US inflation confirms the Fed has much more work to do

US inflation is above 9%, but it is the breadth of the price pressures that is really concerning for the Federal Reserve. With supply conditions showing little sign of improvement the onus is the on the Fed to hit the brakes via higher rates to allow demand to better match supply conditions. The recession threat is rising

| 9.1% |

Fastest US inflation rate since November 1981 |

Well at least it isn't 10%

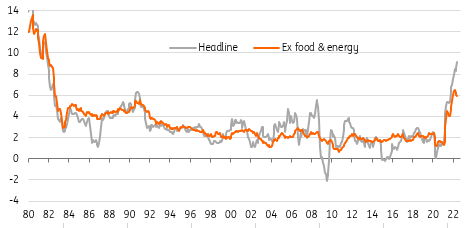

June US inflation came in at 1.3%MoM/9.1% YoY for headline and 0.7%MoM/5.9% for core. Both readings are 0.2pp higher than the consensus was expecting and should all but confirm a 75bp hike on July 27th following the firm June jobs print. This is the fastest rate of headline inflation since November 1981 with the only crumb of comfort being that it didn’t come in as high as the fake report doing the rounds yesterday suggesting a 10% headline reading.

US annual inflation rate (YoY%)

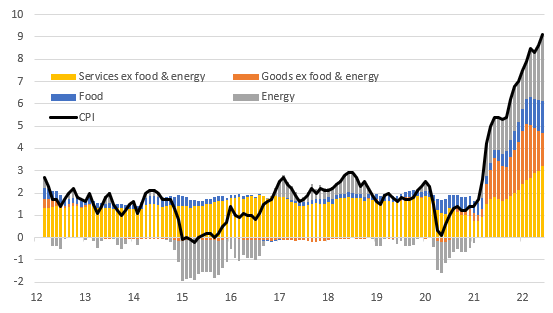

While the core rate did at least slow from 6% to 5.9%, there is not much here that will relieve the pressure on the Federal Reserve to do more to get a grip on inflation. Food prices rose another 1% month-on-month (10% year-on-year), gasoline was up 11.2% MoM (59.9% YoY) while shelter, the biggest component of CPI with a weight of 32%, is up 0.6% MoM. There were also upside surprises from apparel (+0.8% MoM) and used cars (+1.6%), which we thought might have actually dipped marginally. The only major component to see a fall was airline fares (-1.8%), but this does follow three consecutive months of double-digit monthly rises.

We are hopeful that this marks the peak for headline inflation, especially with gasoline prices down around 5% from their June peak, but we can’t rule out another supply shock. In any case we suspect the descent will be slow given the ongoing upward pressure on food prices and the long time it takes for turning points in house price appreciation to feed through into the shelter components of CPI. There is still a lot of pent-up demand in the economy, especially around leisure, hospitality and tourism, as people appear prepared to run down accumulated savings and pay higher prices to do things they missed out on over the past couple of years. Hence why service sector inflation is looking so strong right now.

US services inflation outpacing goods

Demand is still exceeding the supply capacity of the economy

To get inflation meaningfully lower quickly we need demand to better match the supply capacity of the economy. Ideally this would come via the supply channel. Firstly, reduced geopolitical risk to get energy prices lower. Secondly, supply chains easing to improve flows of inputs and lessen pricing power and thirdly, more labour supply to fill the vacancies in the US and again take a bit more steam out of the employment cost story. But it isn’t happening and may not happen for some time – hence why the Fed has thrown in the towel on the notion that inflation would be transitory.

Fed funds to reach 3.5-3.75% by year-end

Instead, the Federal Reserve now acknowledges the onus is on them to hit the brakes on demand via higher interest rates. But by delaying their response and now having to move policy faster and deeper into restrictive territory, there is clearly the fear of a recession. The Fed has accepted that weaker growth is the price we have to pay to get inflation under control

We continue to expect 75bp hike in July with 50bp moves in September and November, followed by a 25bp hike in December taking the Fed funds range to 3.5-3.75% by year-end.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more