Briefing Romania

EUR/RON targeting 4.6500

EUR/RON

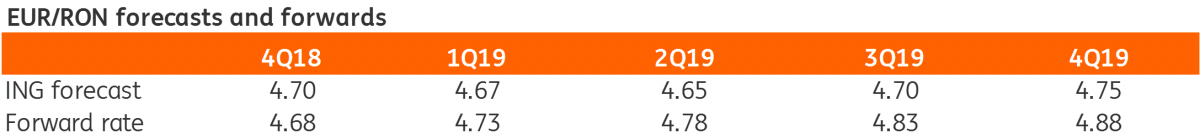

The EUR/RON continues to trade at the lower end of its new 4.6500-4.6600 range. Moreover, the 4.6550 level seems to have acted as a new resistance yesterday. The recent Romanian government bond rally likely driven by new inflows from offshore investors could partly explain the selling interest in EUR/RON. We see the 4.6500 area as a support level and still look for the pair to gradually shift higher towards the 4.6700 area.

Government bonds

Buying interest for government bonds persisted yesterday, triggering a bull flattening move with the belly and the back-end part of the curve shifting up to 10 basis points lower. We expect the positive sentiment to continue to dominate the market in line with the global markets, which are pricing in reduced tightening expectations for the Federal Reserve and European Central Bank. Lower oil prices and a stable Romanian leu are also reasons to believe that the November CPI reading due next week is likely to surprise to the downside – another ROMGBs positive.

Money Market

It is mainly cash balances that are trading these days, aimed at covering the next session of budget payments and the turn of the year. With the budget execution much more even throughout this year, the usual December spending should add a lot less liquidity into the system compared to previous years. Hence, the key rate will likely act as a better anchor for the cash rates than the deposit facility.

Download

Download snap