Turk Telekom: Somewhere to run to

Turk Telekom has reported a solid set of results that continue to defy the general gloom surrounding Turkey. Excellent operational results, stable leverage and ample cash reserves provide a good buffer against current volatility

Results highlights

-

Turk Telekom reported a decent set of 2Q18 numbers. Second quarter revenue rose 10% year on year to TRY5bn, helping EBITDA rise 10% YoY to TRY2.0bn with a 40% margin (1Q18 margin: 42.1%).

-

However, the company posted a net loss of TRY889m in 2Q due to unfavourable currency moves and hedging costs, without which it would have achieved net income of TRY676m.

-

Strong customer attraction and upselling drove Turk Telekom's robust EBITDA performance. Total subscribers reached 43.5m (+937,000 QoQ). LTE now covers 88% of the country, up from 77% last year. ARPU rose from TRY28.2 to TRY30.2 YoY in Mobile but fell slightly from TRY44.6 to TRY43.6 YoY in Broadband. Operationally, this company is in very good shape.

-

Balance sheet metrics also remained solid. Net debt/EBITDA of 1.96x was flat YoY, though the current ratio fell back from 1.27x to 0.99x over the same period. Capex fell 50% YoY to TRY 724mn, putting the Capex/Sales ratio at a decent 14.6%.

-

Regarding the outlook, Turk Telekom is maintaining guidance for 2018 revenues to grow by about 11%, EBITDA to come in at TRY7.6-7.8bn and capex to rise slightly to around TRY4.1bn.

Earnings in detail

-

Turk Telekom's 2Q18 revenues increased by an impressive 10.0% YoY to TRY5.0bn as past (and ongoing) investments in infrastructure and content bore fruit. New subscribers were added across all three growth areas of the company: Broadband (+1.2m), Mobile (+1.4m) and Home TV (+557,000).

-

As well as growing volumes, ARPU increased in Mobile but fell back slightly flat in Broadband, as Turk Telekom competed to maintain its edge in subscriber additions. Broadband ARPU fell back TRY1.0 to TRY43.6 as the proportion of customers using over 75GB of data per month increased from 26% to 35% YoY, while Mobile ARPU rose 7.8% to TRY30.2 as smartphone penetration rose to 82% (well ahead of the market) and average monthly data usage increased 29.5% YoY to 5.7GB per user.

Revenue contributions by segment

-

Looking at the company’s operations, 40% of revenues were generated by Mobile (revenues +11.3% YoY), 29% by Broadband (+10.9%), 10% by Corporate Data (+16.9%) and just 14% by Fixed Voice (-1.4%).Turk Telekom began rolling out its LTE capabilities on 1 April 2016. At the time of writing, 73% of TURKTI’s mobile customers use an LTE-capable smartphone, up from 60% last year. These customers also use more data than their non-LTE peers, increasing ARPU for the company.

-

Bringing all this together, EBITDA increased by 15.0% YoY to TRY2.0bn. The EBITDA margin came in at 40%, up 2ppt YoY but down slightly QoQ. The YoY number was somewhat inflated by the introduction in January of IFRS 15 (see more here). Operating profit was up 12.7% to TRY1.1bn (margin: 21%). However, the bottom line was impacted by a TRY1.9bn charge due to currency moves, causing the company to post a net loss of TRY889m in 2Q18, down from a TRY890m profit in 2Q17.

-

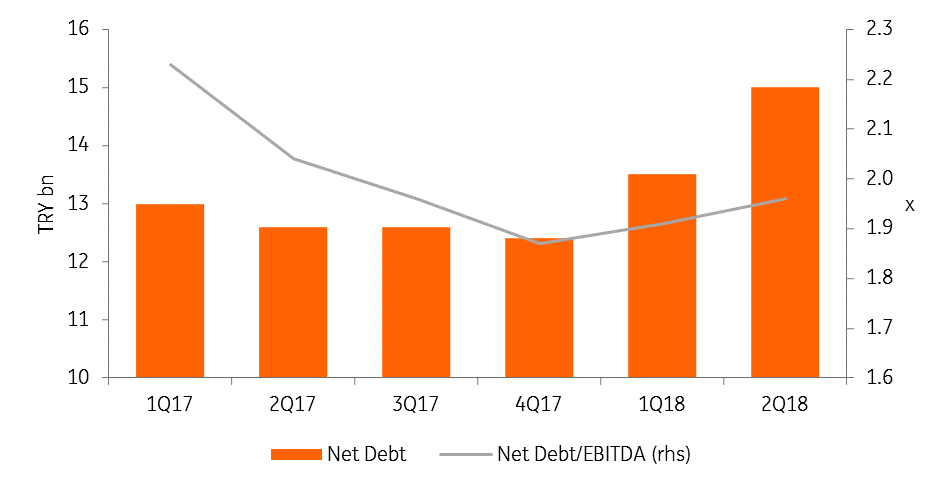

Turning to the balance sheet, the increase in EBITDA was not enough to offset a rise in net debt from TRY13.5bn to TRY15.0bn QoQ (2Q17: TRY12.6bn), causing leverage to tick up very slightly from 1.83x to 1.96x (2Q17: 1.96x). With the spectrum payments and significant investments behind it (Capex is expected to remain fairly steady in 2018), we are optimistic that we should see a further improvement in underlying leverage in the coming quarters, although the capex numbers are affected by the new accounting rules and IFRS 16 will increase borrowings when the company adopts it in January 2019.

- Turk Telekom has total gross debt outstanding of TRY19.3bn. 30% matures in the next twelve months, with a further 19% to follow in 1-2 years, 30% in the 2-5 year bucket and another 21% falling due in over five years. The average maturity of the book is 2.8 years.

-

Turk Telekom remains vulnerable to currency risk due to currency mismatches between assets and liabilities. While assets (and revenues) are priced in TRY, the overwhelming majority of its debt is denominated in FX. At end-2Q18,Turk Telekom had US$4.2bn equivalent of gross FX debt, with a hedge ratio of 43%, up from just 13% in 1Q17. Note that the hedge ratio includes participating cross-currency swaps, FX swaps and cash denominated in FX.

Net debt and leverage development

- Liquidity is decent, though it has weakened recently. The company’s current ratio stands at 0.99x, down from 1.27x in 2Q17. Operating cash flow remains strong at TRY1.8bn, higher than the TRY1.5bn reported in 2Q17. Cash and equivalents increased from TRY2.1bn to TRY4.3bn over the period on higher revenues

Regarding the outlook, Turk Telekom has maintained guidance for 2018 revenues to grow by about 11%, EBITDA to come in at TRY7.6-7.8bn and capex to rise to around TRY4.1bn. The latter two have been adjusted upwards since year-end to reflect the new accounting rules.

Following the strong performance in 1H18, ongoing evidence of strong increases in data consumption and economic digitalisation and the stabilisation in underlying capex as the investment cycle turns, we find these targets entirely credible.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).