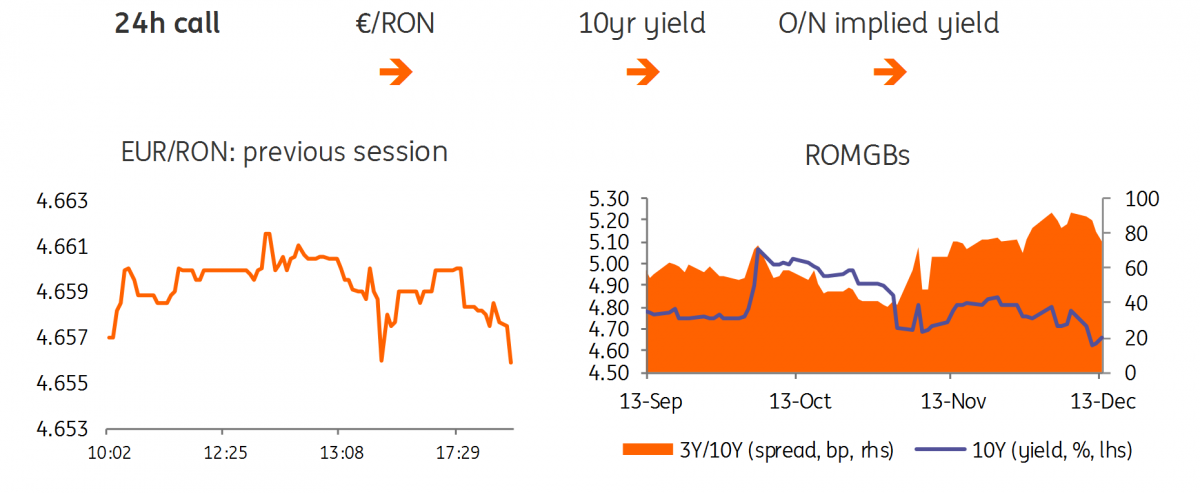

A bit more lively EUR/RON these days as the pair moved within a larger than the usual 30 pips on somewhat higher turnover. We look for the mild upward trend to persist into this year-end.

Government bonds

Some consolidation in Romanian government bonds yesterday after the buying interest seen in the previous days. Today we have two primary market auctions. The Ministry of Finance plans to sell RON 400 million in February 2029 bonds. This will be a test to assess how sustainable the current yields are, after the recent rally. We expect moderate demand around the secondary market closing bids of 4.80%. The second auction is for RON600 million in 1-year T-bills which could be well supported by the improved liquidity conditions seen these days.

Money Market

Things look quite rosy these days in the money market, with carry at deposit facility and downside pressure in longer tenors. It could be too good to be true after the frequent spikes towards or above Lombard rates we’ve had throughout this year. Nevertheless, we take things as they are and notice that the liquidity conditions are supportive at least in the short term.

The market seems to be pricing in accommodative conditions for an extended period as well, considering the drop in longer tenors implied yields with the 3-month to 1-year curve now trading between 3.00% and 3.40%. We believe that eventually, the depreciation pressures on the leu will persuade the central bank to re-enforce an adequate interest rate differential.