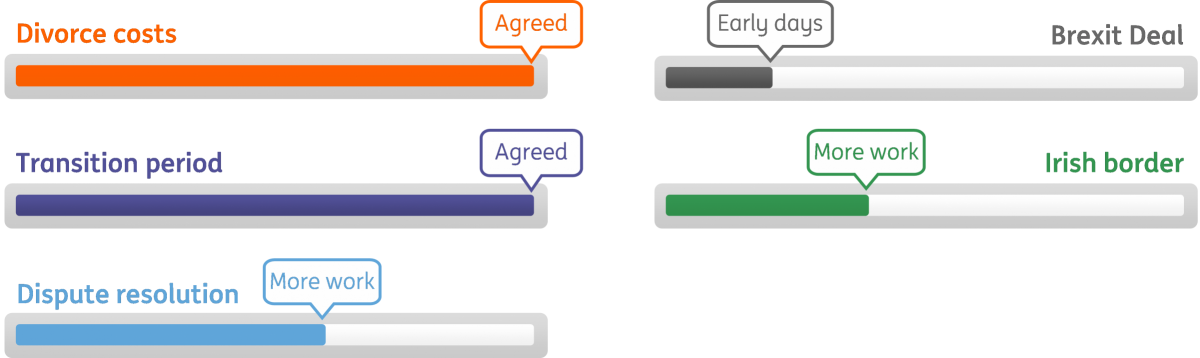

UK: Half way there

The Brexit transition period will bring welcome relief to businesses. But as talks reach the half-way mark, they're now enterring their most difficult phase yet

Negotiators have finally agreed a post-Brexit transition period

After weeks of deadlock, the March EU summit brought the welcome news that negotiators had reached a deal on a post-Brexit transition period. The agreement, which must still be formally ratified later this year, will create a period of time from the end of March 2019 (when the UK formally leaves the EU) until December 2020 where the UK's relationship with Europe will remain virtually unchanged.

This is good news for businesses. The strong commitment this deal brings will remove a fairly big layer of uncertainty, and should be enough to discourage firms from enacting contingency plans for a ‘cliff edge’ next year. But both sides remain poles apart on the post-Brexit trade agreement. As we pass the half-way mark in the Article 50 process, talks are arguably entering their most difficult phase yet. Negotiators have as little as six months to agree on a high level framework for future trade, allowing time for ratification by each individual EU parliament.

The UK’s proposals for post-Brexit trade – a model known as ‘managed divergence’ – have so far been met with a cold reception in Brussels. EU officials are fiercely opposed to ‘cherry-picking’ elements from the single market, and are cautious about agreeing to a deal that could embolden members of the European Economic Area (EEA) to seek their own concessions, or indeed encourage other EU members to look for the exit. Finding a workable solution to the Irish border is also a major focus, and this will be the sole focus of negotiations over the next month or so.

So the key word over the next six months will be “compromise”. This could see the UK stepping back from key red lines – a tough ask for Prime Minister May given the divisions within her government. But it’s also clear this could be lengthy process, and negotiations on the finer details of the post-Brexit trading relationship could extend well into the transition period. This had got observers and businesses increasingly questioning whether a 21-month transition will be long enough for firms to adapt, and for the new customs infrastructure to be built.

Brexit progress check

A May rate hike looks increasingly likely

In the short-term though, the agreement of a transition period makes the prospect of a near-term rate hike from the Bank of England all the more likely. Officials have long talked-up the importance of having an interim period, and at least for now, it will bolster its assumption that the Brexit process will be “smooth”. This comes as the other key input into the Bank’s thought process – wage growth – continues to show signs of life.

Rising wage growth is a key driver in the Bank of England’s thinking. Admittedly, at 2.6%, the current uptick in wage growth says just as much about weakness at the same time last year, as it does about current strength. But even so, the latest numbers indicate that firms are under higher pressure to lift pay to retain/attract talent as the jobs market remains relatively tight. Other surveys paint a similar picture: evidence from BoE agents point to the best year for pay since the crisis, whilst a Markit/REC employment survey recently indicated that starting salaries are rising at the fastest rate in two-and-a-half years.

The combination of Brexit progress and better wage growth figures effectively give the green light on a rate hike at the next meeting in May. The bigger question now is whether they will hike again later this year – markets think it’s roughly 50:50.

A rate hike later in the year could prove tricky

This seems about fair, although we currently think the Bank could run into difficulties in hiking beyond the summer. For one thing, the conclusion of Brexit talks in the autumn will almost certainly be a noisy one. And whilst incomes are no longer falling in real terms, they aren’t set to start rising rapidly any time soon either. With consumer confidence not far off post-Brexit lows (at a time when shoppers globally are the most optimistic they’ve been in over a decade), we think overall economic growth will continue to struggle this year.

This article is taken from our Monthly Economic Update, which you can find here.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more