A tit-for-tat trade war not enough to take global markets down

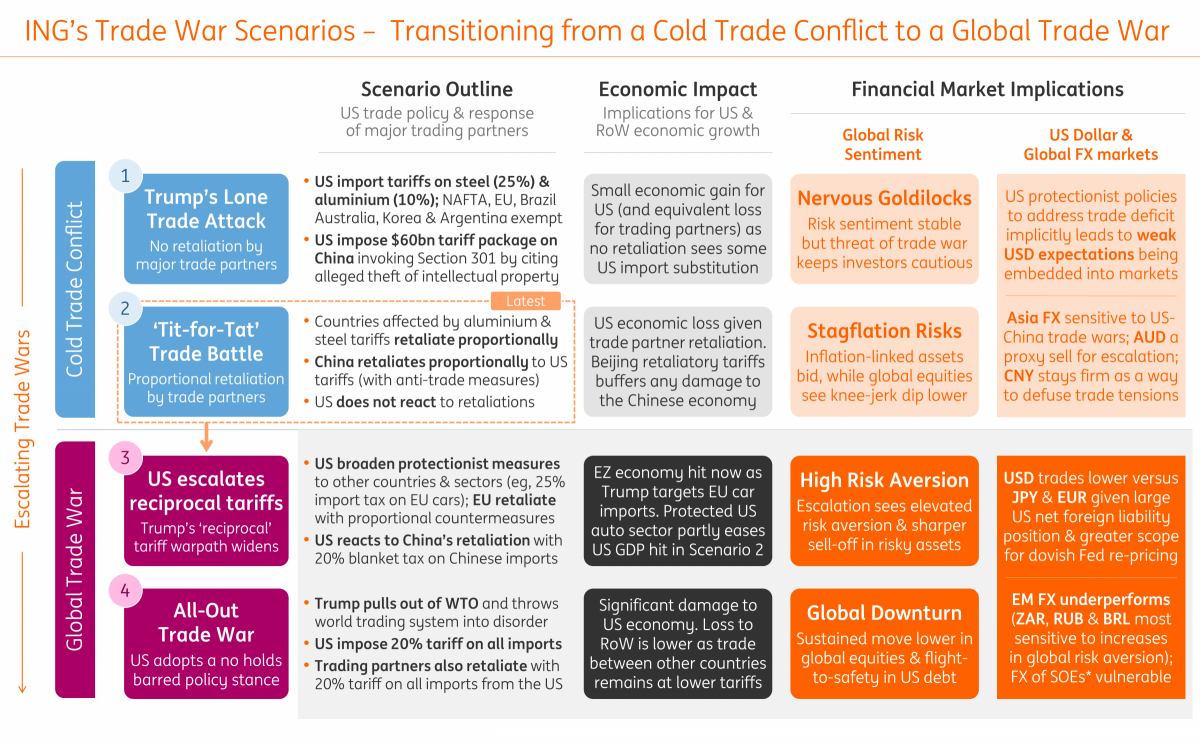

All eyes were on President Trump's Twitter feed this morning, and he did not disappoint. Now, the question is whether the US chooses to escalate this trade fight further. If it does, it would be a paradigm shift for global markets - one that could see a sustained sell-off in risky assets, as well as a broader flight-to-safety in FX and bond markets

Fears of a trade war between the world's two largest economies seemed to have returned today as President Trump tweeted this morning, "We are not in a trade war with China, that war was lost many years ago by the foolish, or incompetent, people who represented the US. Now we have a trade deficit of $500 billion a year, with intellectual property theft of another $300 billion. We cannot let this continue!"

But after Beijing's response earlier today of a reciprocal 25% tariff package on US imports including soybeans, aeroplanes and automobiles - we're now in TradeWar Scenario 2.

In isolation, trade wars don't cause a global downturn - nor a sustained sell-off in risky assets

Anyone who thought China would bow to a protectionist US administration only needs to look at how quick the response came. It looks like major trading partners are ready to react even to the detriment of their own economy and global markets. But it's worth bearing in mind that trade wars are a lose-lose situation because political logic is usually dictating rather than any economic rationale.

Our immediate reaction to China news corroborates what we expected for currency markets in a cold trade conflict:

- The Japanese yen seems to be the best vehicle to hedge for escalating TradeWar (target 100)

- The Swiss franc, euro, and sterling are up against a politically weak dollar

- The Australian and Canadian dollar are a proxy sell for US-China trade tensions while the New Zeland dollar is a relative haven in the commodity space

Other markets showed a typical risk-off response initially: Treasury yields were lower, gold went higher, US stocks declined by around 1.5-2.0% on open. However, the follow through to FX markets has been limited.

Tit-for-tat tariffs still keep us in the realms of Defcon 3 when it comes to trade wars - or what we like to call a cold trade conflict as explained in scenario 2 in our graphic.

But for global market dynamics to transition from a cold trade conflict to an actual global trade war, we need to see either:

(1) A broadening of current US protectionist measures to other countries and sectors – and here we highlight US tariffs on EU car imports as the flagship policy.

(2) The US administration reacting to any retaliatory tariffs from China – by imposing larger and potentially blanket tariffs on all Chinese imported goods.

Either of these would be a substantial rise in the average world tariff rate in a way that requires global markets to take significant notice.

In isolation, trade wars don't cause a global downturn - nor a sustained sell-off in risky assets. But what has typically amplified the risks around a trade war is if it coincides with either rise in geopolitical or foreign policy risks or if increased protectionism occurs alongside a slowdown in the global economy. We would put the first as a bigger risk than the latter, though neither are non-negligible.

It is the signalling channel of US trade policy that has been the key driver for the USD in prior ‘trade war’ episodes. Protectionist measures implicitly signal the US administration's desire for a weaker USD – and such expectations are likely to be entrenched in FX markets until credibly broken.

Viraj Patel

Viraj is an FX strategist at ING. He has been with the firm since January 2015 and covers developed markets. Prior to this, he worked at Barclays and the Bank of England. Viraj read Economics at the University of Cambridge and is currently working towards his CFA charter.

Viraj Patel is no longer part of the ING THINK team

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).