US: Happy shoppers will spend

The US retail sales data for August is not as good as hoped although there was an upward revision to the previous month. The underlying story is very positive, but bad weather could distort upcoming figures

Near-term risks

The August US retail sales report shows headline sales growing just 0.1% month-on-month versus the 0.4% consensus, but there was a chunky upward revision for July to +0.7% from 0.5%. In terms of the detail, auto sales were a drag, falling 0.8% MoM, while clothing fell 1.7% and department store sales dropped 1%. The so-called “control” group, which excludes volatile components and better matches up with the consumer spending numbers that feed into GDP rose 0.1%, but again there were decent upward revisions for July from +0.5% to +0.8%.

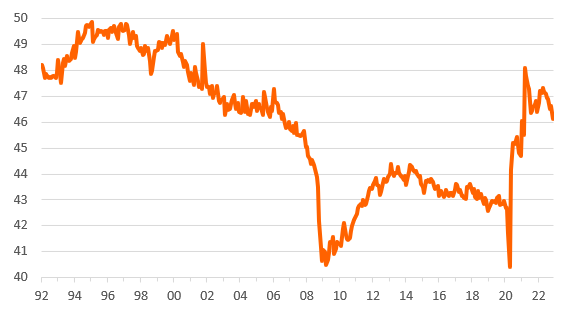

As for the outlook, we have to be cognisant of the near-term risks to retail sales from weather disruption, including Hurricane Florence. This has the potential to lead to some big swings in the data over the next few months, just as we saw last year with hurricanes Harvey and Irma. Households tend to stockpile goods ahead of time and if there is damage we tend to see replacement spending supporting sales in the affected regions – store closures don’t typically last for long. These effects then tend to depress sales in later months as the spending splurge can’t be maintained (see chart below).

Weather can significantly distort the macro figures - MoM% retail sales growth in "control group" Aug17-Aug18

The broader picture

Nonetheless, the underlying situation is very positive. Consumer confidence is at an 18-year high (Conference Board measure) thanks to big tax cuts, a strong jobs market and buoyant asset prices. If we see more upward momentum in wage rates then the story can only get better. As such, we still look for Federal Reserve interest rate hikes in both September and December.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more