Who’s hired? The four contenders for the next Fed chair

President Trump is weeks away from announcing who will run the Fed for the next four years. We take a look at the runners and riders

Question marks over whether Yellen will remain at the Fed beyond February

During his election campaign, President Trump was critical of many institutions and individuals. The Federal Reserve and its Chair, Janet Yellen, didn’t escape. He accused them of keeping interest rates low to benefit outgoing President Obama with Trump stating “she is very political and to a certain extent, I think she should be ashamed of herself”.

This notion that the Federal Reserve was “politicised” has helped fuel the campaign by some Republican lawmakers to rein in the power of the central bank. One way of doing this is by forcing the adoption of a “rules-based” system for setting monetary policy – a mechanistic response depending on how far inflation and unemployment are from a desired level.

These developments led markets to increasingly question how long Yellen would last in her role with some talk that Trump could seek to replace her before her term expires in February 2018. However, since his election, Trump’s attitude appears to have softened. He now admits that Yellen has “done a good job”, adding that “I do like a low-interest rate policy, I must be honest with you”. Treasury Secretary Steven Mnuchin also indicated that Trump was considering re-appointing her, adding that in his view she is “obviously quite talented”.

There are four main contenders in the race for Fed chair

Nonetheless, Trump is considering all his options for the Federal Reserve and he has a lot to think about. With Vice Chair Stanley Fischer having resigned, effective October 13, there are now four vacancies within the seven member Board of Governors at the Fed. With Yellen’s term ending in four months, he can potentially nominate five new members, offering the possibility of sweeping changes in leadership at the Fed.

In this regards, Trump told us last Friday that he and Steven Mnuchin have “had four meetings for Fed Chairman and I’ll be making a decision over the next two to three weeks”. Below we take a look at the leading candidates and what the implications might be for the Federal Reserve.

Taylor rule suggests rates should be nearer 3%

Janet Yellen

We know where we stand with Janet Yellen. Historically she has been viewed as having dovish leanings, but this is less evident currently. She is now much more the centrist, backing the median call of Fed officials for a December rate rise with three more hikes next year - financial markets are doubting there will be even just two over the same time frame. She is keen to maintain financial regulation standards and would likely fight back against President Trump's efforts to water them down.

Gary Cohn

Cohn is currently the Director of the National Economic Council and is helping to get President Trump’s tax reform programme through Congress. A former President/COO of Goldman Sachs, there are suggestions that his chances of taking over at the Fed have diminished following his criticism of President Trump’s response to protests in Charlottesville. In the past he has criticised the Fed for talking too much, which in his view creates market confusion. This suggests a less interventionist approach if he was running the Fed, but the influence on the path for monetary policy is less clear.

Kevin Warsh

Warsh is a Fellow at the Hoover Institute who previously was a Federal Reserve Governor between 2006 and 2011. Before that he was an M&A banker at Morgan Stanley. He has written in support of Trump’s tax and spending policies and the potential for the economy to grow at 3%+ rates. However, he also has a history of being on the hawkish end of the spectrum and has offered some backing to the idea of “rules-based” policy setting, such as the Taylor Rule. He has also been critical of some Fed policy, questioning the effectiveness of QE policies, and again would not be as interventionist as Janet Yellen. In general, the perception is that he would favour adopting a tighter monetary policy stance.

Jerome Powell

Powell is a current Fed Governor, having joined the board in 2012. His current term ends in 2028. He is a former undersecretary of the Treasury and before that worked in private equity. On regulation, he has suggested "there is room for eliminating or relaxing aspects of the implementing regulation in ways that do not undermine the Volcker rule's main policy goals".

This is the continuity candidate should Trump decide against re-appointing Janet Yellen with a perception that he is of a similar mind set on the outlook for interest rates to the current incumbent.

