US housing at mid-year: hitting some turbulence

With the US housing market a bit weak in the second quarter, there could be a pick-up in the second half of the year

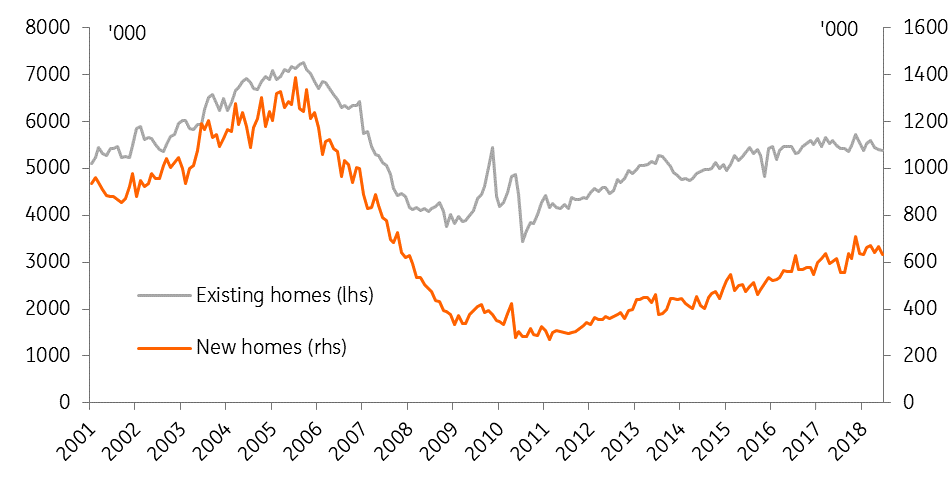

Sales have fallen...

After a strong start to the year, the US housing market has gone through a bit of a rough patch in the second quarter. Figures for June show that sales of existing homes fell by 0.6% from May, the third month in a row of falling sales. New home sales also fell by 5.3%. This takes existing home sales in June back to the level last seen in mid-2016, while new home sales are broadly flat on the year.

But at least pending home sales, a leading indicator for sales over the next couple of months, rose by 0.9% in June. This snaps a three-month declining trend and suggests sales are likely to pick up into 3Q. But while we expect sales to increase a bit in the second half of the year, a major shift upwards in home sales looks unlikely.

New and existing home sales

Buyers face difficulties...

The underlying reasons for stagnating sales remain the same: the dearth of supply on the market and worsening affordability. The supply of homes available for sale rose slightly in June, but supply remains near the lowest level on record. Mortgage rates have stabilised over the past couple of months, with the 30-year effective rate remaining just below 5%. But since house prices are rising at around 6.5%, more than twice the rate that wages are, affordability is steadily worsening for the average home-buyer.

And construction is down too

At the same time, new construction fell sharply in June, with new housing starts down 12.3% to 1173k and new permits down 0.9% to 1292k. While this is a very large fall in new starts, large swings in housing starts from month to month are not all that unusual. Typically, a bad month is followed by a recovery in the following months and that’s what we’d expect to see in 3Q, though there is, of course, no guarantee that this pattern holds up. Still, with inventory scarce, prices high, and demand still solid, it would be surprising if developers didn’t increase construction in the second half of the year.

Monthly change in US housing starts

The economy is booming, why isn’t the housing market?

It’s a bit surprising, and slightly worrying, to see the housing market struggle at a time when the US economy is booming. With wages increasing, unemployment near record lows, and consumer confidence at all-time highs, the market for homes really should be doing better.

There are a few reasons why housing isn’t doing as well as might be expected. The lack of supply and the challenging affordability situation mentioned above are two reasons. Also, the tax cuts Congress passed at the end of last year have boosted disposable income and consumer spending, which is a big part of why the economy is currently growing so strongly. But reductions to the tax benefits of home ownership probably lessened the positive impact on the housing market.

Still, an obvious question to ask at this point is whether housing market softness presages a downturn in the economy. Historically, a slowing housing market tends to precede a slowdown in the economy.

Looking at the rate of new construction and new home sales, which along with house prices are particularly sensitive to economic sentiment and tend to be the most important indicators, doesn’t make us too worried. Housing starts and new home sales are still up on a year ago, and while the annual growth rate is falling it is doing so very gradually. We are still some way away from a situation where the housing market is signaling problems ahead for the economy. That said, if we don’t see a pickup in new starts and overall housing market activity in the second half of the year, the outlook for the economy in 2019 will start to look worse.

New construction starts/home sales and US recessions

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).