Warning lights start to flash on US housing

The US housing market performed strongly through the pandemic, boosted by aggressive stimulus and flexible working. Mortgage rates are now climbing while rising costs are squeezing household budgets. After 30%+ surges in home prices and construction spending, the housing market risks becoming a drag as we head into 2023

Housing boomed through the pandemic

The US housing market has been a major support for economic activity throughout the pandemic. The plunge in mortgage rates as the Federal Reserve slashed borrowing costs, combined with working from home flexibility that opened up more options for where to live, stimulated a surge in demand. At the same time, supply was constrained with Covid restrictions initially leading to a drop in construction activity. Inventory for sale fell to record lows and in the environment of excess demand, prices surged.

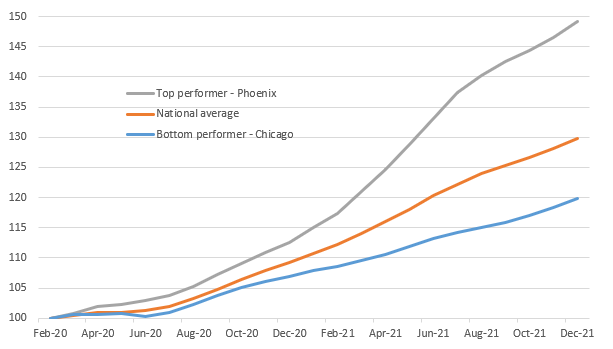

As the chart below shows, the S&P Case Shiller housing index has risen 30% nationally since the pandemic struck in February 2020 with even the worst-performing city, Chicago, experiencing a 20% rise. Tampa and San Diego have both seen 41% increases, while the top performer is Phoenix where average prices are up 49% on February 2020 levels.

US Case Shiller index house price levels (February 2020 = 100)

Construction surge contributed strongly to growth

Residential construction spending fell 5% between March and May 2020, but as working and movement restrictions lifted, construction activity recovered. It is now up 35% on pre-pandemic levels with builder sentiment buoyed by higher selling prices, even as labour and building supply costs rise. The result is that residential construction investment growth has outpaced overall GDP growth so that this sector alone accounts for 3.5% of total economic output.

In the near-term, housing looks set to continue to contribute positively to the economy. Employment and wages are rising across the country, supporting demand, with new and existing home sales remaining robust. This continues to support home builder optimism with housing starts and building permits at levels last seen in 2006.

Housing construction and building permits approaching 2005 boom levels

But there are warning signs...

However, warning signs are starting to illuminate. This morning’s mortgage application data showed a small dip in applications for home purchases. The move wasn’t big – we are certainly off the recent peaks in the first and fourth quarters of 2021. The problem is, we could be in for much larger declines in the coming months.

That’s because mortgage rates are now rising rapidly at a time when rampant inflation is eroding household spending power and consumer confidence. The University of Michigan reports sentiment is the weakest since 2011 and is not far off the lows seen during the global financial crisis in 2008. With potential home buyers starting to feel more nervous about the economy, the prospect of sharply higher monthly mortgage payments adds an extra reason for caution.

Mortgage rates are surging as the Fed fights inflation

Mortgage rates are climbing fast and demand is stalling

Treasury yields are spiking higher as Fed officials switch to a narrative of wanting to stamp down on inflation, with financial markets now anticipating the fed funds rate ending 2022 at 2.25%, a 200bp increase on the start of the year. The Fed is also expected to soon start shrinking its $8.9tr balance sheet by allowing some maturing assets to run off, increasing the amount of bonds the market needs to absorb. Higher benchmark borrowing costs imply further upside risks for mortgage rates.

The chart above shows the national average for a 30-year fixed-rate mortgage has increased from 3% in September to 4.5% last week, which is enough to increase monthly mortgage payments on a $200,000 loan by $210 per month. We look for that 30-year average rate to hit 4.8% in the next couple of weeks, which would add a further $45 per month. Fifteen-year fixes and adjustable-rate mortgage costs are also moving higher.

Housing could swing from excess demand to excess supply

Inventory levels remain low by historical standards at 1.7 months worth of sales for existing homes. They are starting to creep a little higher for new homes at 6.3 months worth of sales versus 3.5 months in late 2020. But if housing sales do indeed slow in response to weaker demand, those inventory numbers could quickly climb. Remember too that with the building permit and housing construction starts at elevated levels, there is going to be more residential properties coming onto the market later this year and early 2023.

Consequently, we see a growing likelihood that the housing market will start to move from one of significant excess demand, which has fueled the house price and construction surge, to one where we are in better balance. However, with the Fed focused on fighting inflation through higher fed funds interest rates and the shrinking of their balance sheet, we could see mortgage borrowing costs continue to rise rapidly. This would heighten the chances that the housing market then swings towards excess supply and home prices start to fall.

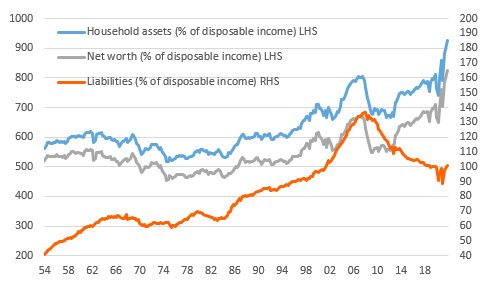

Household assets and liabilities (% of disposable income)

While this in itself is not especially concerning from a household balance sheet perspective, with household liabilities looking low by historical standards, it can feed through into further falls in consumer confidence and weaken consumer spending, while also putting the brakes on new residential construction. Consequently, this is a sector we are keeping a watchful eye on and if we do indeed see the housing market start to wobble it could be a factor that limits the scale of Fed policy tightening and could be a catalyst for actual rate cuts again in late 2023.

Housing market slowdown will drag inflation lower too

Housing market slowdown will open the door for Fed rate cuts in 2023

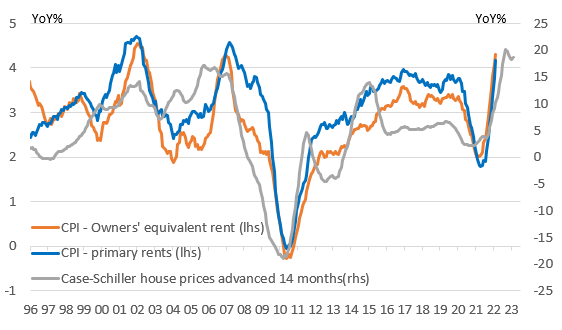

Housing is not only important from an activity perspective. The sector also carries more than 30% of the weighting of the consumer price inflation basket via primary rents and owners’ equivalent rent. Should home prices stabilise and potentially even fall, this can quickly translate into lower inflation readings. This would give the Fed more flexibility to respond with interest rate cuts if they do indeed end up hiking so much that the economy starts to weaken.

As such we increasingly see the prospect of aggressive 50bp rate hikes from the Fed at coming meetings before interest rate cuts come through in the second half of 2023. We will explain this view in more detail in our new monthly forecast update next week.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more