US inflation has passed its peak

A rare pleasant surprise from the CPI report with headline inflation dropping to 8.5%YoY from 9.1% on lower fuel prices, airline fares, clothing and education costs. Ongoing falls in gasoline will mean the headline rate falls further in August, but core inflation is likely to be stickier due to labour costs and will keep the Fed firmly in tightening mode

| 8.5% |

US inflation rateJuly |

| Better than expected | |

US inflation slows more than expected

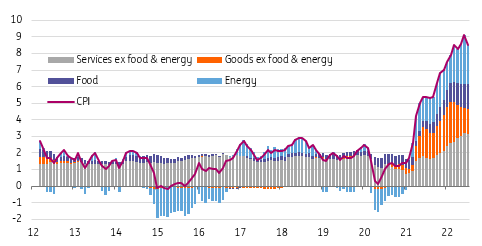

We don’t often get pleasant surprises surrounding the US inflation data so July’s numbers are something to be cherished. Both the headline and core (ex food & energy) rates reported monthly increases that were 0.2pp lower than expected. Headline CPI was flat on the month (consensus 0.2%), resulting in the YoY rate dropping to 8.5% from 9.1% while the core rate rose "just" 0.3%MoM (consensus 0.5%). The Year-on-Year rate, therefore, stays at 5.9%.

Developments within core are primarily responsible for the surprise with the housing rental components within shelter posting more moderate increases than anticipated while airline fares fell 7.8%MoM and used cars fell 0.4%. Apparel prices dropped 0.1% with education and communication also experiencing a 0.2%MoM fall. Gasoline fell 7.1%, but bigger falls will occur next month. On the upside, food prices rose 1.1%MoM/10.5%YoY

Contributions to annual CPI rate (YoY%)

Core inflation still subject to upside risks

Today’s report should provide support to the notion that the US has now passed the peak for headline inflation with lower gasoline prices, down a dollar a gallon nationally on their June 13 peak, set to have a more substantial impact in the August inflation print. We are forecasting the YoY rate dropping to 8.3%.

However, core inflation remains on an upward trajectory due to rising housing rental costs and service sector inflation pressures. Wages are the biggest cost input for the service sector. The latest jobs report showed that they continue to push higher, but with productivity having fallen through the first half of the year, unit labour costs are surging. In an environment where decent demand means companies can pass higher costs onto consumers, we don’t see core inflation peaking until around September/October time with the core rate up at around 6.5%YoY by then

Headline & core inflation with ING forecasts

Much more data to come ahead of September 21st Fed meeting

It is important to remember that there is another jobs report and another inflation report ahead of the September 21st FOMC meeting. But inflation remains far from target, the economy has added more than half a million jobs last month and third-quarter GDP is set to rebound based on consumer movement data. Add to all that a positive contribution from net trade and a less negative drag from inventories then the case for a third consecutive 75bp Federal Reserve rate hike in September remains strong.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more