Weaker natural gas assuming no surprises

The European gas market faces several risks heading into 2025, although our balance suggests prices should trend lower next year. Meanwhile, the US gas market is set to tighten, supporting prices

European storage draws quicker than expected

The European natural gas market has strengthened as we move deeper into the 2024/25 winter. TTF front-month prices have traded close to EUR50/MWh and to levels last seen back in November 2023. Storage started the heating season at 95% full, and while comfortable, it was slightly lower than we were expecting. In addition, a lack of wind power generation in November saw the power sector turn more heavily towards natural gas for power generation. This saw storage falling at a quicker-than-expected pace at the start of the heating season. At 82% full, European gas storage is below the five-year average for this time of year. This means that, assuming a normal winter, storage will end the heating season lower than initially expected.

Our European balance shows storage at the end of March 2025 at around 40% full. This is down from the 58% full at the end of March 2024. While significantly down year-on-year (due to a mild 2023/24 winter), this storage is still fairly comfortable on a historical basis and supports the view that European prices should trend lower through next year. We are forecasting TTF to average EUR33/MWh over 2025. However, there are plenty of risks.

In our balance we are assuming that Russian pipeline flows via Ukraine will stop on 31 December 2024. We are also assuming that the EU can pull in 4bcm of additional LNG supply between November and the end of March, compared to the same period last year. In addition, we expect European gas demand to increase by around 2% YoY in 2025. This is where there is most uncertainty, given that demand is going to be largely weather-dependent.

EU gas storage falling quicker than expected (% full)

Russian flows via Ukraine to stop

As mentioned, we are assuming that Russian gas flows via Ukraine will come to a stop on 31 December 2024. Gazprom’s transit deal with Ukraine expires at the end of 2024 and Ukraine has made it very clear that it has no intention to extend this deal. This means that the EU will lose around 15bcm of gas supply annually, which is equivalent to around 5% of total imports. While there have been some efforts to try to keep gas flowing through a possible swap with Azerbaijan, it appears that these flows will stop and we believe this should be priced into the market. This leaves a downside risk to the market. If for any reason these flows continue, the European market will be left better supplied than many were expecting.

While Russian flows via Turkstream may increase marginally, the EU will have to rely further on LNG imports to make up for this shortfall.

Recent moves by Russia also suggest that it is more willing to continue supplying Europe than in 2022. This is evident in Russia's recent decision to continue to sell volumes into the spot European market after having stopped delivering gas to OMV under a long-term contract. This was after OMV said it would not pay Gazprom for gas, in order to recoup money it was awarded in an arbitration related to flows that Gazprom halted in 2022.

A factor that needs to be followed closely is how recent US sanctions against Gazprombank will impact Russian gas flows, if at all. This was the bank used by European buyers to pay for Russian gas. The Russian government has allowed for changes in the way payments can be made, but it is still yet to be seen if this will hinder flows. We should get more clarity following the wind-down period for transactions, which ends on 20 December 2024. This puts all Russian gas flows to the EU (including volumes via Turkstream) at risk. Russian volumes via Ukraine and Turkstream make up around 9% of EU gas imports.

The EU still imports a sizeable share of Russian pipeline gas (%)

