FX: Looking for the Covid correlation

Increases in Covid-19 cases can explain some of the recent diverging FX paths, such as Asian currencies’ outperformance. But when we look at last month's data, there seems to be no correlation with the stringency of containment rules, but this could partly be down to the lack of adequate quantitative measures

Better virus situation helping FX outperform

As global risk appetite faces the challenges posed by second virus waves, we looked into last month’s FX and virus-related data to see how much contagion and re-imposing of restrictions have impacted the FX performance.

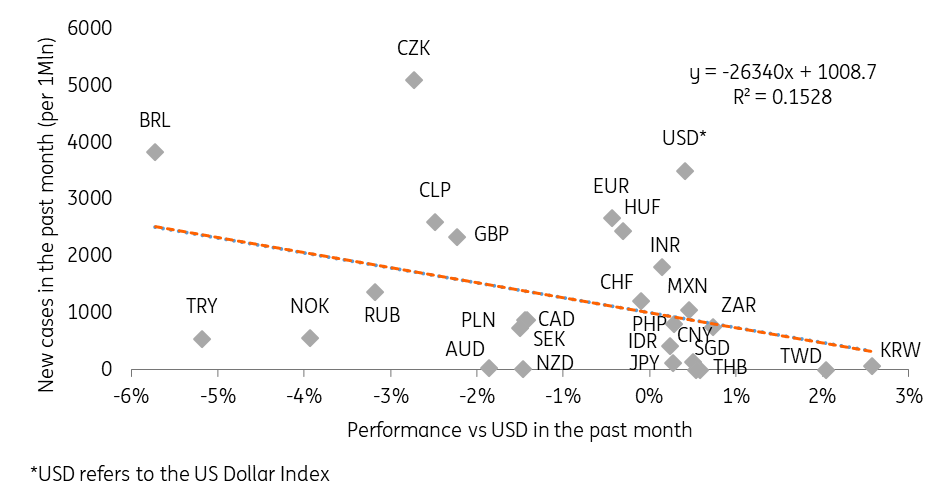

The chart below shows the performance of some major currencies vs the USD in the period 7 September - 5 October plotted against the increase in confirmed Covid-19 cases per 1 million people in the same period. The intuition would be that a more serious contagion situation in a country has made the currency less attractive compared to its peers.

Covid-19 cases and FX performance

The negative correlation is in line with this intuition. Incidentally, this tends to endorse the notion that the recent outperformance of Asian EM currencies compared to other EM FX has been a function of Asia’s less concerning virus situation compared to other regions in the world.

No evidence that stringent measures played a role

Still, the response of the pandemic has been quite different in many countries and not always directly correlated with the number of cases. If FX performance is linked with the ability of a country’s economy to recover at this stage, it would mostly be the stringency of the anti-pandemic measures that would have an impact rather than the simple rise in infections.

The main issue is however finding a measure to track the deepness of restrictive measures. A commonly used indicator is the Oxford Stringency Index, where a higher score equals more stringent measures and would therefore need to show a negative correlation with FX performance.

Given the Stringency Index is rather stable (it hardly changed for many countries over the last month) and often lags the announcement of new restrictive measures, looking at the change in the index over the past month (like above with total cases) appeared unfeasible. In the chart below, we considered the latest value of the Stringency Index instead, plotted vs the FX performance over the last month.

Oxford Stringency Index and FX performance

Despite a lightly negative-sloping trendline, there is no evident correlation. Once again, this may be largely due to the lack of a quantitative measure to track the deepness of Covid-19 restrictions. Still, markets might also have a higher sensitivity to the simple increase in contagion numbers instead, as they tend to frontload the imposition of draconian measures and the consequent impact on the economy.

Of course, the spread of the virus and what it means for future lockdowns are only a subset of the factors driving global FX rates – especially compared to the strength of fiscal and monetary measures and what they mean for global recovery hopes. Yet the above analysis does loosely support the intuition that FX outperformance will be hard to see at a time of escalating new cases.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more