Bank of Japan stays on hold but policy adjustment is coming

Based on upbeat activity data and higher-than-expected inflation, we believe the BoJ will take steps to normalise policy by adjusting its yield curve control tool in the coming months

| -0.1% |

Policy rate |

| As expected | |

BoJ rate hike will likely come next year but YCC policy will likely come to an end this year

The Bank of Japan held its first policy decision meeting under Governor Kazuo Ueda. As expected, the BoJ has not changed any policy settings but made significant changes to the statement. The BoJ has removed its entire forward guidance on rates from the statement, which means that it sees macro conditions as having changed meaningfully and monetary policy is now in need of a new approach. This naturally leads to the need for a policy review as suggested in today's meeting. At least one year has been suggested for this review. We think today's BoJ action was well-orchestrated in the sense that it secures flexibility for future policy changes while curbing market expectations of an early rate hike.

Governor Ueda clearly messaged to the market that the BoJ's easy policy will be maintained for a while as premature tightening could threaten the fragile recovery and the Bank will monitor inflation to see whether it can be sustained above 2% persistently. Inflation is key to determining the actual timing of a rate hike decision. Although the BoJ suggested it could take a year to 18 months to review policy, the BoJ's actions won't be bound by it. At the press conference, Governor Ueda confirmed that even as the review is continuing, the board will make policy decisions at each meeting and decide whether a policy change is needed.

We maintain our BoJ call for a first rate hike in 1Q24 as we believe that Japan's inflation rate should run a bit faster than the BoJ's outlook. In our view, higher-than-expected wage growth and a relatively solid recovery in the service sectors would support above-2% inflation for the time being. Regarding the yield curve control policy, we still see the possibility of a change as early as June. The YCC is one of the monetary policy tools but has created side effects for market functioning. We think that the BoJ will try to differentiate between YCC policy and policy rate action. To improve the market functioning, the BoJ is expected to adjust or scrap its YCC policy in the near future.

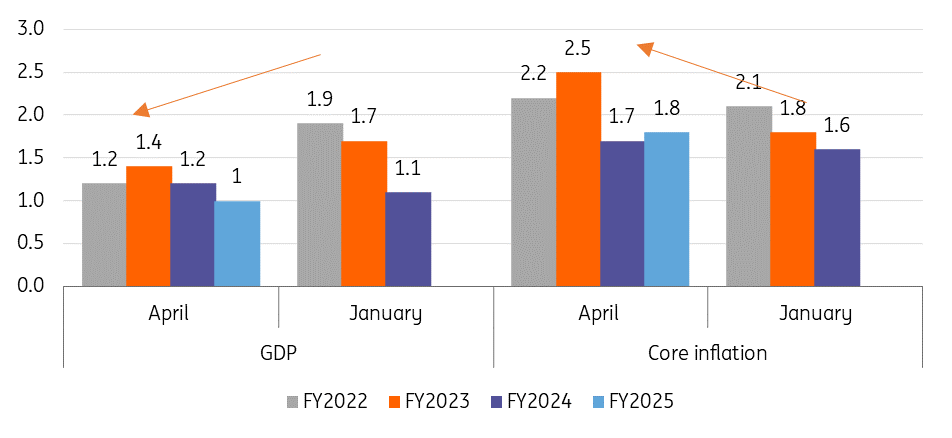

BoJ's outlook for economic activity and prices

The BoJ's latest update on the macro outlook showed that GDP forecasts have been revised down for FY2023 and FY2024, while core inflation forecasts were revised up quite significantly. We think that the BoJ sees more downside risks to growth over the next few years but the economy is expected to grow faster than its potential GDP rate. More importantly, the BoJ now sees inflation remaining above 2% through FY2024, meaning that Japan's inflation is expected to stay above the BoJ's target for two consecutive years. We also think that core inflation is likely to remain above 2% as service-driven growth continues this year while higher-than-expected wage gains this year could improve consumer's purchasing power. Recent price gains in the housing market are also a good sign of sustainable inflationary pressures that the BoJ has been seeking.

