US: Onwards and upwards

Given fiscal tailwinds, the strong jobs market and surging corporate profits, we look for the economy to continue growing robustly through the rest of the year, which will keep the Fed on its “gradual” policy tightening path

A positive story

For all the negative headlines regarding trade wars, interest rate hikes, political uncertainty and fears for what an inverted yield curve could portend, the US economy continues to perform very well. The US expanded 4.2% annualised in 2Q18 and we look for growth of 3-3.5% in 3Q with full year 2018 growth of around 3%. With all of the key inflation measures at or above the Federal Reserve’s 2% target policy makers are likely to continue with “gradual” interest rate hikes.

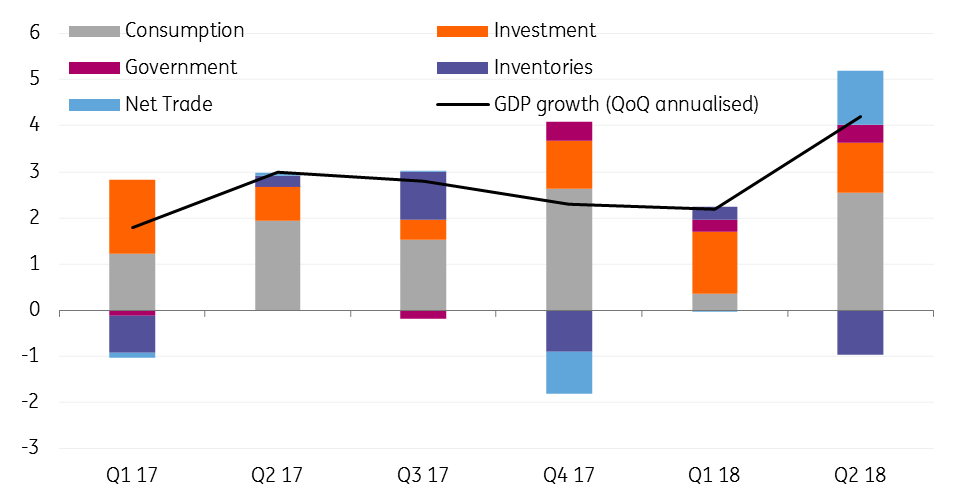

In terms of the 2Q GDP report, consumer spending made a major contribution as the combination of a strong jobs market and huge tax cuts boosted household incomes. Investment also performed strongly while net exports contributed around a quarter of the 4.2% annualised growth.

Contributions to US GDP growth

3Q looking strong

The third quarter is likely to see net exports swing back to a negative contribution given the recent trade numbers while inventories are likely to be at least partially rebuilt. Consumer spending is set to post decent growth again given tax cut-induced positive real household disposable incomes and the fact confidence has risen in both July and August to currently stand at an 18-year high.

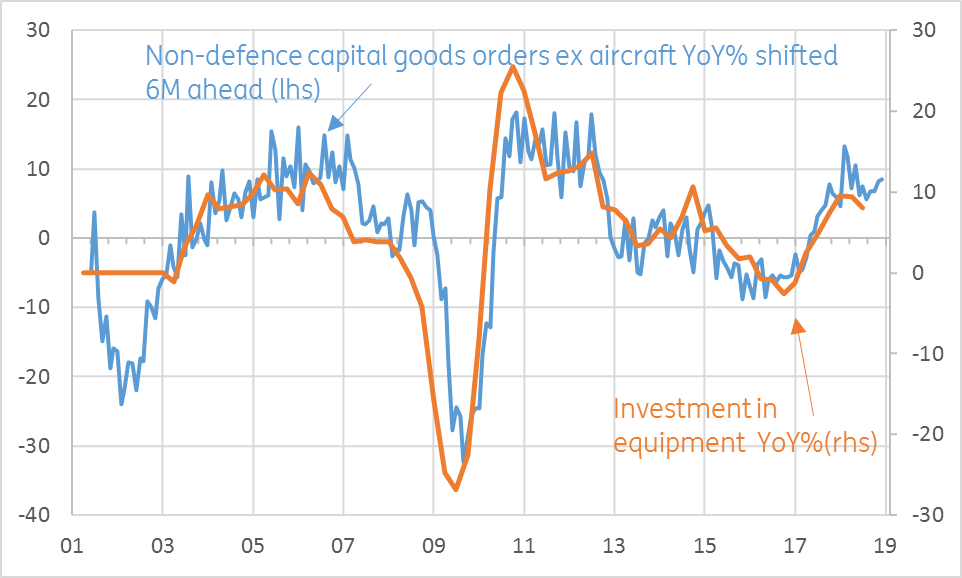

The investment outlook is looking very strong, too. Corporate profit growth is accelerating, rising 7.7% year on year in 2Q18 while after tax profits are up over 16% YoY. This shows companies have money to spend, which is evident in durable goods orders data. Non-defence capital goods orders are picking up again and are consistent with investment in equipment and software growing in excess of 10% YoY.

The outlook for investment remains strong

But there are risks for 2019

While headline CPI and PCE deflator inflation readings of 2.9% YoY and 2.3%, respectively are likely close to a peak, we suspect the core rates at 2.4% and 2% have further to rise. There is growing evidence that pay pressures are building given the tightness in the jobs market and this could help nudge broader inflation readings higher. As such, we continue to expect Federal Reserve interest rate hikes in September and December.

