US inflation no barrier to Fed rate hikes

Headline inflation in the US has slowed to 2.2% YoY, but this reflects a $25/bbl plunge in oil prices since October. Strip this out and “core” inflation is up and will continue grinding higher as spare capacity in the economy shrinks.

Latest inflation figures

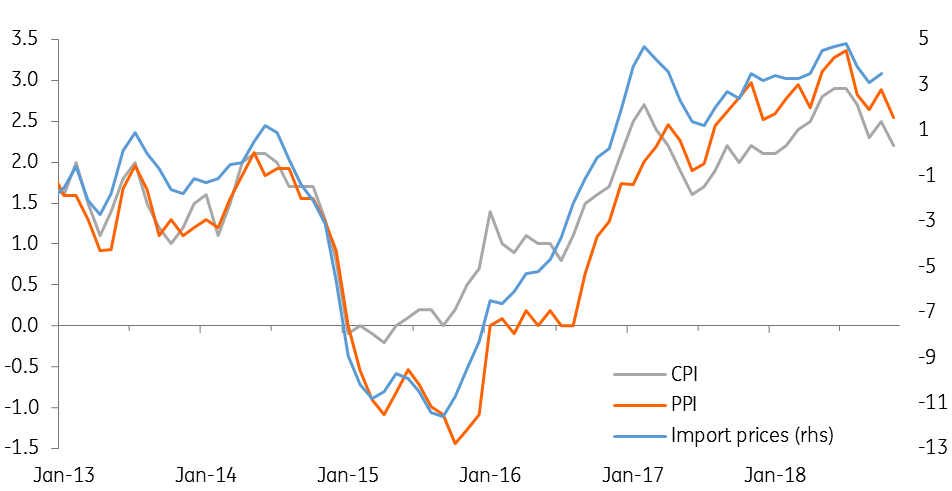

US inflation was flat on the month (as expected) meaning that the annual inflation rate slowed to 2.2% in November, down from 2.5% in October. The main drag was energy because of the $25/bbl drop in the price of oil seen over the past two months with gasoline prices falling from a national average of $2.92/gallon at the beginning of October to $2.41 currently. There was also weakness in apparel, transport fares and personal computers.

US headline inflation measures

Core inflation should grind higher

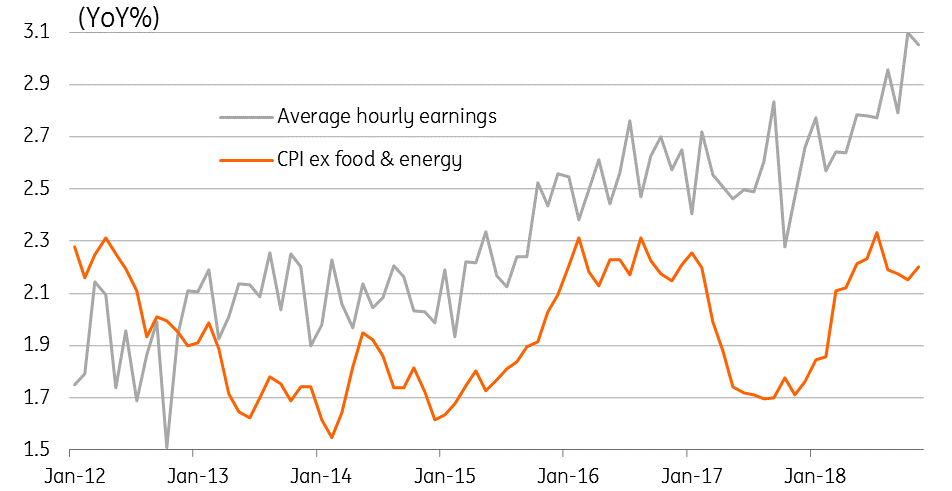

So-called “core” inflation, which strips out the volatile food and energy components rose 0.2% MoM, which leaves the annual rate of this inflation measure at 2.2% - as expected. Once again, housing made a strong contribution, rising 0.3%MoM with medical care and recreation both rising 0.4%MoM.

We suspect that this core measure will continue grinding higher through the first half of 2019. The US is largely a service sector economy and the biggest cost input is labour. Average earnings are rising with the Federal Reserve also noting a pick-up in non-wage benefit costs such as paid vacation days, signing bonuses and healthcare packages so in an environment of decent growth there is a good chance firms will look to pass these costs onto consumers. At the same time, producer price inflation is moving higher, suggesting pipeline pressures are building more broadly in an economy which has rapidly been eating into its spare capacity.

With core inflation set to break above 2.5% YoY next year and the economy likely to experience solid, if somewhat slower growth than in 2018, the arguments for interest rate increases from the Federal Reserve will remain strong. President Trump will not like it, but we fully expect a 25bp rate hike at the 19 December FOMC meeting. We are currently forecasting three further 25bp rate hikes next year, but this is subject to downside risks given escalating trade fears.

Wages & core inflation

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more