What to expect from the WASDE

The US Department of Agriculture will release its monthly WASDE report (World Agricultural Supply and Demand Estimates) on Tuesday, and there are a number of things the market will be keeping an eye on. Here's what we'll be following most closely

Russian wheat output- potential for further downgrades?

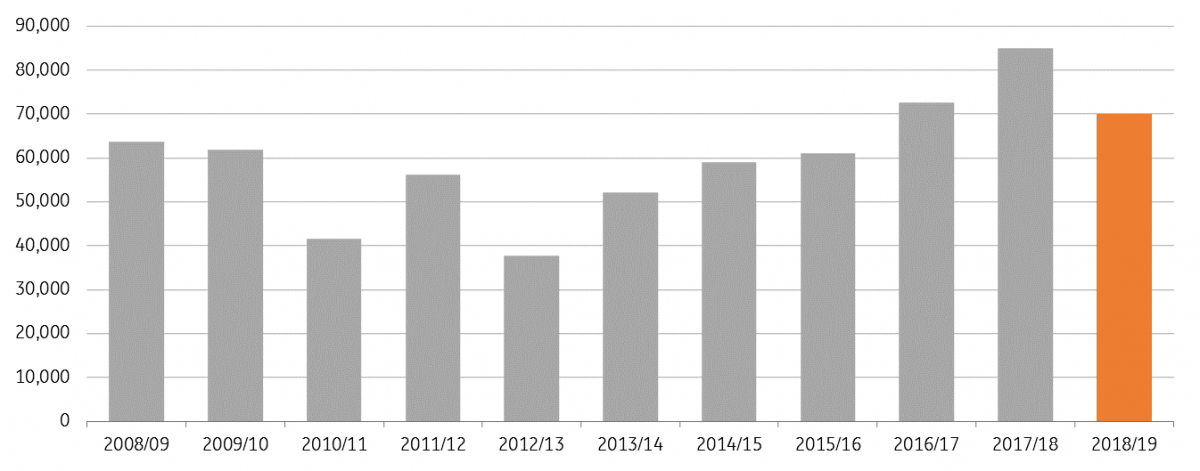

There have been growing concerns over the Russian wheat crop. Recent dry weather conditions have meant that a number of analysts have downgraded their outlook for the Russian crop. In the May WASDE, the agency forecast the 2018/19 harvest at 72mt, this compares to the Russian Grain Union’s more recent estimate of between 68-69mt. Meanwhile, we continue to hold our forecast at 70mt. This is a number that most analysts appear to be moving towards for now. While this will be a significant fall from the 85mt harvested in the 2017/18 season, it is important to stress that a 70mt crop would still be well above historical averages, and the third largest crop on record.

Meanwhile, given the depreciation in the Russian Rouble (which is trading around 62 to the USD at the moment, compared to 56 earlier in the year), we believe that farmers will still look to export as much as possible. Therefore, while we expect to see a fall in exports, we do not believe it will be in line with the decline in production. Instead, we expect to see a drawdown in domestic inventories. In May, the USDA was forecasting Russian 2018/19 exports at 36.5mt, down from 39.5mt in 2017/18.

Meanwhile in Ukraine, we do not expect any significant changes. In the previous WASDE, the USDA estimated Ukrainian 2018/19 wheat output at 26.5mt, which is broadly in line with the 25-26mt that the Ukrainian Grain Association recently estimated.

Russian wheat output set to decline (000 tonnes)

US winter wheat concerns linger

The big question mark is around the US wheat crop. In the May WASDE, the USDA forecast that the 2018/19 wheat harvest would total 1,821m bushels. According to a Bloomberg survey, analysts expect the USDA to downgrade the crop to 1,811m bushels, however, the range of estimates is fairly wide at 150m bushels.

Concerns lie with the condition of the winter wheat crop. The USDA’s crop progress report continues to show that US winter wheat is in poor condition, with 35% of the crop rated poor to very poor, this compares with just 15% at the same stage last year.

