US: Grim jobs report reinforces growth fears

The US economy lost 140,000 jobs in December and with Covid cases rising once again we can't rule out further economically damaging containment measures. While we remain very upbeat on the US' medium- to long-term prospects, we have to be braced for more bad economic data that could last well into 2Q21

| -140,000 |

The number of Americans losing their jobs in December |

Covid containment weighs on the labour market

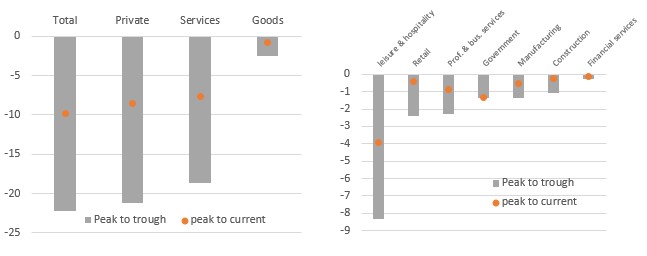

The December US jobs report makes for grim reading. Non-farm payrolls fell 140,000 versus expectations of a 50,000 rise. The leisure and hospitality sector bore the brunt of the pain with job losses of 498,000. The narrative here is that the stay-at-home orders in California, the most populous US state, and the closure of dine-in eating in New York and some other cities has hit this industry incredibly hard. This had already been flagged by the Homebase survey while yesterday’s ISM service sector report also indicated a decline in employment was likely.

The government sector also continues to feel significant pain with employment falling another 45,000 with state and local government budget continuing to be stretch to the limit as tax revenues plunge. Education and health, meanwhile saw employment fall 31,000. Other sectors all saw gains, but employment remains well down on pre-pandemic levels.

Job losses by sector (millions)

Jobs market is fundamentally weak

The loss of momentum in job creation has been evident for some time, but the fact we have now seen an outright fall in jobs will put more pressure on the incoming administration to step in with another significant fiscal support package. After all, we must remember there are still 9.8 million people fewer in work than before the pandemic so confidence and incomes are being squeezed.

There is a lot of focus on the unemployment rate trending down (it held at 6.7% in December), but we feel looking at employment as a proportion of working age population is a better gauge of the jobs market.

The chart below shows that at just 57% this is weaker than at any point during the Global Financial Crisis and is on a par with what the US was averaging in the 1970s when female labour market participation was lower. As such, the US jobs market has a long way to go before it has fully healed.

Employment levels and employment as % of working age population

No improvement until Covid is defeated

The situation won’t improve meaningfully until Covid containment measures are lifted, which could be a number of months away. While the vaccination program is starting to gain traction there is a window of extreme vulnerability as the number of cases and hospitalisations rise. Should the new, more transmissible variant of Covid gain a foothold here then this would increase the threat of more near-term containment measures, which would undoubtedly come at a severe economic cost. This in turn risks further job losses.

We already know that consumer spending fell in November and next week’s retail sales report will likely show a drop in December. A deteriorating jobs situation implies things may not improve meaningfully in 1Q21.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more