From profits, all else follows…

On a quiet day in markets, perhaps dig a little deeper into today's US 2Q18 GDP revision (yawn), where profits data can hide nasty surprises - we aren't expecting any

Every silver lining has a cloud

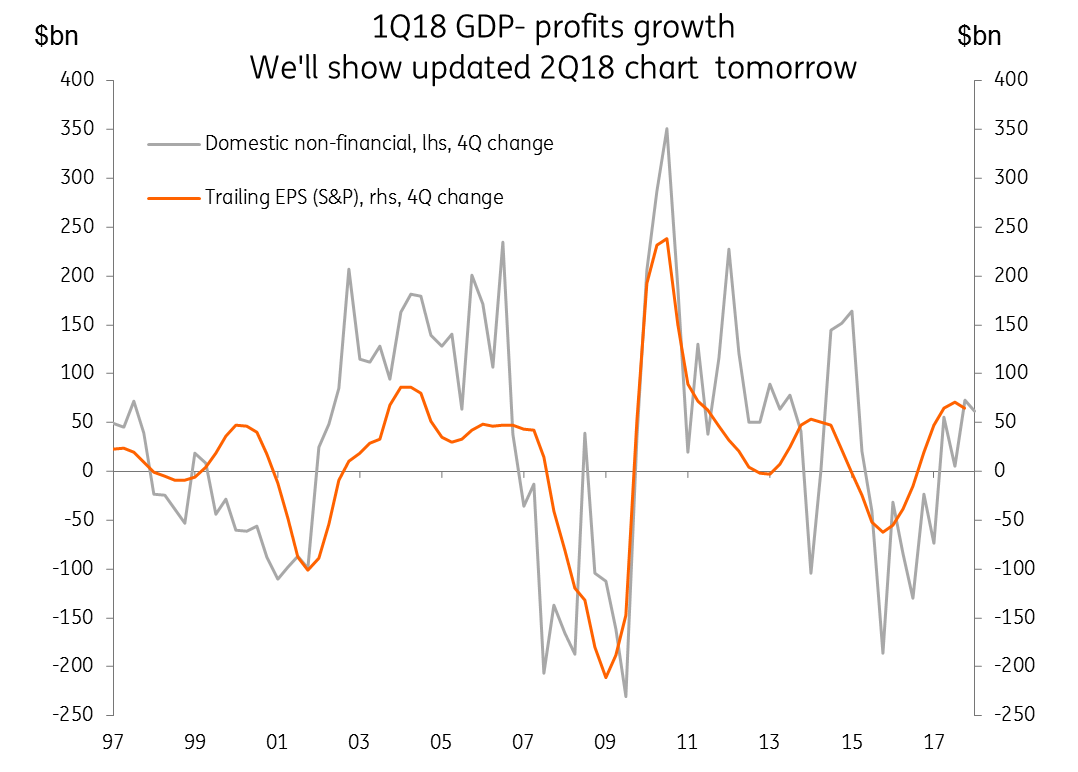

I have never been asked what chart I would take to a desert island if I was allowed only one, and still had to do my job. But that has never stopped me from sharing my choice, which would be the US GDP-based profits data. You see, in a very simple mental model of how the global economy works, profits are the feedstock that determines almost everything else. Higher profits mean more investment. More investment means rising employment. Rising employment means higher wages, and so on all the way to consumer spending,inflation, and central bank rates etc.

It is a simple model, and the world is far more complicated than this. But I find it has served me pretty well as a starting point over the last quarter century or so. The profits figures are released only with the first revision of the US GDP figures (out today), and they are often overlooked.

What is particularly helpful about US GDP-based corporate profits (choose the domestic-only series to avoid imported volatility), is that they are derived from corporate tax returns. That is important. Official earnings guidance from firms, even earnings announcements, are run through the mangle of accountancy tricks and fudges. Only when these are exhausted, does the grim reality emerge. On the other hand, when earnings really take a nose-dive, most firms will be pretty quick to tell the tax authorities. No one wants to pay more tax than they need to - especially in corporate America.

So what we find is that the GDP-based measure of corporate profits, despite the reporting lags, can offer a lead to bad news (not good, only bad). This makes it a useful, albeit limited indicator for economic slowdowns. You can keep your yield curve slope and recession charts This one works because it really does get to the heart of what drives the business cycle.

Now I am not saying that we should expect any alarming signals from the data later today. But as people fret about the new highs reached in the S&P500, or the dip in copper prices, or Treasury curve inversion, this is the only one you need to consult to see if you should keep your head, or head for the hills.

Other than this, today looks as if it is searching for direction. Yesterday's Mexico trade deal is already today's fish and chip wrapping, there is nothing new on China trade or Canada. Asian equity futures seem mixed as do Asian FX, and bonds.

US GDP-based Profits up to 1Q18

Financial stability, or prudence?

I am continuously grateful for the comments and offerings of others with which I can vehemently disagree, providing me with (usually) something to rant about in this not-quite daily note. Today's vote of thanks goes to ECB Chief Economist, Peter Praet. He is quoted in a story today saying that financial stability is not the primary responsibility of central banks, rather "...Patient, prudent and persistent monetary policy is still needed".

I don't have the context, and so apologies Peter if this is unfair (I'm reasonably sure he doesn't read my stuff). But if you had to choose between financial market instability, or prudent, patient and persistent monetary policy, wouldn't you choose to avoid financial instability? Because to ignore it would undermine all the other goals. Isn't that what the GFC taught us? Have no lessons been learned in the ten years since then? I think I know the answer to this one, but I am saving that for another thin news day.

Thanks also to US Treasury Secretary Steven Mnuchin (certainly doesn't read me) for saying that China's support for the yuan isn't manipulation, but allowing it to weaken would be. I really don't need to say anything here do I?

Asia day-ahead

We covered the G-7 releases earlier, and Asia is just about closed for the day as far as economic data releases go. If you are interested, take a look at Vietnamese data out today. We don't formally cover this very interesting economy, but the August inflation, trade, production and retail sales data released today could provide an early litmus test for the rest of the region. Vietnam strikes us as having huge potential as one of the few remaining genuinely cost competitive economies in the region. If offers what China once had, before it priced itself out of the manufacturing sector.

Tags

ProfitsDownload

Download opinion

29 August 2018

Good MornING Asia - 29 August 2018 This bundle contains {bundle_entries}{/bundle_entries} articles

Robert Carnell

Robert Carnell is Regional Head of Research, Asia-Pacific, based in Singapore. For the previous 13 years, he was Chief International Economist in London and has also worked for Commonwealth Bank of Australia, Schroder Investment Management, and the UK Government Economic Service in a career spanning more than 25 years.

Robert has a Masters degree in Economics from McMaster University, Canada, and a first-class honours degree from Salford University.

Robert Carnell

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more