Whilst the USDA is estimating that the 2018/19 season will see US ending stocks falling to 955m bushels (from 1,070m bushels in 2017/18), this could be offset somewhat by weaker exports. At the moment the agency is forecasting exports at 925m bushels, up from 910m bushels in 2017/18. However, the stronger US dollar may support the idea of weaker exports, particularly if USD strength is here to stay.

Further downgrades for Brazilian corn output?

Dry weather in Brazil continues to be a problem for the country’s safrinha corn crop, and as a result, we continue to see revisions lower in production estimates. In the May WASDE, the USDA forecast total Brazilian corn output at 87mt, down from 98.5mt last season. However, expectations are that we will see the crop downgraded towards 84mt.

CONAB, the Brazilian crop agency, will also be releasing its latest estimates for the Brazilian corn crop on Tuesday, and in CONAB's May report, the agency forecast the crop at 97.8mt, higher than what the USDA is currently forecasting.

While export returns for Brazilian farmers are attractive, given the continued depreciation in the Brazilian real, we believe it will be difficult for Brazilian exports to increase much more than the USDA is currently forecasting. At the moment the USDA forecasts corn exports at 30mt over the 2017/18 season, which leaves domestic inventories fairly tight if the domestic crop does turn out to be closer towards 84mt.

US corn looks in good shape

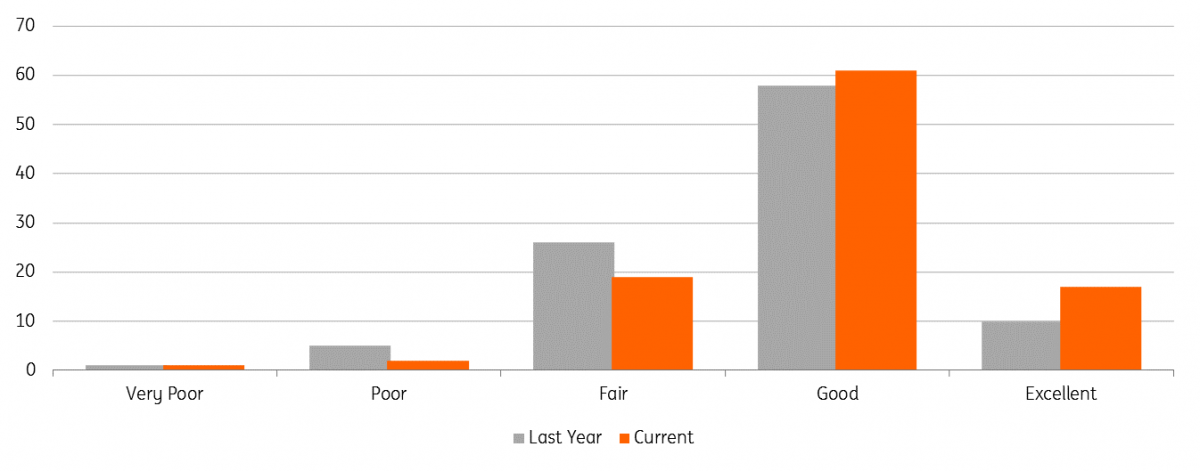

While there are plenty of concerns over how the US wheat crop will play out, the outlook for US corn production is looking more positive. Plantings are mostly complete, while according to the USDA’s crop progress report, 78% of the corn crop is rated good to excellent, which compares to 68% at the same stage last year. This better condition of the crop could mean that the USDA looks to revise higher its yield estimate for the 2018/19 season. Right now, they are assuming a yield of 174bu/acre, down from 176.6bu/acre in 2017/18. A revision higher in yield expectations could put some immediate pressure on the market.

However, the USDA may decide to wait until later in the summer before it makes yield adjustments based on the crop condition. Either way, it is unlikely that we will see production estimates match output last season, given the fall in acreage we have seen in 2018.

US corn crop in good condition (%)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more