UK: The narrowing rate hike window

Wage growth and Brexit will largely determine the path of BoE policy

As we noted last month, there are plenty of tough decisions to be made in the UK in 2018. One of these decisions lies with the Bank of England, who must choose whether or not the economy can handle further rate hikes. Policymakers have loosely signaled they would be prepared to increase rates at some point again this year, and amongst other things, the decision hinges on wage growth and Brexit.

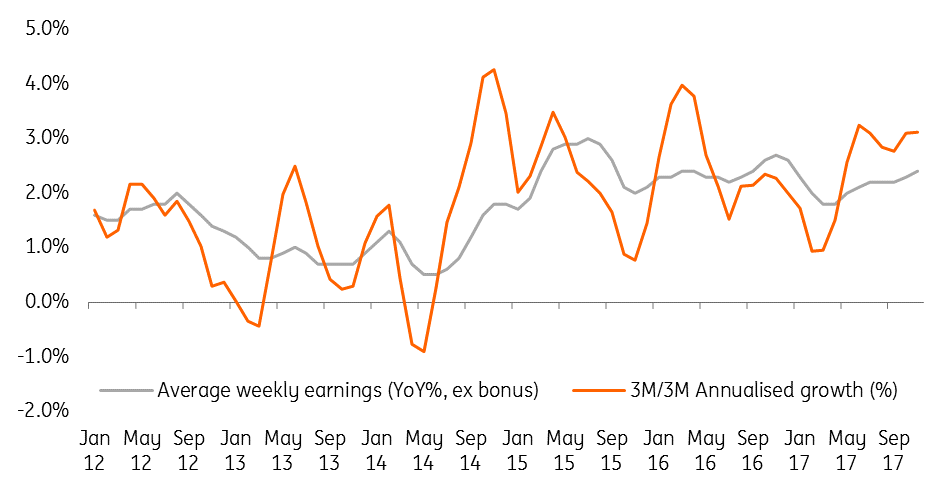

There is evidence of a pick-up in wage growth

On the former, there’s little doubt the latest news has been more positive. For instance, take a look at the 3M/3M annualized growth in wages (which whilst clunky-sounding, is a better measure of current momentum than year-on-year comparisons). This suggests pay is rising has been rising at an annualized rate of 3% over the past 3 or 4 months.

Recent wage growth momentum has been better

What’s less obvious is why wages have been rising more quickly of late, or how long it will last for. The upbeat explanation, and the one backed by the Bank of England, is that firms are having to increasingly hike salaries in a bid to retain staff. With the unemployment rate at the lowest level since 1975, there are signs that skills shortages are developing certain sectors. There have also been suggestions that some employers are feeling pressure to ensure wages keep pace with the cost of living, with inflation currently close to 3%.

| 3% |

UK Inflation |

This is all likely to be true, but there are a few reasons to treat the recent momentum with an element of caution. Some of the pick-up witnessed over recent months is linked to an increased minimum wage. It’s worth noting too that the latest rise comes off a very low base – the level of pay was virtually flat through last winter.

We doubt we will see a sustained pick-up unless productivity improves

We also suspect that some firms will continue to take a more conservative wage setting approach, particularly amidst low productivity growth, sluggish economic growth and rising input costs, all of which will be putting pressure on margins. We’re therefore still slightly skeptical that wage growth will rise dramatically as the Bank of England expects – 3% on average in 2018.

Having said that, we suspect the recent momentum may give the majority of MPC members more confidence that the direction of travel is positive. It’s also worth noting that the headline wage growth figures will be flattered by the base effects that we noted above (a weak start to 2017) over the next few readings. Put another way, there’s little reason at this stage for the Bank to doubt its optimistic outlook for pay – although we suspect they may look to nudge down their 3% forecast a touch at the February meeting.

While agreement of phase 1 on Brexit is a positive there is a long way to go and we are still waiting on the transition agreement

So with a tick provisionally in the wage growth box, the odds of a rate hike this year look increasingly dependent on Brexit. The BoE bought itself some time in December by saying that it would provide a fuller analysis of Brexit progress at the February meeting. But since it said that, there’s been little to report. Nothing has been firmly agreed on the transition period, while technical talks on the finer legal issues continue. Nor has there been any further clarity on which Brexit model the UK is aiming for. We’ll have to wait for a speech from PM May slated for mid-late February to get some initial clues here.

A February hike looks unlikely but May is a possibility

So with nothing new – and with the Brexit countdown clock continuing to tick – it’s perhaps not that surprising that BoE officials have done little to talk up the possibility of a February hike. The closest we’ve got to a rate hike signal so far this year is from Deputy Governor Broadbent, who when asked about the chances of a hike in 2018, said “Well, who knows. … we said over the three-year period… I think we had another two or three”.

We suspect the Bank will keep its cards equally close to its chest at this next meeting

We suspect the Bank will keep its cards equally close to its chest at this next meeting, albeit remaining cautiously optimistic on the direction of travel in the negotiations. But by the time May’s meeting rolls around, we’re likely to have a transition period agreed-in-principle (given firms have made it clear they’ll start preparing for the worst if there is no news by March). In theory, we’ll also have further clarity on the UK’s choice of trade model. We’ll also have a more concrete idea about the direction of wage growth.

Policymakers will also be acutely aware that Brexit talks could become increasingly messy in the lead-up to October, by which time a deal will need to be agreed to allow time for ratification. So May’s meeting could be the most opportune time to hike this year, and for now, we think it’s evenly balanced as to whether they do so or not.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more