Other candidates

Other candidates include Stanford University professor John Taylor (famous for his 1993 monetary policy rule and a former Treasury Undersecretary) and Columbia University professor Glenn Hubbard, who was in the running to take over at the Fed in 2006 but lost out to Ben Bernanke. They wrote a recent joint paper with Kevin Warsh backing Trump’s fiscal plans, but the fact Warsh was interviewed, and Taylor and Hubbard apparently weren't suggests their chances are relatively slim.

Rules-based approach could be a key factor in Trump's thinking

The candidate that Trump chooses may well come down to whether he backs the rules-based approach that would rein in the power of Federal Reserve officials. While adopting such a rigid system would arguably increase transparency there is the issue of what data to use and the flexibility that it permits to respond to fast-moving events.

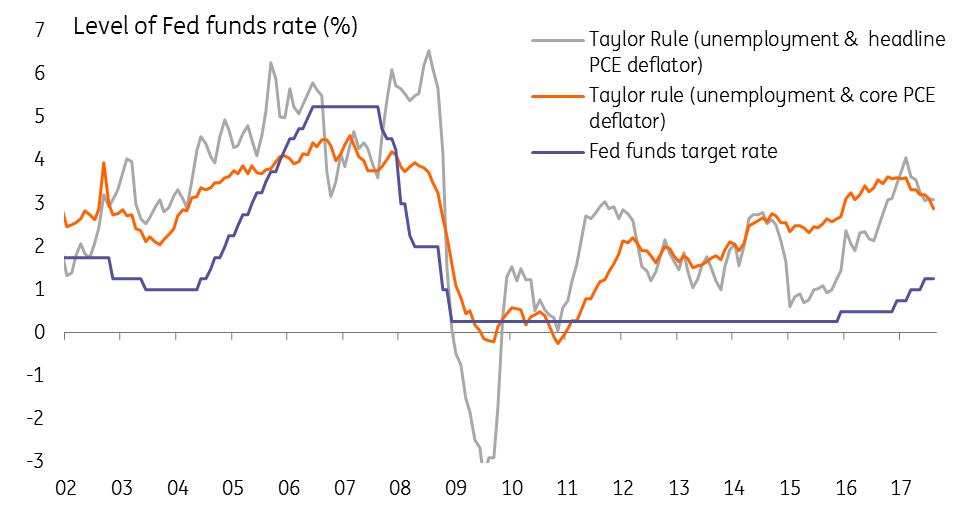

Moreover, Taylor Rule models suggest that interest rates should be substantially higher than where they currently stand, irrespective of which inflation and output measure is used and the weight placed on each. In any case, the Fed already looks at such rule-based outcomes, but according to Fed voter Neel Kashkari, “ultimately we use judgment and historical precedence to decide if that guidance makes sense given other important economic trends that rules don’t consider.”

With the mid-term elections little more than 13 months away and Trump’s popularity already looking shaky, it seems highly unlikely he would opt for this approach.

Another factor that leads us to believe Trump won’t go down this route is the fact he has struggled to make headway on his fiscal stimulus and tax plans, and the economy looks increasingly unlikely to receive any benefit until well into next year. If the Fed funds rate was at 3% as currently prescribed by the Taylor Rule then the outlook for GDP growth would be weaker, the jobs market softer and the dollar significantly stronger given ongoing loose monetary policy elsewhere.

With the mid-term elections little more than 13 months away and Trump’s popularity already looking shaky, it seems highly unlikely he would opt for this approach. Instead, Trump's rhetoric suggests momentum is shifting towards 'dovish' Yellen being asked to serve a second term, much like Obama and Clinton re-appointed incumbents of opposing political persuasions.

What is a rules-based approach?

The main argument in favour of adopting a rules based approach to setting monetary policy is that it increases transparency. If people know how the Fed is likely to behave then businesses and households will be better able to plan for the future.

The best known of these is the Taylor Rule, named after Professor John Taylor from Stanford University. Given the Federal Reserve has a dual mandate of stable prices and maximum sustainable employment he created a formula for setting interest rates that minimizes the deviation from these goals:

But the chief problem with adopting such a prescriptive approach as the Taylor Rule is the quality of the data that can be put into the model.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more