Why did the Italian Target2-deficit fall in July, despite ongoing QE?

The Italian Target2-balance, which started to increase steadily in early 2015 as the ECB's QE programme began, appears to have stabilised in 2017. But QE is still ongoing. What's going on?

Eurozone Target2-balances widening since early 2015...

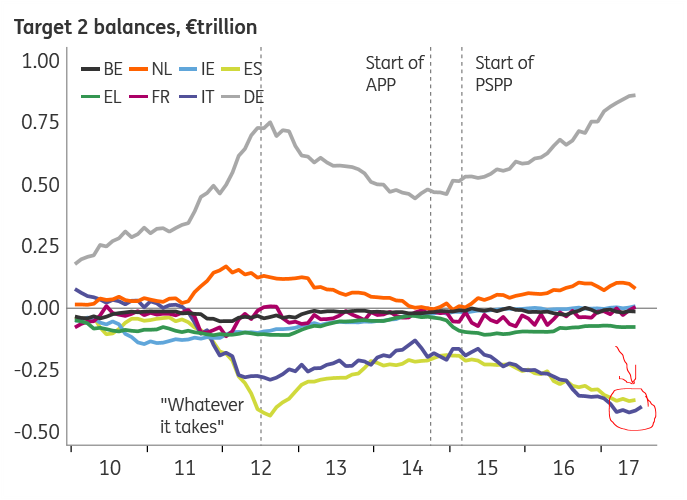

Target2-balances are the claims and liabilities between Eurozone central banks and the ECB, that result from cross-border payments settled in central bank money. That sounds rather arcane and technical. And in fact until 2008, few cared about these balances between central banks. That changed quickly after 2008 when in the midst of the Eurozone debt crisis, balances between Eurozone central banks rose to unprecedented heights. Mainly the German and Dutch central banks acquired net claims on the ECB, while Spain and Italy were the main deficit countries. Back then, these imbalances reflected a relocation of private capital out of the south and towards the north of the Eurozone.

After Draghi's famous "Whatever it takes" comments in July 2012, Target2-balances gradually declined again. But as the ECB embarked on QE in early 2015, Target2-balances started to widen once more. In fact, the German Target2-surplus is higher today than it ever was in 2012. Yet the Italian Target2-deficit has stopped widening this year, and in fact, has been moving sideways since February.

Useful Target2-explainers by the ECB

Italian investors have been taking their money out of the country...

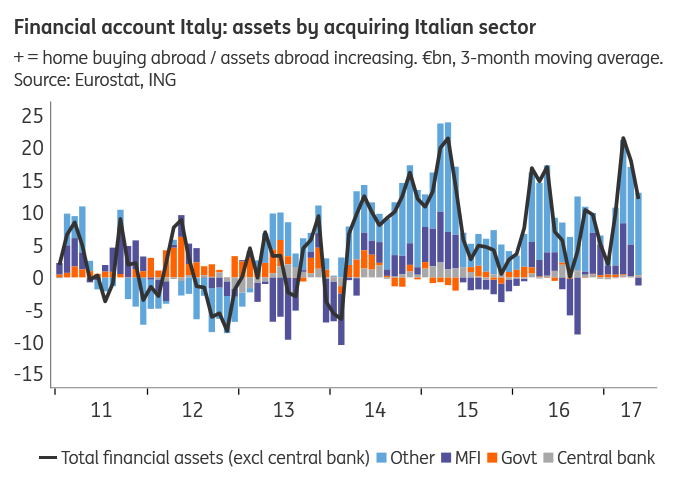

QE is an important driver of the Target2-developments witnessed over the past two years. The presence of central banks as dependable buyers in the market has enabled investors to sell their government bonds and direct the proceeds elsewhere. Zooming in on Italy, balance of payment data show that both foreign and Italian investors have taken the opportunity to sell Italian government bonds. As the chart below shows, Italian banks and especially Italian investors have been making substantial portfolio investments abroad over the past years, after selling some of their Italian government bonds. This portfolio reallocation by Italian investors explains roughly half of the observed increase in the Banca d'Italia's Target2-deficit over the past two-and-a-half years.

It should be noted that Italian foreign investment is also helped (and the Target2-deficit mitigated) by the fact that Italy runs a current account surplus today -- contrary to 2011-2012 when it ran a current account deficit.

...while foreign investors have stopped taking their money out of Italy

Italian portfolio reallocation abroad appears to continue unabated in 2017, and can therefore not explain that the Italian Target2-deficit stopped increasing this year. For that, we have to look at the other important driver of the Italian Target2-deficit, which is foreign investors. They have been divesting Italian government and bank bonds (the latter replaced partly by the ECB's TLTRO funding). Yet since the start of this year, the outflow of foreign money has greatly diminished (see chart below). The foreign divestment of Italian government bonds has shrunk, while foreigners are even back buying some corporate and bank bonds. This explains the stabilisation of the Target2-deficit since February.

It can be considered good news that foreign money is no longer leaving the country. Yet it remains to be seen how foreign (and domestic!) investors will behave in the near future. With QE slowly drawing to a close, the guaranteed buyer Eurozone government bond markets have grown accustomed to, is going to close up shop. Moreover, with Italian elections to be held in Spring 2018 at the latest, political uncertainty remains elevated.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).