Nonetheless, headwinds are building for the economy and this should result in slower growth in 2019. This, in turn, will help to keep the yield curve relatively flat. We see QoQ annualised growth averaging closer to 2% next year based on tighter monetary conditions (lagged effects of rate hikes and the strong dollar plus some talk about raising bank capital buffers given Fed comments about financial stability) and the fading support from fiscal stimulus. It is probable that there may be some slowdown relating to trade protectionism and emerging market worries, which could soften the investment and job creation outlook.

Trade to remain in the headlines

On trade, there have been some encouraging signs regarding a deal with Mexico, but a standoff with Canada and threats to pull out of the WTO aren’t positive. It is difficult to see any meaningful improvement in US-China relations this year particularly with President Trump about to pull the trigger on an additional round of tariffs on $200 billion of imports into the US. The EU-US friction also looks set to continue with Trump suggesting that the EU’s offer of removing tariffs on imports of US-made vehicles is “not enough”, implying that European authorities need to do something to stop consumers preferring European made cars over US cars.

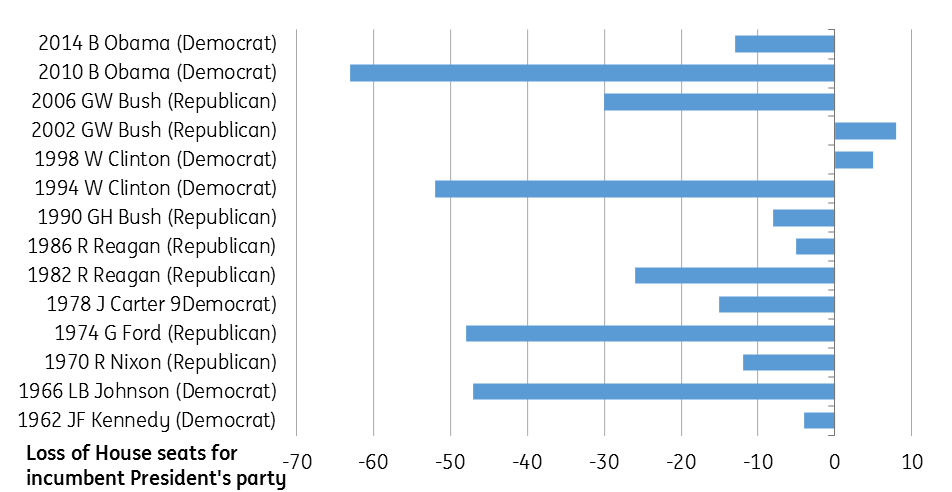

Trade threats have little prospect of easing until after the 6 November US mid-term elections when all 435 House of Representative seats are up for grabs along with a third of the Senate. Currently, the Republicans hold the Presidency and majorities in both the House and the Senate, but there is a strong chance the Democrats will break this stranglehold – incumbent Presidents typically see their party lose seats at the mid-terms. This could have ramifications for economic and trade policy while also dramatically heightening the chances of impeachment proceedings being started against President Trump.

A president's party usually loses seats at a mid-term election

The threat to Trump

Three key factors tend to determine the outcome of mid-term elections: The President’s personal approval rating, the generic polling of the parties and the health of the economy. Unfortunately for Trump and the Republicans, they only really have the economy going for them.

Trump’s personal approval rating is just 41%, which is the lowest of any President in the September of their second year since Harry Truman over 70 years ago. The polling for the Republican party is not great either with surveys suggesting the Democrats are around 5-8 percentage points ahead of the Republicans across the nation. At the same time, there has been a surge in the number of Republican politicians who are not going to contest their seats, most notable being House speaker Paul Ryan. These are termed “open seats”, which have historically been more difficult to defend.

Given the Democrats need to gain just 23 seats to win control of the House, a swing which is less than that of 1994, 2006 and 2010, we suspect it is achievable. A Democratic takeover of the Senate is less likely, but not impossible. Of the 35 seats being voted on, the Democrats control 24 together with two independents who caucus with them while the Republicans have nine. Given the Vice-President has the casting vote in any legislative vote tie, the Democrats need to win two or more of those nine Republican seats. The surprise result in Alabama's special election late last year will give them hope.

Loss of Republican control of Congress would severely limit Trump’s ability to pass legislation, hurting the prospect of further fiscal stimulus (such as his $1.5 trillion infrastructure spending plan) or healthcare changes. However, it could open the door to concessions on trade.

With the election out of the way, pro-trade Republican politicians and corporates, who have been quiet in the lead up to polling, may be prepared to make a more forceful stand against Trump’s protectionist measures. The President may well listen if there is growing evidence of a negative impact on the economy – so long as he can still portray the end result as a “big win”. Concessions from the EU and China could get him there.

The risk is he could choose to double down and implement further protectionist measures, but this would risk hurting equity markets, which he often views as the key barometer of his performance. A weaker economy and falling US household wealth would not stand him in good stead for a defence of his presidency in 2020.

The bigger personal threat to Trump is that of impeachment. The most plausible scenario is if the investigation of Russian interference in the 2016 election by special Counsel Robert Mueller shows direct and incontrovertible evidence to support impeachment. A simple majority in the House in favour of starting proceedings would result in a Senate trial. Given this would require a super majority of 67 out of 100 Senators who are likely to largely vote on party lines, Trump could survive, but it would be tight.

Download

Download article

7 September 2018

Global Economic Update: Peak Trump? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more