ZAR: Bouncing off the ropes

Why foreigners are still looking for the positives after Zuma's purge

What's happened?

President Zuma’s dramatic cabinet reshuffle last week, including the removal of his respected Finance Minister Pavin Gordhan, has weighed heavily on South African assets and the Rand. This came at a time when Rand assets, particularly debt, were in strong demand. Unless the new team start to undermine Gordhan’s 2017/18 fiscal plans or the SARB is pressured into early rate cuts, we expect investors will continue to find value in the ZAR. We favour USD/ZAR trading back towards 12.00 over a twelve month horizon.

The key issues

President Zuma’s purge of Pavin Gordhan and six other cabinet ministers has naturally un-nerved investors. The move has proved divisive within the ANC executive team. The opposition has proposed a no-confidence motion in Zuma – to be debated April 18th. However it seems unlikely that an ANC dominated National assembly would allow such a motion to pass.

After April, the political calendar advances to the ANC Congress in December, when a new leader will be chosen. While Jacob Zuma will retain Presidential power until general elections in 2019, the choice of a new ANC leader (and likely future President) will give an indication as to the direction of travel.

Politics and its impact on the fiscal outlook will have a major say in the ratings story. Given the low share of hard currency debt in South Africa’s total external debt, the key focus will be on the S&P and Moody’s rating of local currency debt. Junk local currency ratings from both agencies may only be an issue for 2018.

Our valuation models show the ZAR to be cheap on both a short term financial fair value and also a medium term fundamental basis. In a benign reflationary environment, we see USD/ZAR upside limited to 14.00/50 and favour 12 in a year.

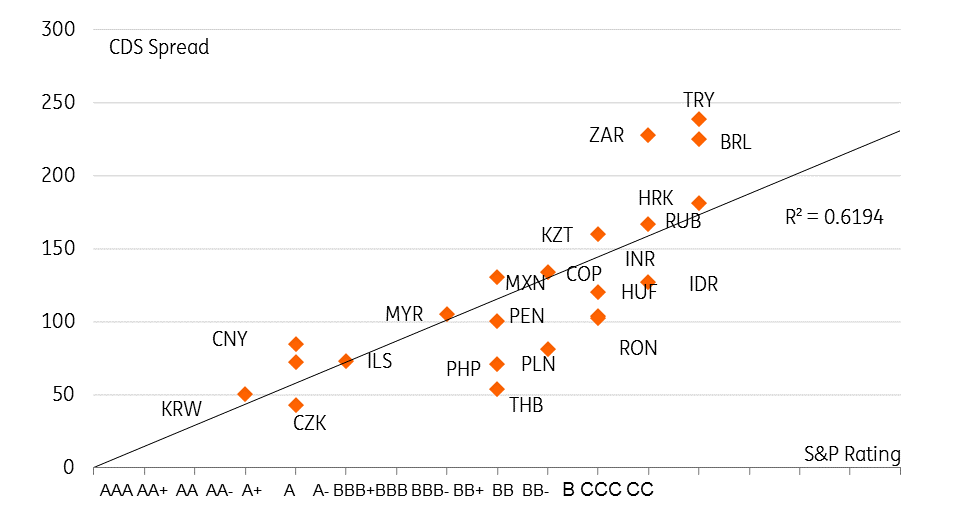

South Africa's sovereign CDS trades firmly in sub-investment grade territory

Why had ZAR been doing well?

Up until the cabinet re-shuffle of March 30th, the ZAR had been one of the best performing EM currencies this year. Driving that strength had been the global reflationary story – not just Trump’s possible fiscal stimulus, but also the prospect of more synchronised global growth.

Expectations of higher growth in 2018 have lifted growth prospects amongst the commodity exporters in particular. South Africa’s key exports, precious and industrial metals, have performed well in such an environment.

