US jobs numbers could soon start to turn

Today’s data offers further evidence that labour demand remains strong despite clear signs of a weakening economy. Labour data is a lagging indicator though and with CEO confidence at the lowest point since the Global Financial Crisis, we expect a more defensive stance of American companies to result in much weaker jobs numbers later in 2023

US manufacturing in contraction territory with little prospect of a swift recovery

The ISM manufacturing index has long been regarded as one of the best indicators of the health of the US economy. Unfortunately the December report is soft, falling to 48.4 from 49.0. This is the second consecutive month of contraction, where it has come in below the 50 break-even level. New orders have been sub-50 four months in a row and production has now followed for the first time since May 2020. Export orders and the backlog of orders are also weak so there appears to be little prospect of a swift rebound in output.

Another interesting story is that the prices paid component measure of inflation pressures fell sharply yet again and is deep in deflation territory. Moreover, this is the longest stretch of declines in the index since 1974-75, underscoring how significantly price pressures have swung from one extreme to another as supply chains ease and demand softens. The clear positive from this is that goods prices should continue to soften, helping to nudge inflation rates lower.

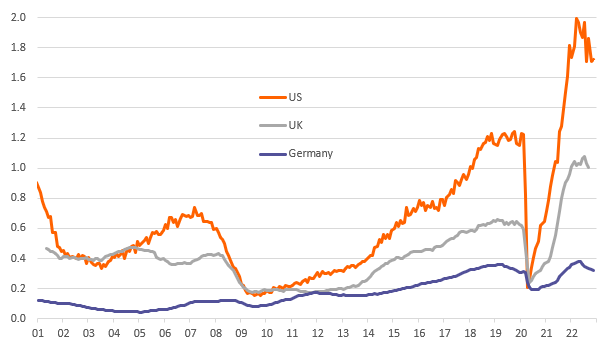

Ratio of job opening to unemployed people by country

Yet firms continue to hire...

The one clear positive from the report was the rise in the employment component from 48.4 to 51.4. The index is back above its 6M average and suggests that the sector should contribute positively to payrolls growth in Friday’s jobs report.

This positive labour market story was supported by the JOLTS – Job Opening and Labour Turnover Statistics – data. It showed that the number of November job openings came in much higher than expected at 10.458mn (consensus 10.05mn) while there were some sizeable upward revisions. The series is past its peak (11.85mn in March 2022), but this is still an incredibly strong level with 1.7 job vacancies for every unemployed American – well ahead of other major economies as the chart above shows. Therefore this data coupled with the ISM employment number should point to a decent payrolls figure of around 200,000 on Friday with wage pressures remaining elevated at 5% year-on-year.

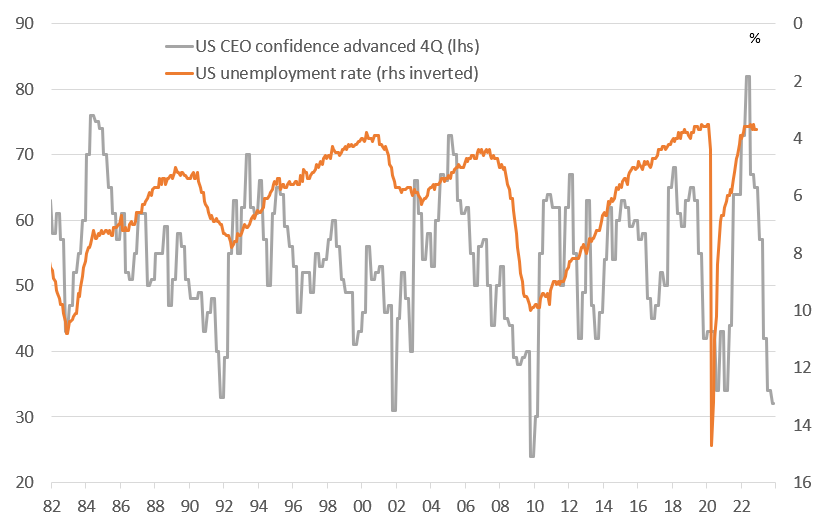

Conference Board measure of US CEO confidence doesn't bode well for the jobs market

A more defensive US corporate attitude suggests the jobs market will become tougher

Nonetheless, there is clear reason for caution. With business surveys looking weaker and the Conference Board’s measure of CEO confidence on a par with the depth of the Global Financial Crisis, the likelihood of recession is high. Labour data is a lagging indicator and we readily imagine that if business leaders are as pessimistic as the data suggests then we should be braced for more job loss announcements and reduced capex spending as American firms adopt a more defensive posture. So while Friday’s jobs report may look OK, the prospects for later in the year do not look anywhere near as good.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more