US growth: back from the brink

Just a few weeks ago, markets were worried that the US economy might have stagnated in the first quarter. However, a recent raft of positive surprises means that we should be expecting 2.5% annualised growth from Friday's 1Q GDP report

A tough start

There was considerable pessimism surrounding the US economy at the beginning of the year. Global slowdown fears had prompted steep falls in equity markets through late 2018, which in turn, sapped US business and consumer confidence. Much of the concern related to US-China trade tensions and while President Trump had postponed additional tariffs on Chinese imports, there was little sign a trade deal was close.

Then there was the ongoing government shutdown, which left hundreds of thousands of government workers without pay through late December and much of January and led to expectations of weaker spending. On top of this,there were the headwinds from the lagged effects of higher interest rates and the stronger dollar plus fading support from the fiscal stimulus. As such, there were some analysts talking about the possibility of the economy having contracted in 1Q.

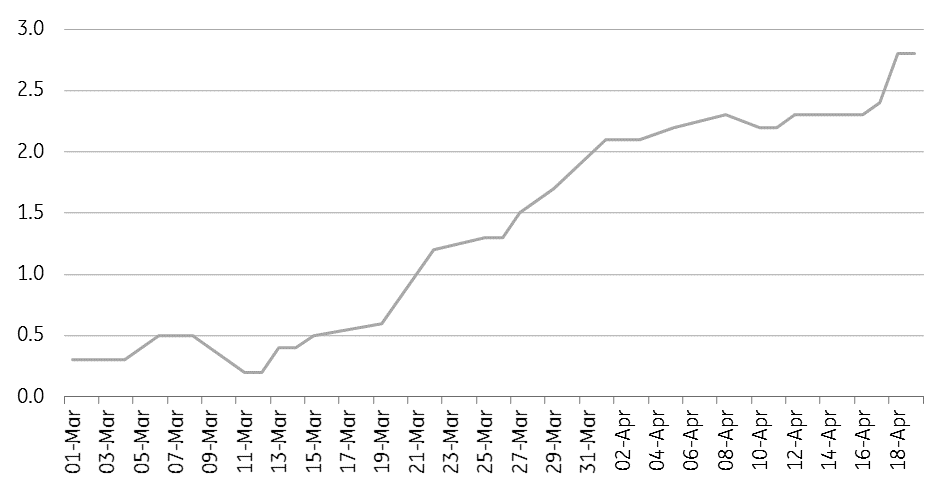

Evolution of the Atlanta Fed's GDPNow model forecast for 1Q GDP growth

A late turnaround...

However, there has been a dramatic turnaround in recent weeks. The Atlanta Federal Reserve bank has a model that predicts GDP based on released data, called GDP Now, which really highlights the change of fortunes. Just four weeks ago, it was suggesting the US 1Q GDP figure could be as low as 0.2%. Today, it's suggesting that we should be looking for 2.8% thanks to strong retail sales, construction and ISM manufacturing numbers. Such an outcome would be well ahead of the 2.2% rate recorded in 4Q18.

We are looking for growth of 2.5% while the consensus is a little more cautious in forecasting 2.2% growth for 1Q (the range of forecasts is from 1% to 2.9%).

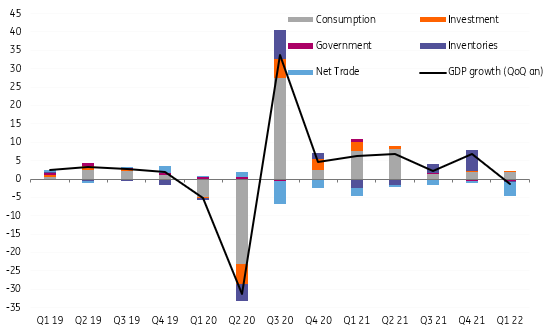

Consumer spending will have slowed to something around the 1.4% mark given the monthly numbers already released, but the latest retail sales numbers for March suggest that spending will have ended the quarter in a good position, with positive momentum heading into 2Q.

Investment is likely to have done well with residential investment set to bounce back after contracting in every quarter through 2018 - lower mortgage rates are certainly supporting mortgage applications. Investment in equipment should be firm while government spending is likely to have bounced after the government shutdown through much of December and January.

We also know that trade will be making a major positive contribution as firms brought forward imports to 4Q ahead of the anticipated hike in tariffs from 1 January. US businesses correspondingly cut import orders for the start of 2019. That tariff hike was subsequently postponed by President Trump, but businesses weren't to know that and given the length of time it takes to ship products across the Pacific, we probably won't see any rebound in imports to America until the March and April reports.

US GDP growth with component contributions (ING forecasts for 2019)

Inventories to be the main drag

The main negative is likely to be inventories. They had been built up through 2H18 (with the surge in imports in late 2018 contributing to them) and we suspect there will be some unwind. Certainly the ISM reports pointed to this component being a drag on headline economic growth.

Our other key concern relates to the typical underperformance of 1Q GDP growth (see link for more details and possible explanations). The chart below shows that over the past ten years 1Q GDP has a mean of 0.8% growth and a median of 1.5%, which is significantly worse than every other quarter. Indeed, 2Q has a mean of 2.6% and a median of 2.9% growth over the past decade. This provides a note of caution for the market not to get too excited ahead of Friday's figure.

The 1Q conundrum... 1Q continues to underperform

Growth resilience underlines the case for stable interest rates

We expect the US to record slower growth from the 2.9% rate recorded in 2018, which is unsurprising given the fading support from fiscal stimulus. However, the positive labour market story, which is leading to rising worker pay, and signals that the US and China are close to agreeing a deal on trade mean that we continue to look for respectable growth of around 2.4% for the full year. As such, we don't expect to see a recession and continue to argue against the prospect of a Federal Reserve interest rate cut this year - something that the market continues to price as a 50:50 call.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more