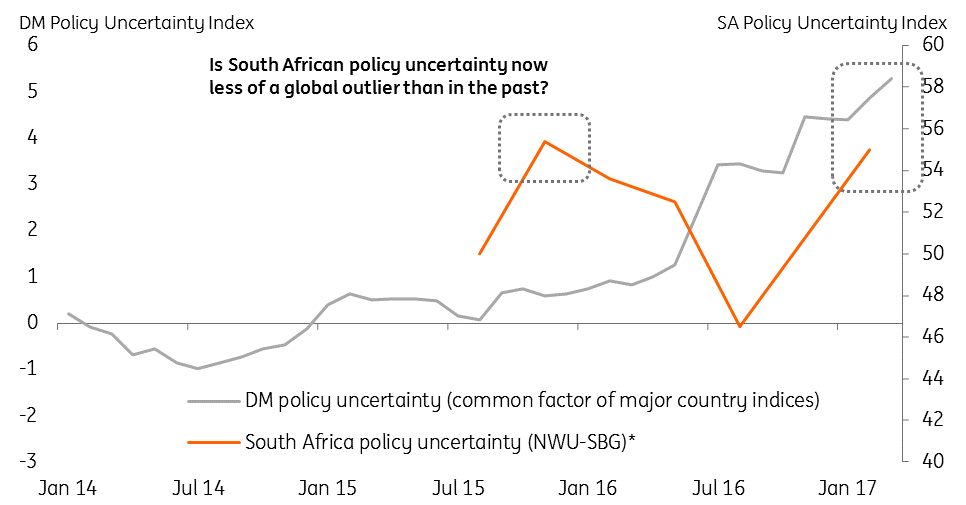

In addition to the benign environment supporting the carry trade, rising policy uncertainty in Developed Markets has encouraged diversification into EM.

We argue that the convergence of DM economic uncertainty on to that of EM is one of the reasons why the recent ZAR sell-off has been more limited than that seen in December 2015 – when President Zuma removed Finance Minister Nene and his replacement survived three days.

Developed Market versus South Africa policy uncertainty converge

How much political risk is priced?

President Zuma’s decision to purge his cabinet, including his Fin Min Gordhhan, was a surprise and hit asset markets hard. The move indeed was as a surprise to many in the ruling ANC, prompting criticism from Deputy President Ramaphosa amongst others.

The opposition are attempting to capitalise on this disunity amongst the ruling the ANC by proposing a No-Confidence motion.

This will be debated in parliament on April 18th. However the ANC has a substantial majority in the National Assembly and the immediate indication is that the ANC are unlikely to back such a motion.

The political calendar moves forward to the ANC Congress in December

Assuming the No-Confidence motion is defeated, the political calendar moves forward to the ANC Congress in December. Here a new ANC leader will be elected, although Jacob Zuma will retain his position as President until general elections in 2019. The choice of ANC leader and the continuity or otherwise of Zuma-style politics will make it another volatile December for the Rand.

To gauge the amount of political risk priced into the ZAR, Viraj Patel has updated ING’s short term Financial Fair Value (FFV) model. This looks at where USD/ZAR should be trading based on typical drivers such as rate differentials and commodity prices. Currently it looks as though a 3% political risk premium may be in the ZAR – slightly less than the 4-5% readings seen through late 2015 and early 2016 (when Fin Min Nene was removed and Fin Min Gordhan came under investigation from the ‘Hawks’).

Unless we see a substantial shift in key inputs into the FFV, e.g. rate spreads widening sharply in favour of the USD or a collapse in commodity prices, we would argue that local political risk might only be worth a further 1-2% Rand depreciation at this stage.

Why are portfolio flows so important to the ZAR?

