What to expect from the March US jobs report

February’s very soft jobs report contributed to markets pricing in Fed rate cuts later this year, but we expect a much better set of figures for March which should help ease market fears about a slowdown

Jobs growth – back to trend?

February’s 20,000 reading for payrolls growth was astonishingly bad. In fact, we described it as being “too bad to be true” given all other survey evidence has pointed to ongoing robust demand for workers. Instead, we suggested that there may be some data issues, particularly given the disruptive influence of the government shutdown in late December/January. We didn’t trust the 311,000 payrolls gain for January either, which was massively above market expectations. But if you take an average of January and February together you get 165,500 per month and that is something we could believe.

This marks a slowdown from the consistent 200,000+ gains seen through much of 2018, but it is understandable given some moderation in the pace of economic growth. Another factor that has contributed to a slowdown in hiring is the lack of available workers to fill the vacancies. We continue to highlight the National Federation of Independent Business’ survey on hiring which shows 37% of small businesses have vacancies that they cannot fill. At the same time, the Federal Reserve’s Beige Book said that as of March “Labour markets remained tight for all skill levels, including notable worker shortages for positions relating to information technology, manufacturing, trucking, restaurants, and construction”.

Lack of workers contributing to slowdown in employment

Hopefully, a rising worker participation rate can improve the supply-demand balance and fill some of the skills gaps as it is clear that demand for workers remains pretty strong. The ISM manufacturing index for March saw a five-point jump in its employment sub-component so we think a 160,000 reading for March payrolls is achievable. We also think there is scope for an upward revision to the February reading. The consensus estimate is for payrolls growth of 179,000 within a range of 120,000-280,000 from 71 different economists according to the Bloomberg survey.

| 160k |

ING forecast for March payrolls growth |

Wages continue to rise

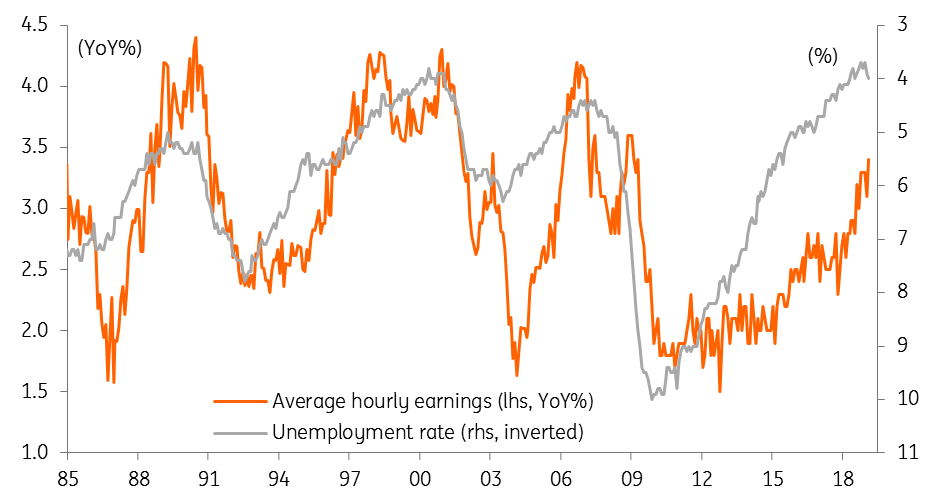

Wage growth is currently running at 3.4% year on year, which is the fastest rate of increase since April 2009. This is being fuelled by the competition for workers at a time when unemployment is close to 50-year lows. According to the Beige Book, as of last month “wages continued to increase for both low- and high-skilled positions across the nation”, adding that “contacts in about half of the Districts noted rising non-wage forms of employee compensation, including bonuses, relocation assistance, vacation time, and flexible work arrangements”. Consequently, we look for another 0.3% month on month (MoM) gain, which has the potential to push the annual rate of wage growth up to 3.5%. The consensus is for 0.3% MoM growth with the annual rate holding at 3.4%.

Pay is responding to record low unemployment rate

| 3.5% |

ING's prediction for March pay growth(YoY%) |

Unemployment close to 50-year lows

The unemployment rate dropped from 4% to 3.8% last month and we suspect it will hold at that level in March. It was lower in September and November last year at 3.7%, but with some signs that “economically inactive” people are being lured back into the labour market with the prospect of higher pay another decline in the unemployment rate looks a bit of a stretch. The consensus is also for it to hold at 3.8%.

| 3.8% |

ING's prediction for March unemployment rate |

What it could mean for the Fed

Financial markets are clearly worried about the threat of a US recession with the yield curve having inverted and futures contracts pricing in interest rate cuts from the Federal Reserve. However, we are more upbeat and believe that competition for labour gives workers a sense of job security and is leading to higher rates of pay. This is boosting household incomes and should underpin consumer confidence and spending. If progress can be made on US-China trade talks this can remove some of the economic uncertainty and keep demand for workers strong. As such, while we acknowledge there are more headwinds for the US economy in 2019 versus last year we are in the camp that expects US monetary policy be left unchanged this year, especially with pay gains likely leading to broader inflation pressures.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more