US: Still feeling it…

Consumer confidence has improved again in August as the strong jobs market, massive tax cuts and buoyant asset prices keep households in the mood to spend

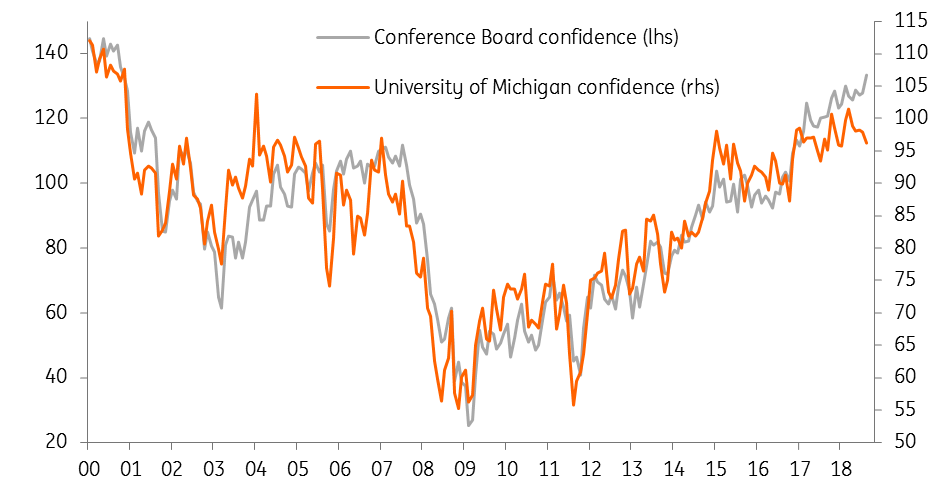

The final reading of August University of Michigan consumer confidence has improved to 96.2 from the preliminary figure of 95.3 and suggests households remain very positive on their own personal situation and that of the US economy. This follows from last week’s Conference Board measure, which rose to an 18 year high. However, the chart below shows there is some divergence between the two series emerging right now, which we should keep an eye on.

With the jobs market going from strength to strength and tax cuts putting more money in peoples’ pockets, there is a strong appetite to spend. Rising home and equity market prices are also boosting household wealth, so it is little surprise to see optimism is at such strong levels. The only thing missing is wage growth, which continues at a subdued 2.7% rate - slower than headline inflation of 2.9%. If we can see the pay story improve (we look for wage growth to pick up to 2.8% next Friday) this could see sentiment hit new record highs.

As such we expect consumer spending to remain a key driver of US economic activity. Consumer spending rose at an annualised rate of 3.8% in 2Q18, and we look for another 3% figure in Q3, helping to fuel full year US GDP growth of around 3%. With annual inflation at or above 2% on the headline and core (ex-food and energy) measures this suggests the Fed will continue hiking rates in a “gradual” fashion. We look for both a September and a December Fed rate hike with two further moves next year.

US consumer confidence measures - 2000-2018

Download

Download article31 August 2018

In case you missed it: Deal or no deal? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more