Unexpected drop in Taiwan’s export value

The later than normal sales of smartphones, along with high base effects, have also led to negative inflation

We underestimated the high base effects (9.3%YoY in the same month in 2016) and the impact of delayed sales of smartphones on Taiwan’s export growth in October. That export growth came in at 3%, we were forecasting 16% while the consensus was 7%. The previous figure was 28.1%.

Our forecast for imports was closer (Actual: 0.1%; INGf: 1.3%; cons: 2.1%: prior: 22.2%).

As Taiwan’s trade is mostly driven by the smartphone and gadget industry, the delayed sales overlapping high base effects resulted in low growth. We are still optimistic that the fourth quarter of this year and the first of next will be good months for exports as pre-sales show demand for smartphone gadgets is strong.

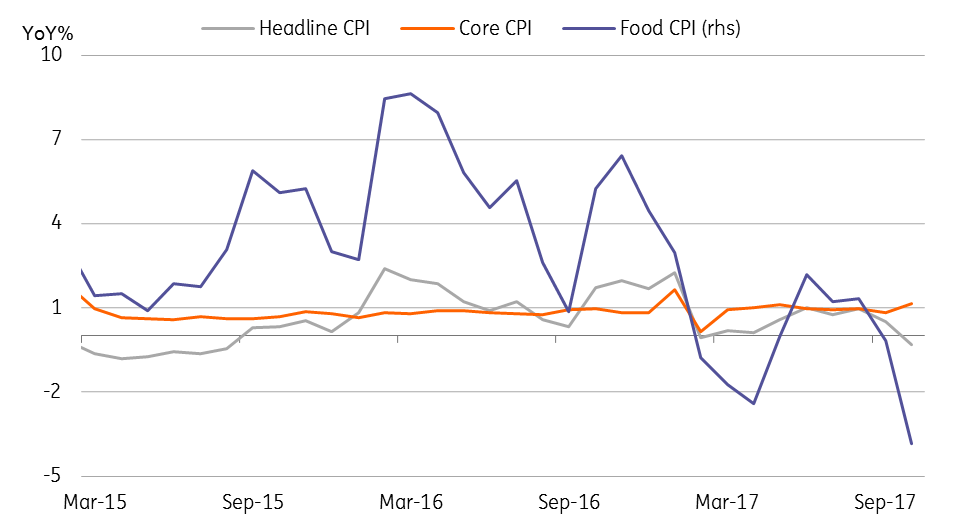

Base effect push food price and headline CPI to deflation

Rising global crude oil prices and high China PPI, due to deleveraging reform, helped push Taiwan’s WPI inflation higher in October than we had thought (actual: 1.58%; INGf: 2.1%; prior: 1.62%).

But CPI was pushed below zero again due to high base effects and cheaper food prices (Actual: -0.32%; INGf: 0.0%; cons: 0.2%; prior: 0.5%). The lower food price trend may continue due to a high base until February.

Base effects are playing central roles in this weak data. They do not reflect the underlying good trade growth and mild positive inflation of the economy. We believe the Central Bank of the Republic of China (CBC) could remain on hold for a further year. However, with a new governor next February we may need to watch out for something new.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).