US GDP: Big and Beautiful

Friday's GDP report should support the case for a December interest rate increase

There was a wave of financial market optimism surrounding President Trump's election given what his proposals might mean for economic activity. Tax reform, infrastructure spending and the cutting of red tape led many, Trump included, to predict the US economy was about to enter a new period of more vibrant growth. 3% would be the new norm rather than the anaemic 2% that Americans had become used to in the wake of the global financial crisis.

However, as Trump has subsequently found, getting promises through is not always as easy as it first seems - even if the party you represent has a majority in both Congress and the House of Representatives. Consequently, those growth expectations have since been paired back and have not been helped by the economic loss and disruption caused by hurricanes Harvey and Irma in August and September.

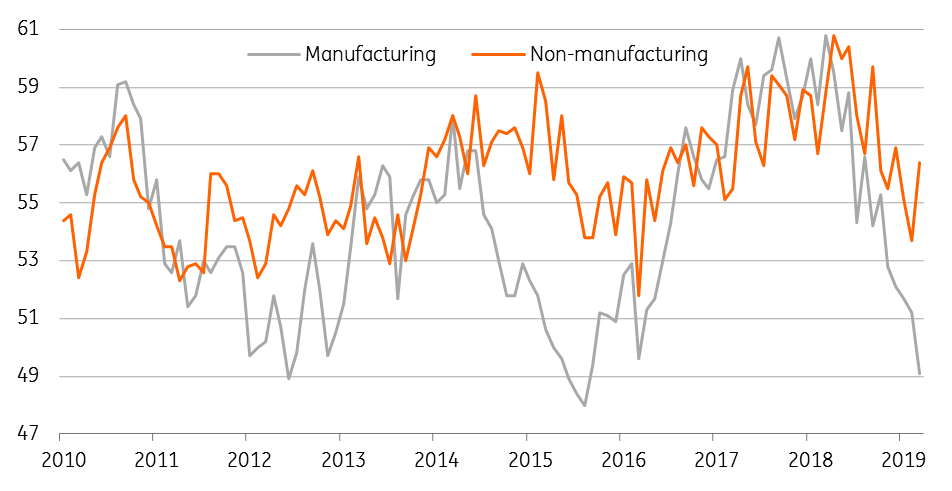

The subsequent data has actually been better than expected so after a decent 1Q GDP outcome and a strong 3.1% reading for 2Q we are hopeful of another healthy figure for 3Q on Friday. Business surveys are strong with the ISM manufacturing and non manufacturing headline figures at 13- and 12-year highs respectively, unemployment at a 16-year low, wages picking up and confidence high. Consequently we are looking for 2.9% growth.

| 2.9% |

ING's forecast for 3Q GDP growth |

This is a touch above the 2.5% consensus forecast and is also a little above the 2.7% "now cast" calculated by the Atlanta Federal Reserve, which mirrors key data releases used by the Bureau of Economic Analysis to calculate the official data. While we acknowledge the potential for hurricane effects to have perhaps depressed activity in Texas and Florida more than we have estimated, we think there is the potential for upside from inventories. Inventories were aggressively run down in 1H17, meaning that they subtracted from growth. We expect to see a rebound with companies keen to replenish stocks in 3Q, which should boost growth.

As for 4Q, well it looks as though the economy has started the quarter strongly. We are currently forecasting growth of around 2.8% with post hurricane rebuilding and people replacing lost items due to the storms helping to add to growth for what is economy that already looks in good shape. This strong growth story should mean that spare capacity in the economy continues to shrink, which should see inflation pressures build.

Wages are also rising and imported inflation is being pushed up by the dollar's decline since the start of the year while rising oil prices will also contribute to higher inflation readings. With growth looking firm, inflation likely to rise and Federal Reserve officials broadening out the reasons for why higher interest rates much be required (financial stability risks, asset valuations and loose financial conditions) we think next week's FOMC statement will underline the strong case for a December interest rate rise.

ISM index points to GDP strength

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more