US: Booming jobs market argues against rate cuts

The US jobs market continues to surge with the unemployment rate at the lowest level since December 1969. The market is pricing Fed rate cuts, but we really don’t see the need

No signs of a slowdown here...

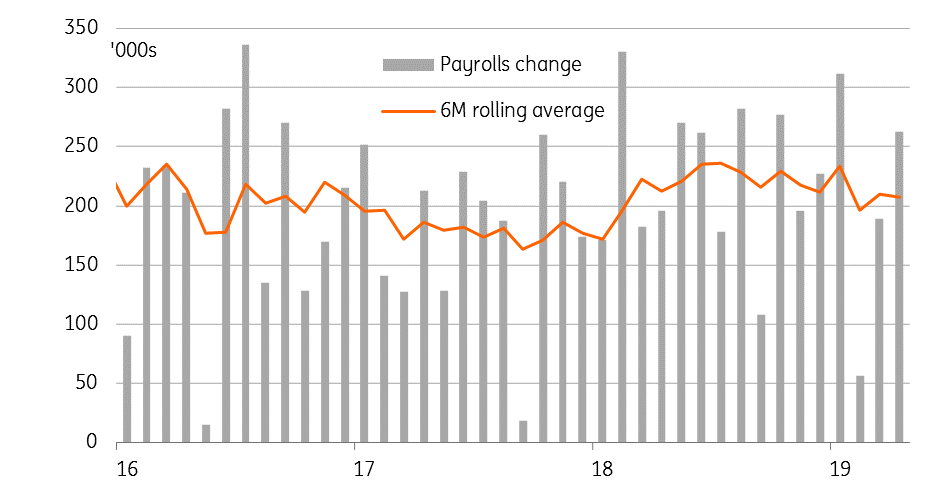

The US economy created 263,000 jobs in April, well ahead of the 190,000 consensus forecast and there were a net 16,000 upward revisions to the previous couple of months of data. This is an incredibly strong outcome and suggests US corporates aren’t experiencing the downturn priced by the bond market.

We had expected a weaker outcome, but this was more due to the lack of available workers with the right skill sets than any dip in demand for labour. The National Federation for Independent Business reported yesterday that 38% of its members couldn’t fill their vacancies due to a lack of workers, but clearly today's data shows that firms can hire.

Manufacturing employment rose 4,000, construction was up 33,000 while service sector employment rose 202,000 and government was up 27,000. The latter may be a prelude to a pick-up in hiring for the national census, although much bigger gains relating to this are expected in coming months.

US monthly non-farm payrolls growth

Unemployment hits new lows, wages responding

For those that love accuracy, the unemployment rate fell to 3.585% from 3.811%, which takes us to a new 50-year low and highlights how tough it must be for companies to hire workers with the skills their business need. The participation rate fell yet again and now stands at just 62.8% after 490,000 workers left the civilian labour force.

This demand-supply imbalance in the jobs market is boosting pay to some extent, but not by quite as much as we had hoped. Pay rose 0.2%MoM/3.2%YoY versus a consensus forecast of a 0.3%MoM gain. However, March’s figure was revised up by a tenth of a percentage point to 0.2%MoM so on balance it is broadly in line. Given the competition for workers, we expect pay to continue grinding higher.

Wages following unemployment

Why cut rates?

With workers secure in the jobs and experiencing rising pay this should continue to support consumer sentiment and underpin household spending. Trade and inventories will swing from being a big net positive contributor to growth in 1Q19 to being a drag on GDP growth in coming quarters, but consumer spending can more than offset this. Assuming a US-China trade deal can be agreed and investment spending stays firm we continue to look for the US economy to expand at around 2.5% this year, suggesting little need for interest rate cuts from the Federal Reserve.

With wage growth picking up and firms increasingly using benefits packages to retain and incentivise staff we suspect that the market is underplaying the inflationary pressures coming from the labour market. The combination of decent growth, better financial conditions and a consistent grind higher in inflation means we are firmly in the camp that expects monetary policy to be left unchanged throughout 2019.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more