US: A President under pressure?

The US economy continues to roar, and with upward inflationary pressures, the Fed remains in tightening mode. But with just under five weeks to go until the November mid-terms, the Republicans are seemingly facing an uphill battle, which could lead President Trump to focus even more on his protectionist stance

The US economy continues to prove the doubters wrong. Activity is incredibly strong, and job creation is vibrant while wages and asset prices are on the rise. As such it’s no surprise that business and consumer confidence are at multi-year highs. Given the often repeated comment that elections are all down to “the economy, stupid” it would be fair to assume the Republicans should be riding high in the opinion polls ahead of the mid-term elections. But they aren’t.

In fact, polling analysts and bookmakers suggest it is likely that the Democrats will win control of the House of Representatives. This will have implications for President Trump’s agenda, the outlook for trade policy and as a direct result, the economy and financial markets.

US election scenarios and potential implications

Our base case: Democrats win control of the House of Representatives

We have written about what is driving polling and what could yet influence the election, as well as a scenario analysis of the possible outcomes. We won’t repeat ourselves, but the potential implications of each can be seen in the infographic above.

Our base case is that the Democrats win control of the House of Representatives from the Republicans, but fall narrowly short in the Senate. The key implication is that it makes it more challenging for President Trump to pass major legislation. That is not to say deals can’t be done, but given entrenched political positions, getting both sides to compromise enough will be difficult. Faced with this, we suspect President Trump is likely to focus more on his executive powers, which include trade policy.

China shows no sign of cracking

China remains firmly in the spotlight, with the recent 10% tariff on $200bn of imports into the US set to be hiked to 25% in the New Year. China shows no sign of cracking on US demands for enacting policies that will slash the bi-lateral deficit and protect intellectual property in the US Administration’s eyes. In fact, those tariffs may well be expanded to all Chinese imports in 2019. While the Democrats are likely to push back against trade penalties for “allies” such as the EU, they have a history of being more protectionist and may well back the President to some degree on his attitude to China.

A compromise is still possible

There have been some positives on trade, such as the new agreement with Mexico and Canada offering encouragement. If President Tump can forge a united front with the EU, Mexico, Canada and Japan regarding China, there are more likely to be concessions he can label a “win” for his stance. There are clear uncertainties though regarding this. If compromises are not forthcoming and the trade war intensifies this would risk impacting supply chains, rising prices, hurting growth and could lead to equity market price falls, which President Trump often views as a key barometer of his performance. A weaker economy and falling US household wealth would not put him in good stead for a defence of his presidency in 2020.

Fiscal stimulus will gradually fade through 2019

Domestically, further tax reform is possible, but new initiatives would need to be focused at the lower end of the income distribution to get Democrat support. A watered-down version of the President’s Infrastructure Investment plan may also be possible. However, this is not going to happen quickly, and we suspect the fiscal support for the US economy will start to fade through 2019. Moreover, the strong US dollar and a gradual increase in interest rates will act as a brake on growth while trade uncertainty and emerging market fragility could also contribute to a gradual slow down.

We're not forecasting a recession, but a strong US dollar and a gradual increase in interest rates will act as a brake on growth while trade uncertainty and emerging market fragility could also contribute to a gradual slow down

That is not to say we are forecasting a recession. We still feel that there are strong underpinnings to the US economy with a key upside risk potentially coming from the labour market. The jobs story has clearly strengthened over the past twelve months with the pace of job creation currently averaging 207,000 per month in 2018 versus 182,000 last year and the demand for workers continues apace according to surveys. This is translating into higher pay and we look for wage growth to finally push above 3% year on year in 4Q18 – the fastest rate of pay growth since April 2009. If the shortage of workers leads to an acceleration in pay from here - there is likely to be more upside for consumer spending too.

We see four rate hikes before end 2019

In terms of interest rates, while the Fed no longer views monetary policy as “accommodative”, it certainly can’t be described as “restrictive”. As such, the Fed suggests that the most likely course of action is a further rate hike in December taking it to a total of four 25bp interest rate rises in 2018, with an additional three hikes in 2019. This is a view that we now agree with.

After all, the economy looks set to grow 3% this year and 2.5% next year, with inflation set to stay above the 2% target, thanks to wage rises, higher oil prices and some influence from higher tariffs. This is also likely to keep upward pressure on Treasury yields in the near-term with the 10Y possibly testing 3.5% at some point.

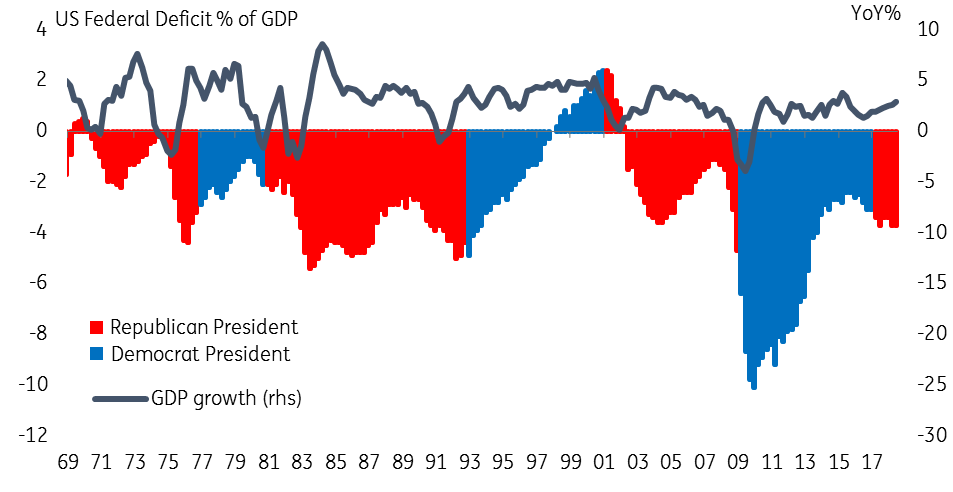

Federal deficits by party

Another issue: Deficit on course to rise to 5% of GDP

Another issue that could impact the Treasury market over the medium to longer term is lingering concerns over the US fiscal story.

According to the Congressional Budget Office, the huge tax cuts and spending increases implemented by President Trump mean that the federal deficit is on course to rise to 5% of GDP over the coming years. This deeply troubles fiscal hawks. If growth was to disappoint, the risk is that the deficit could rise sharply. Given the polarisation of views on Capitol Hill, this runs the real threat of government shutdowns, which could add to political, economic and market uncertainty.

Download

Download article5 October 2018

Global Economic Update: Looking for a silver lining This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more