Briefing Romania

A challenging year ahead for the Romanian leu

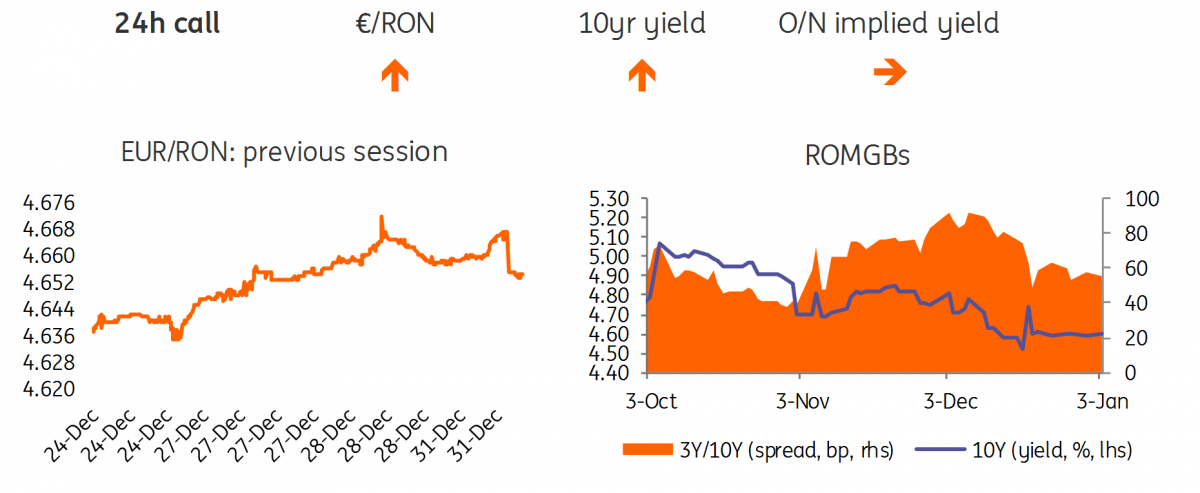

EUR/RON

The EUR/RON traded with an upside bias throughout the last days of 2018 on decent turnover, closing the year around 4.6650. Markets seem to be moody these days, hence we expect the mild upside pressure to continue. 4.6700 looks like a strong resistance with clustered trading around it when it was previously tested suggesting central bank involvement. We expect the National bank of Romania to shift its comfort range for the EUR/RON higher this year. While the timing is a tough call, the press briefing after the 8 January rate-setting meeting could be an opportunity for the central bank to reassess its stance on the currency.

Government bonds

Romanian government bonds traded quietly with a bear flattening touch into the year-end with the market likely waiting for the final fiscal adjustments. The auction calendar for this month will start on 7 January with RON400 million in October 2021 bonds. An adviser to the Prime Minister announced on social media that 2018 ended with a cash-based budget deficit of 2.92% of GDP. The budget execution after 11 months of 2018 posted a deficit of 2.74% of GDP. The Fiscal Council noted that for 2018 we could see a significant difference between the ESA and cash methodology for Romania’s budget deficit.

Money Market

Cash rates have been trading above the Lombard rate over the year-end, as the NBR did not organise a repo auction on Monday. Some liquidity could be coming back to the market now as the Ministry of Finance potentially steps up monthly spending.

Download

Download snap