Where is inflation in Thailand?

There has been none in the last three years and we do not expect it to emerge in 2018, allowing greater scope for the Bank of Thailand to remain on hold this year

| 0.8% |

Thailand inflation in December (YoY) |

| Worse than expected | |

Downside inflation surprise

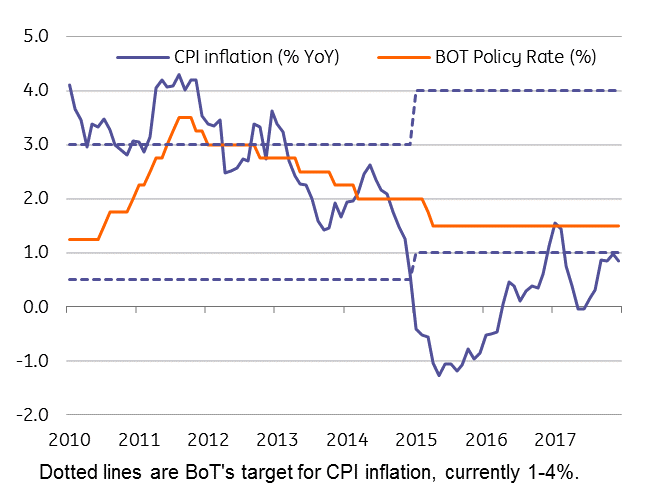

Thailand consumer price inflation in December was below expectations at 0.8% year-on-year, vs consensus for it to remain unchanged at the 1% rate of November. This puts full-year 2017 average inflation at 0.7%, an acceleration from 0.2% in 2016 and from -0.9% in 2015. However, inflation has persisted below the Bank of Thailand’s 1-4% medium-term target set in 2015.

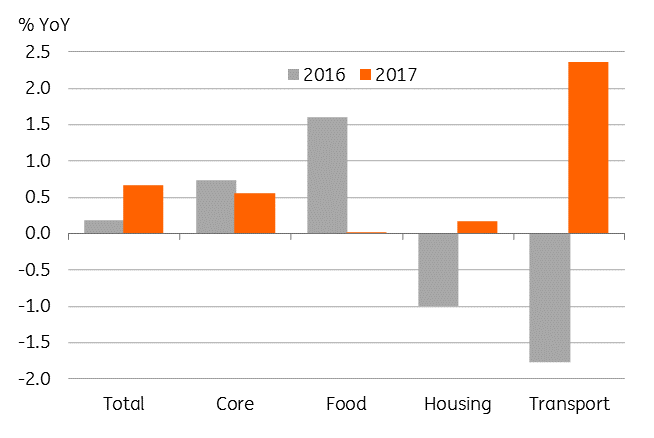

Divergent trends in food and transport prices

Food and transport prices are the typical drivers of CPI inflation in Thailand. While both these components are positively correlated, the trends in the two were in opposite directions in 2017. Improved crop production kept the food component flat after a 1.6% increase in 2016. Pass-through of higher global oil prices caused a sharp spike in the transport component to +2.4% from -1.8%. We expect these trends to hold in 2018.

Inflation by main components

Weak domestic demand, strong THB

Apart from the influences from food and oil prices, weak domestic demand and strong Thai baht (THB) appreciation are factors contributing to low inflation. Again these trends are likely to hold in 2018. The THB’s 10% appreciation vs USD made it the third best-performing Asian currency in 2017, after the Korean won and Malaysian ringgit, thanks to the persistently wide external surpluses the economy is enjoying.

| 10% |

THB appreciation vs USD in 2017 |

The BoT need not follow the US Fed

Low inflation has allowed the BoT to maintain the current accommodative monetary policy stance for a prolonged period.

The BoT need not follow the US Fed in tightening nor is there need for higher interest rates yet, says governor Veerathai Santiprabhob

Released today, the minutes of the BoT meeting held on December 20 revealed that the policymakers assessed risks to the central bank’s 1.1% inflation forecast for 2018 as evenly balanced, while growth remained below potential. The BoT forecasts GDP growth in 2018 at 3.9%, close to the pace this year though the minutes point to downside risk from deceleration in exports.

Inflation and BoT policy

ING forecasts on-hold BoT policy in 2018

We reiterate our forecasts for no change to BoT policy in 2018. This rests on our below-consensus forecasts of GDP growth of 3.5% and CPI inflation of 1.0% this year (consensus 3.7% and 1.4% respectively). Our end-2018 USDTHB forecast is 32.00 (consensus 32.5).

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).