Unlocking French consumers

French consumers show more optimism in June and signal a greater intention to spending over the summer. However, fears of unemployment should continue to cast a shadow over this picture for some time to come

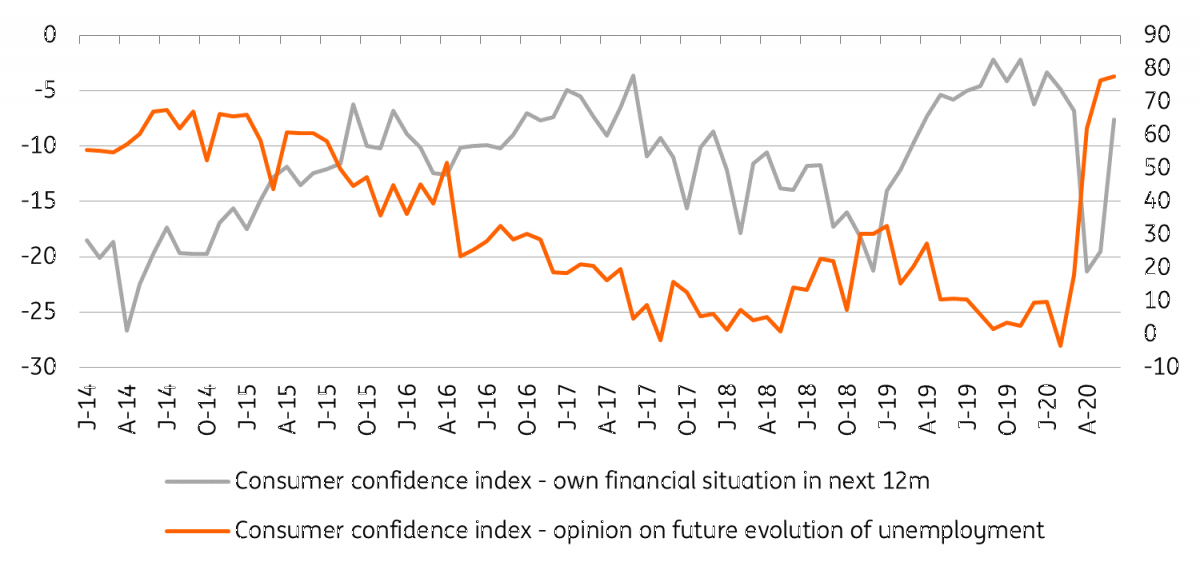

Consumer confidence in France rebounded in June, but did not return to its level at the beginning of the year, which was one of the highest in a decade, as confidence had just recovered from strikes and the “yellow vest” crisis. The survey continues to show an improvement in both recent and future savings capacity, which was already the case in May. Households also show more confidence in their future personal financial situation: although they are not as optimistic as they were at the end of 2019, the level of of optimism in June is one of the highest in the past decade. As a result, purchasing intentions have also picked up. The only component still preventing household confidence from returning to the levels seen at the beginning of the year is the fear of unemployment. With one in two private employees temporarily unemployed and 1.07 million more people in the unemployed population in two months, the situation on the labour market is exceptional and worrying.

We expect this to continue in the coming months, as while the unemployed population is expected to shrink by about half a million people in the first months of deconfinement, this will still leave the unemployment rate at 10.5% at the beginning of 2021. Indeed, more and more temporary workers will find new jobs, notably thanks to the reopening of the tourism and hotel sector, but they will be partly replaced in the ranks of the unemployed by those who are likely to become victims of their employers going bankrupt and will therefore slow down the decline.

Figures published yesterday by DARES showed the start of a decline in the number of unemployed in the A-category of nearly 150,000 in May. This is the first effect of economic unlocking: some temporary workers are back at work (at the same time, the number of short-term unemployed has increased by more than 200,000). The trend should continue, as described above. But once the holidays are over and the euphoria of renewed freedom of movement has worn off, consumers could return to more cautious saving and consumption behaviours after the summer. In any case, today's figures confirm the fact that the rebound in activity in the third quarter will be driven primarily by household consumption. We expect growth to reach 45% quarter-on-quarter annualised in 3Q20, which should allow the 2020 recession to stay below 10%.

French consumers still fear unemployment

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).