Risk case becoming base

With trade tensions spilling over into asset markets, it is time to consider if our risk scenarios are becoming the base case.

Unintended consequences

If Donald Trump is surprised that his trade measures are leading to firms shuttering domestic plants and moving overseas, like one well-known manufacturer of classic motorcycles reported in newswires today, the rest of the world isn't. Yet I personally doubt this will cause any change of heart at the White House. Facts have become so unfashionable amongst policy setters these days. No, opinion is all that matters, boosted in many cases by generous measures of prejudice.

I could, if I wanted, take some consolation in a news story doing the rounds yesterday showing Chinese officials making last-ditch efforts to avoid the imposition of the various tariffs and retaliatory measures that both sides in this particular campaign of the global trade war have been throwing about. But I won't. Because even though it is plainly obvious that these tariffs are as bad for the US as they are for everyone else (even more obvious today), I am forming the opinion that President Trump simply wants these tariffs. He thinks he can win a trade war, and my guess is that he will continue to believe this until we have had many more casualties, like the Wisconsin based bike maker.

That should make us look at our forecasts quite critically. For the most part, forecasters tend to opt for a "muddle-through" scenario. It's an 'easier sell' to colleagues than a disaster. Crying 'wolf' too often will get you a bad name, and may cost you your job, though there are plenty in the market who have made a profession out of a perma-bear attitude. Being wrong, consistently, is not a guarantee of a lot of unwanted free-time, but it helps if you have a fantastically good story to back it up. Then 'wrong' merely becomes 'early'.

Right now, an assumption of a serious interruption to global trade should make us look at a number of our assumptions:

- Stock markets - falling sales volumes and squeezed margins, together with higher rates is not a favourable stock environment - recent declines are poised to recover from any change of heart on the trade outlook, but equally, they are poised for further declines on an intensification of this trade mess.

- Bond yields and the yield curve - inversion is a step closer today - but not for the reasons we have been tracking (higher short rates), but because the longer end of the yield curve is now beginning to price in a chance of recession. More news like today and this will come even closer to inversion.

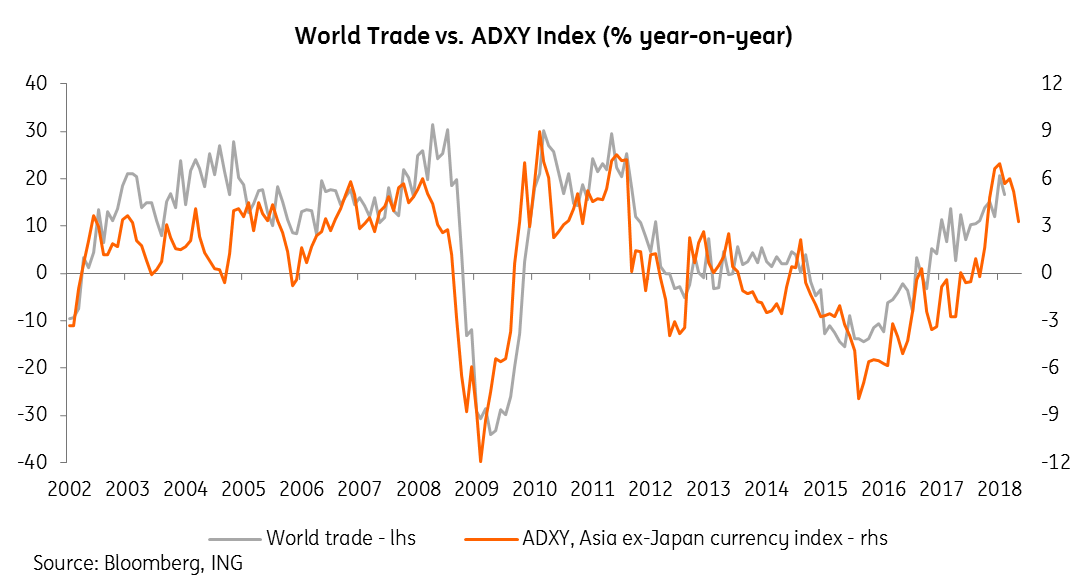

- Currencies - EURUSD may be a trade-off between competing central bank views, but a negative trade scenario is unambiguously bad news for emerging market currencies. For Asian FX the correlation with global trade is tight - falling trade...weaker Asian FX (see chart).

- If Asian FX is weaker, Asian inflation will be higher, all else being equal - that means more work for the central banks to do, and a weaker outlook for domestic growth. That isn't good for anyone.

We aren't there quite yet, but our recent FX forecast updates already took a significant step in this direction.

Asia - Singapore in the spotlight

Today's main Asian release is Singapore's May industrial production data. Recent prints have been OK, though they have been saved by petrochemicals, and a resumption in pharmaceutical production growth after a soft patch in 2017. The numbers have been supportive of a reasonable growth projection for 2018, but not in a terribly convincing fashion, with gains typically narrowly based. Analysts look for this data to show a 10%YoY gain on a 0.2%MoM decrease in April, but it will be the composition as much as the headline figure that will be worth watching.

G-7 - confidence is no guarantee of anything

US consumer confidence is about the only noteworthy print in the G-7 today. Consumer confidence is currently riding high - in fact, higher than pre-financial crisis highs. But as that tells you - consumer confidence is not a terribly good guarantee of continued good times. The confidence indicator was 111.94 in July 2007, steady at this level for some years. By the end of that year, it had dropped to 90.2, and it troughed 14 months later at 25.3. It is 128 currently.

A more worrying and potentially more forward-looking indicator is Germany's Ifo index, which fell further yesterday. This index has fallen now in six out of the last seven months. Trade concerns, and perhaps a little Brexit anxiety are not helping the outlook for Europe's largest economy, and by extension, the euro.

Download

Download opinion

26 June 2018

Good MornING Asia - 26 June 2018 This bundle contains {bundle_entries}{/bundle_entries} articles

Robert Carnell

Robert Carnell is Regional Head of Research, Asia-Pacific, based in Singapore. For the previous 13 years, he was Chief International Economist in London and has also worked for Commonwealth Bank of Australia, Schroder Investment Management, and the UK Government Economic Service in a career spanning more than 25 years.

Robert has a Masters degree in Economics from McMaster University, Canada, and a first-class honours degree from Salford University.

Robert Carnell

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more