BoJ outlook sees higher-than-target inflation for two years

| 3.5% |

Tokyo CPI% YoY |

| Higher than expected | |

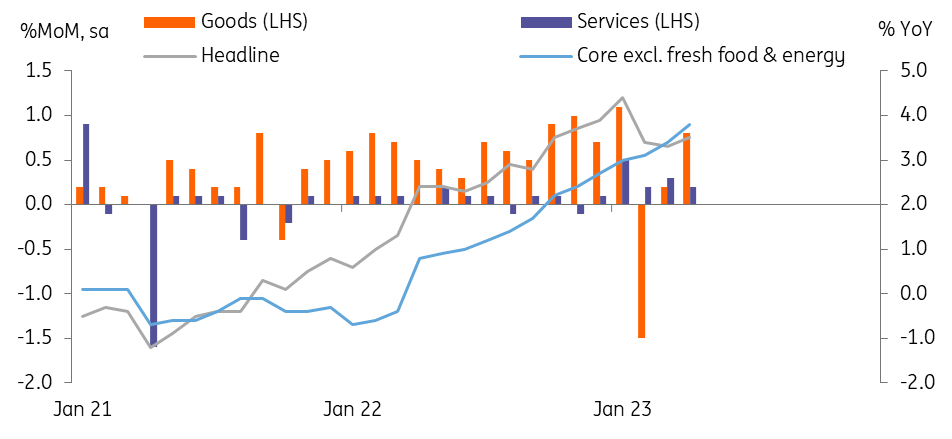

Inflationary pressures seem to be expanding

The most relevant data for the BoJ's policy actions, among several releases today, should be Tokyo CPI. Tokyo consumer prices rose unexpectedly to 3.5% year-on-year in April (vs 3.2% in March and market consensus), despite a decline in utility prices (-2.0%). Also, core inflation excluding fresh food and energy accelerated even faster than the headline rate to 3.8% (vs 3.4% in March). Inflationary pressures are becoming more broad-based, not only due to the secondary effects from the previous hikes in commodity prices but also due to demand-driven price gains. In the monthly comparison, goods prices jumped 0.8% (MoM seasonally-adjusted) and services prices gained a solid 0.2%.

Inflation rose unexpectedly with both goods and services prices rising

| 0.8% |

Industrial production% YoY |

| Higher than expected | |

Upbeat IP and sales outcome point to a solid GDP rebound in the first quarter

Industrial production rose 0.8% MoM sa in March (vs 4.6% in February and the 0.4% market consensus) for the second month on the back of strong automobile production (4.6%). Regarding IT products, the good news is that semiconductor manufacturing equipment rose solidly for two months. But production of electronic parts and devices continued to fall, thus we believe that the downcycle of chips and IT will bottom out in the latter part of the year. Retail sales also rose 0.6% MoM sa (vs 1.4% in February and the 0.3% market consensus) in March, recording the fourth consecutive monthly rise. We think the reopening has stimulated consumer spending and this will likely stay healthy for a while. Based on today's monthly activity data, we expect first quarter GDP to increase 0.4% QoQ sa from the mere 0.02% rise in 4Q22.

| 2.8% |

Jobless rate |

| Worse than expected | |

The jobless rate unexpectedly rose but not too worrying at this point

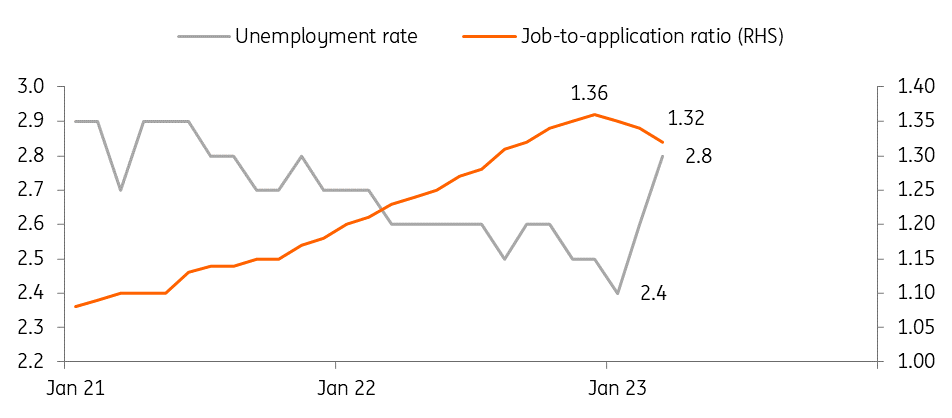

Labour market data retreated for the second consecutive month. The jobless rate unexpectedly rose to 2.8% in March (vs 2.6% in Feb and 2.5% market consensus) and the job-to-applicant ratio also fell to 1.32 (vs 1.34 in February), after hitting a recent high of 1.36 in December. However, the labour participation rate rose meaningfully to 62.6% (vs 62.1% in Feb) and the data shows that female workers returned to the labour market as the Covid situation has improved and face-to-face service job opportunities have likely increased. We believe that labour market conditions maintained a healthy level with employment in the non-agricultural sector rebounding fairly quickly and the unemployment rate still remaining below 3%.

Labour data weakened further in March