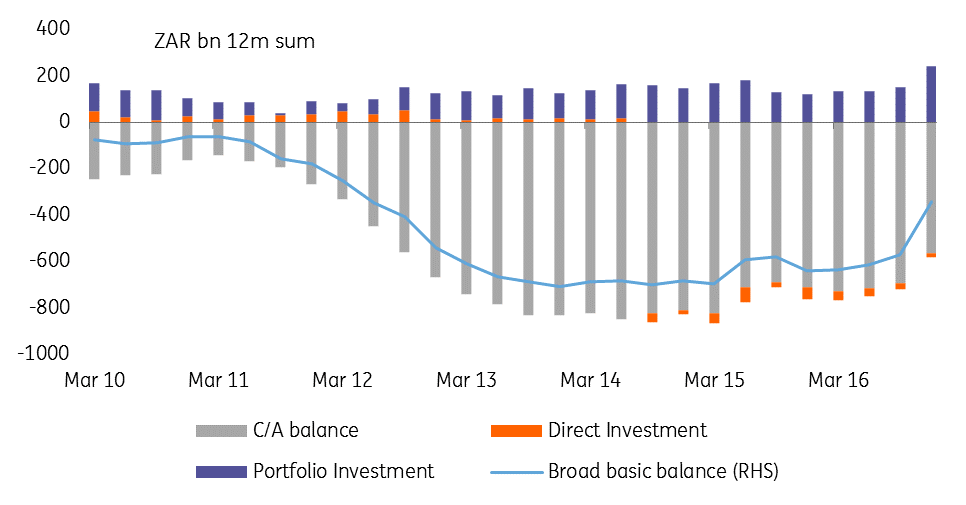

South Africa was one of countries hit hard by Bernanke’s tapering comments in 2013 – largely because of the size of the current account deficit. Back then South Africa ran a current account deficit close to 6% of GDP. Even though this deficit has narrowed sharply since then, a deficit of 3.0/3.5% in 2017 is still heavily reliant on portfolio inflows for financing – largely because net FDI inflows are flat.

A sizable narrowing in South Africa’s Broad Basic Balance (Current account + direct investment + portfolio flows) has helped the ZAR, but that improvement has been substantially driven by portfolio flows.

South Africa’s large external funding deficit requires that investors continue to see value in South Africa’s large stock of debt and equity assets

South Africa’s large external funding deficit requires that investors continue to see value in South Africa’s large stock of debt and equity assets. In fact South Africa’s stock of portfolio liabilities, at 68% of GDP last summer, are the largest amongst EM nations. These liabilities are comprised of debt and equities at 20 and 48 per cent respectively according to the IMF.

ZAR helped by narrower current account balance and better portfolio investment

Why are sovereign ratings so important?

As above, on-going portfolio inflows are critical to financing South Africa’s deficit. Notably this year’s inflows into South Africa have largely been into debt markets. South Africa’s ability to issue debt in local currency means that South Africa’s share of hard currency in its external sovereign debt is a relatively small 10%.

And that is why South African authorities tried to put a positive spin on the recent S&P downgrade. The junk status was only assigned to foreign currency debt

South African authorities tried to put a positive spin on the recent S&P downgrade. The junk status was only assigned to foreign currency debt. The local currency rating, while also cut one notch, still sits as investment grade.

The IMF paper we referenced earlier highlighted the differences of junk status for South Africa’s foreign currency versus local currency rating. The report cited US$2bn of outflows of junk status for the foreign currency rating, but a more sizable 2.5% of GDP (around US$8 bn) of outflows should the local currency rating be cut to junk – by both S&P and Moody’s.

The reason for this much larger reaction to the local currency, rather than the foreign currency rating, is because of key local currency sovereign bond indices such as Citi’s WGBI and Barclays Global Aggregate index which require Investment Grade status for inclusion. A move by both rating agencies is required to prompt removal from the index.

How far away is the South African local currency sovereign rating away from junk? S&P is one notch away from junk, Moody’s two. Moody’s has South Africa on a negative outlook, which looks likely to result in a downgrade over the next 30-90 days.

Whether Moody’s keeps South Africa on a negative outlook, after a downgrade, will be important.

Whether Moody’s keeps South Africa on a negative outlook, after a downgrade, will be important. Even a negative outlook could take another 12-18 months to resolve. That means the more dangerous scenario of both S&P and Moody’s local currency sovereign ratings being cut to junk may only be a 2018 story, if at all.

