US: Not so confident now…

US payrolls will be the most watched release this week, but the biggest surprise could come from consumer confidence as rising gasoline prices and mortgage rates sap sentiment and potentially pose downside risks for spending

Feeling the pinch?

Ever since President Trump got his $900/household tax cut through last December, gasoline prices have been on the rise. They are now up more than 50 cents a gallon on the December lows, which based on average driver consumption of 685 gallons of fuel a year will cost a single car owning household $350 more this year. If you are an average two car household then there will only be $200 of your tax cut left.

At the same time, mortgage rates have been rising sharply to stand at seven year highs. These stories are linked since rising fuel prices are a key factor that could push consumer price inflation up to 3% this summer. As such, Federal Reserve market expectations have crept higher and 10Y Treasury yields broke above 3%, although have subsequently edged lower on geopolitical worries.

Higher fuel and mortgage costs mean that there is a bit of a squeeze on household spending power right now and we believe this could lead to a fall in consumer confidence this week. The consensus expectation is that the Conference Board measure of confidence, to be published Tuesday, will drop marginally from 128.7 to 128. We think a sub 125 reading is probable and it could go as low as 121, which would take us back to the levels of last September, well before the tax cuts were passed.

Gasoline prices and mortgage rates are climbing

Does it matter?

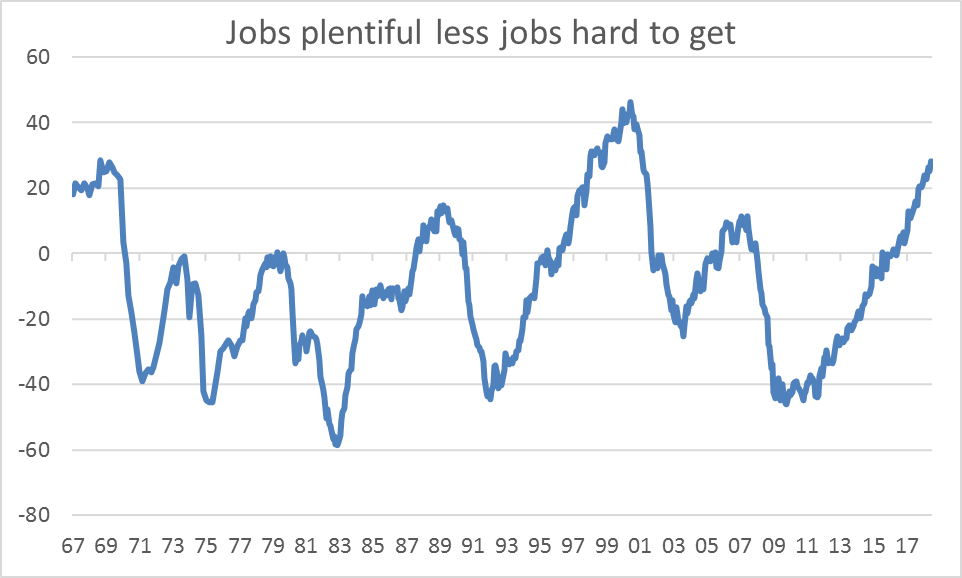

While this could cause some concern within financial markets, we have to recognise that the jobs market is strong and there is a lot of optimism surrounding US economic prospects. We also believe it is only a matter of time before wages respond to the tighness in the jobs market given unemployment has only been lower in one month of the past 48 years. As such we don't expect to see a collapse in sentiment anytime soon. Moreover, as the chart below shows, ever since President Trump's election victory the relationship between consumer confidence and consumer spending has broken down. Confidence is at levels that have historically been consisten with real spending growth of 5% or so rather than the 2.5% the US economy is currently experiencing. As such, interpretation of any large drop in sentiment is challenging.

For now we are sticking to our view that the Federal Reserve will raise interest rates 25bp at the upcoming June FOMC meeting with two further hikes in the second half of the year. We expect oil prices to stabilise with the 22 June OPEC meeting potentially resulting in some increases in oil supply. Such an outcome would take some heat out of the oil market and stabilise gasoline prices. However, should it fail and gasoline and mortgage rates continue to rise at the rates we have recently been seeing then the impact on confidence and spending may become more pronounced and we would potentially need to review our Fed forecast.

Confidence has been overstating the story

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more