Hungary: Countdown to tightening reaches one

Core inflation ex-tax has just reached the 3% target, suggesting monetary policy normalisation is coming very soon, but not next week. We have one semi-serious and two strong arguments favouring a wait-and-see approach

Inflation reached the target ...sort of

As the NBH's latest press release suggested, the Monetary Council is going to start policy normalisation as soon as core CPI ex-tax reaches or exceeds the target. With this measure having reached 3% (2.988% for the sake of accuracy) in January, mainly on market services, it has become clear that the NBH will start the tightening soon ...but not at its next rate setting meeting next week (26 February) as – being semi-serious here – we are still, in fact, below the target.

External factors could affect the inflation forecast

The global environment could potentially affect economic activity as well as core inflation, which is on the monetary policy horizon. If moderate growth prevails in Europe, especially in Germany, it implies downside risks for underlying inflation in Hungary. As the ECB also seems less likely to start policy normalisation in 2019, based on the latest comments by ECB prominents, it suggests that the NBH is likely to wait until the next Inflation Report. The upcoming new staff projection in March might have an bearing on the velocity of the tightening cycle, but won’t influence the starting point, in our view. This is based on the fact that the NBH emphasised that domestic underlying inflation is far more important from a monetary policy point of view, than what the ECB will or won't do.

The NBH can't wait for long

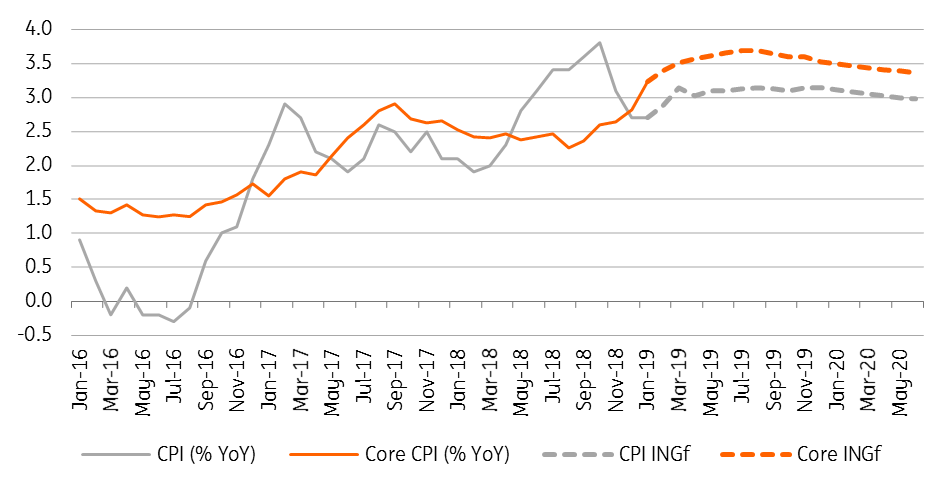

We see the core CPI ex-tax rising clearly above the target in February, to reach 3.2% YoY. Moreover, it could go as high as 3.5% YoY by mid-2019. Against this backdrop, the NBH must start its tightening cycle, even if some of the downside risks come true. Failing to start at least in March will damage the central bank's credibility. So why wouldn't we call for an immediate start of the tightening cycle besides the outdated inflation forecast of the NBH? Because another factor will play a significant role in the expected hold in February, calling for a one-month delay: the ability to use the available tools for tightening.

ING inflation forecasts (% YoY)

The role of crowded-out liquidity is essential

At the next opportunity, in March 2019, the Council will decide on the amount of liquidity to be crowded out and will take this into account in setting the stock of central bank swap instruments.

The normalisation will consist of two components simultaneously, according to our understaning. First, a shift in the interest rate corridor (or only a hike in the overnight deposit rate, as we forecast) and, second, a reduction in the amount of the FX swaps portfolio providing HUF liquidity. FX swaps are the essential instruments setting the excess liquidity in the banking sector, so a reduction in this will decrease the 'crowded-out liquidity'. However, the Monetary Council can decide on the amount of liquidity to be crowded out only at the next opportunity in March 2019. This technical issue increases the chance of a February wait-and-see meeting and an action-packed March meeting.

Summary

We believe that we are only one month away from the start of the Hungarian monetary policy tightening. The soft 3% core CPI ex-tax, the latest developments in the external environment, thus the outdatedness of the December NBH Inflation Report and staff forecasts and the missing availability of adjusting the crowded-out liquidity in February all call for a one-month delay. The 26 February rate-setting meeting could simply be the prologue for an action-packed March gathering.

Download

Download opinion

Peter Virovacz

Peter Virovacz is a Senior Economist in Hungary, joining ING in 2016. Prior to that, he has worked at Szazadveg Economic Research Institute and the Fiscal Council of Hungary. Peter studied at the Corvinus University of Budapest.

Peter Virovacz

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more