Of course were President Zuma to make further changes which question the strength of the institutional framework (a key concern for the ratings agencies) those downgrades could come earlier. Additionally any pulling back on plans for 2017/18 fiscal budget deficit of near 3% of GDP and more dangerously any pressure on the central bank to ease, would be met with alarm.

| US$8bn |

debt outflows from S.Africa if local currency ratings cut to junk |

Where should USD/ZAR be trading in theory

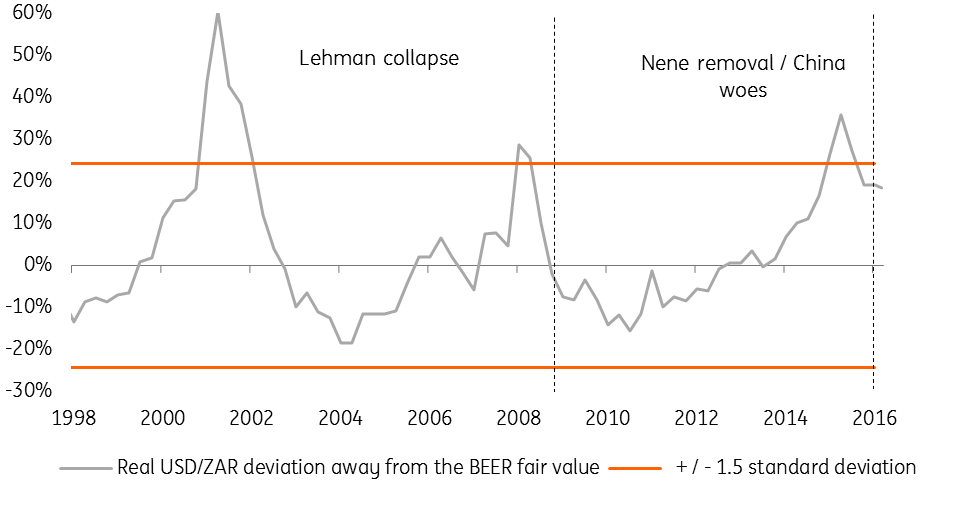

One of the reasons we believe the recent ZAR sell-off has been quite limited owes to valuation. Petr Krpata’s work on medium term fundamental valuation (BEER) points to USD/ZAR being overvalued by around 18%.

This compares to around 9% overvaluation during the ZAR’s recent peak two weeks ago. While a meaningful in absolute terms, it is important to note that the current ZAR mis-valuation is not far away from the upper 1.5 standard deviation band limit. The last two times the rand persistently traded through these valuation limits were during (a) the post Lehman collapse EM sell-off; (b) the extreme rand fall in late 2015 /early 2016 (a mix of both internal political woes and external concerns about China). This suggests the scope for another large scale sell-off looks limited from here.

While the current ZAR valuation does look attractive, we note that on comparative basis it is not as attractive as TRY valuation. As Fig 11 shows TRY is meaningfully more undervalued than ZAR (following the large scale lira sell-off during H2 2016 and the early part of 2017), with the lira being extremely stretched even by its own standards.

USD/ZAR deviation from fundamental fair value

Where do we think USD/ZAR will trade in practise?

USD/ZAR shows both the highest realised volatility (e.g. one year at 19% vs TRY 13%, RUB 16%, BRL 14%) and trades on the highest implied volatility amongst its peer group of high yielders. Needless to say forecasting the Rand comes with an extreme health warning.

Over recent years the SARB has downplayed the pass-through effects of the weaker Rand to inflation

SARB interest rate policy will also be important in forecasting the ZAR.Over recent years the SARB has downplayed the pass-through effects of the weaker Rand to inflation. For the time being, we would imagine investors would want to see a hawkish SARB and indeed pricing of the policy curve has jumped 50bp at the back end just over the last week.

Our assumption is that the SARB will keep the policy rate at 7.00% this year. The next SARB meeting is not until May 25th, allowing some time for the dust to settle.

On the assumption that key institutional/fiscal confidence does not erode – and that the central bank does not come under any pressure for easier policy (no signs as yet) - we think ZAR under-valuation will dominate over coming quarters. A firmer ZAR would be consistent with our generally bullish view on the commodity currencies which sees AUD/USD back to 0.80/85 on a 12/24 month basis and USD/CAD back to 1.30.

In all we think continuity of the Zuma administration, surviving a No-confidence motion, could see USD/ZAR trade into the 14.00/50 region in 2Q17. Thereafter valuation metrics should come into play and expectations of stronger global growth into 2018, helped in part by clarity on what Trump can achieve, stand to drive USD/ZAR closer towards fundamental fair value levels closer to 12.00.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more