US: Retail sales continue to slumber

US retail sales missed expectations in February. Weather may have played a part, but with household incomes continuing to rise thanks to employment and wage growth gains, we remain upbeat on the sector's prospects

Sales fall in February

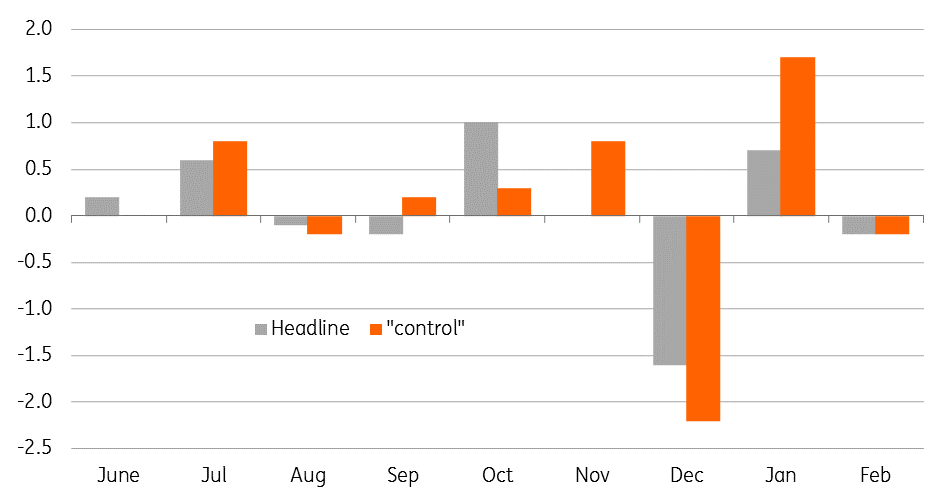

On the face of it, US retail sales numbers for February, are very disappointing. Headline sales fell 0.2% month on month versus expectations of a 0.2% increase, but there have been upward revisions to the history, most notable for January which is now reported as a 0.7%MoM gain versus the 0.2% figure initially reported.

There are major revisions throughout the report. The 'control', that better reflects the consumer spending patterns within GDP by excluding volatile items such as gasoline station sales, autos and building materials & garden equipment, saw sales fall 0.2% versus expectations of a 0.3% rise. However, January’s figure was revised up to +1.7% from +1.1%.

US 'month on month' retail sales growth (%)

Weather and government shutdown issues?

It's possible the fall-out from the government shutdown through late December, and early January continues to influence the data given hundreds of thousands of pay cheques for government workers were delayed. Slow tax refunds, again tied to the government shutdowns, could also be a mitigating factor. It may also be that the poor performance of the stock market through late 2018 weighed on spending, but with the jobs market looking strong and overall pay continuing to rise, we expected to see stronger numbers

The details show building materials and garden supply saw sales fall 4.4%MoM – the steepest decline in nearly seven years. This may well be due in part to colder weather, and we would expect a rebound in March. However, the 1.2% drop in food sales is more difficult to explain. It's the biggest decline in around ten years. Taking this all together we look for a decent bounce back in March.

Fed remains on hold

This shouldn’t have a major influence on the outlook for Federal Reserve policy. Officials continue to highlight their patient stance, and we expect that will continue.

We will be looking to Friday’s jobs report as the next major focus. We expect that to show a healthy increase in payrolls of around 160,000 with wage growth ticking up to 3.5%, which should underpin consumer spending. We continue to look for stable Fed monetary policy this year, despite markets pricing in the possibility of interest rate cuts.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more