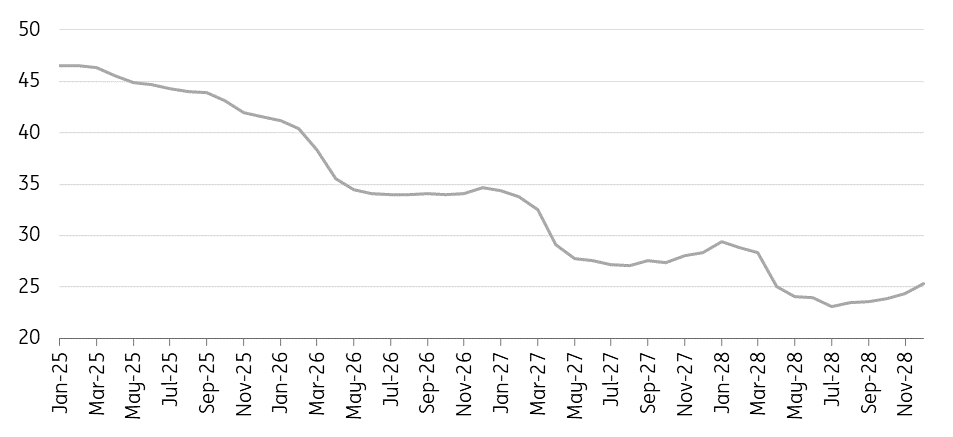

The TTF forward curve tells us a lot

The shape of the TTF forward curve is interesting. It's currently showing that summer 2025 prices are trading at a premium to winter 2025/26 prices. Usually, you would expect summer prices to be at a discount to winter prices to incentivise the storage and carry of gas for the higher demand winter period. The forward curve is reflecting a possible rush to fill storage and meet the European Commission’s target of having storage 90% full by 1 November. Recently, the Commission also increased its intermediary targets, wanting storage to be 50% full by 1 February, up from a previous target of 45%. These intermediary targets are to try to ensure that storage is filled steadily. Our European balance suggests the region is already set to meet this target.

Sticking with the forward curve, and looking further out, it is not until 2026 that we see the curve taking a significant step lower, which reflects expectations of the startup of new LNG export capacity from Qatar. This ties in with our LNG balance, which shows the market relatively balanced in 2025, but well supplied in 2026.

TTF forward curve in backwardation through 2025 (EUR/MWh)

European gas demand to tick higher

In our balance, we are assuming that EU gas demand will grow by around 2% YoY. This still leaves demand around 17% below the 2017-21 average. Where demand ends up will depend on how winter weather evolves. In addition, if the higher prices we are seeing persist for a while longer, this will likely not help with the recovery in industrial demand.

While gas demand from the power generation sector was stronger in November, forward spark spread values for 2025 – currently in negative territory – show that gas demand from the power sector should remain fairly weak.

Robust Asian LNG demand

Asian demand for LNG has been strong this year. Lower prices have seen price-sensitive buyers in the region returning to the market. Chinese LNG imports have been strong despite growing pipeline volumes from Russia. There has been a significant pick up in the sale of LNG-powered trucks in parts of China, which has proved supportive for LNG demand while weighing on diesel demand. Chinese LNG imports have exceeded 98bcm over the first 11 months of the year, up 13% YoY and on course to hit record levels this year, exceeding the 107bcm imported in 2021.

While spot Asian LNG continues to trade at a premium to TTF, there is little between the two markets through summer 2025. This suggests that we could see increased competition between the two regions, particularly if Europe faces a bigger job (relative to 2024) to refill its storage.

There is also a fair amount of regasification capacity in Asia set to start in 2025, with more than 115bcm expected to start. This capacity is dominated by China, which makes up almost 70% of the total. While increased regasification does not translate into a guaranteed increase in demand, it does show that demand from the region is expected to grow strongly with investment in the necessary infrastructure.

LNG supply growth in 2025

There is a fair amount of US LNG export capacity ramping up at the moment, and further capacity is expected to start up over the course of 2025. In addition to the US, there is also a capacity set to start up in Canada and Mexico. With the capacity added this year and next, we are looking at around 50bcm of additional LNG supply in 2025.

There are, however, clear risks with ramp-ups – and there is certainly the risk of unplanned outages at already-producing plants, which could see the net addition of LNG supply coming in lower.

US natural gas market to tighten in 2025

US natural gas prices have rallied as we head into the 2024/25 winter. Front-month Henry Hub futures recently traded to their highest level since November 2023. While US natural gas storage is still comfortable and 7.8% above the five-year average, the gap to the average has narrowed as we have moved through the year.

US natural gas production is estimated to have marginally fallen this year. Demand has remained robust, driven by stronger demand from the power sector along with firm demand from LNG export plants.

For 2025, US natural gas production is expected to edge higher, growing by 1.1Bcf/day. Demand growth is expected to be even stronger. This is driven by the ramping up of new LNG export plants with Plaquemines, Corpus Christi stage 3 and Golden Pass. Natural gas demand from US LNG export plants next year is expected to grow by around 1.7Bcf/day.

This stronger demand, coupled with the potential for upside in gas demand from the power sector, means that the US gas market is likely to continue to tighten next year. We currently forecast Henry Hub to average US$3.50/MMBtu in 2025.

ING forecasts

Download

Download article

11 December 2024

Commodities Outlook 2025: A bearish horizon This bundle contains 15 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more