Bank Indonesia keeps rates untouched as inflation moderates

Bank Indonesia opted to pause today, confident that core inflation will stay within target

| 5.75% |

BI policy rate |

| As expected | |

Central bank keeps rates at 5.75%

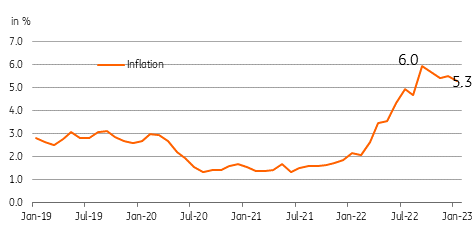

Bank Indonesia (BI) opted to keep rates untouched at 5.75% today, bringing Governor Perry Warjiyo’s recent rate hike cycle to an end. BI remains confident that the current policy stance will help ensure core inflation remains within target. Moderating price pressures and the relative stability enjoyed by the Indonesian rupiah (IDR) were the likely factors in today's decisions. Headline inflation dipped to 5.3% year-on-year in January, down from 5.5% the previous month, while core inflation eased to 3.3%.

Slower inflation for transportation and utilities helped ease price pressures and we could see inflation inch lower should current trends in energy prices hold.

Easing inflation gives BI space for a pause

What next?

We had priced in the possibility of a surprise 25bp rate hike today after market participants adjusted expectations for the Fed’s terminal rate, but easing inflation may have convinced BI to shift to a more dovish stance with a pause. BI indicated that it is coordinating with government officials on the planned regulation for exporter earnings which may have lowered the need to utilise rate increases to steady the IDR. Furthermore, Warjiyo indicated that the central bank would utilise its ongoing “operation twist” to help mitigate the impact of potential Fed rate hikes in the coming months.

We believe BI can opt to stay dovish in the near term should inflation sustain its downward path and IDR remain stable.