Trade trumps positive payrolls

Another decent jobs' report, but with heightened trade tensions posing downside risks for growth, the Fed will remain in easing mode

| 164k |

July increase in non-farm payrolls165k consensus |

Payrolls a victim of the economy's success

US non-farm payrolls rose 164,000 in July, almost identical to the 165,000 consensus forecast. There were 41,000 downward revisions to the past couple of months and we are running well below the 220,000 or so average seen through 2018. On balance, however, the report shows that US companies still have an appetite to hire. Indeed, we continue to argue that a slowdown in hiring should be expected. This is the longest US economic expansion since records began in 1854 with unemployment close to 50-year lows at 3.7% (same as in June) so it is unsurprising that companies complain that difficulty finding suitable workers is the biggest constraint on hiring.

| 3.2% |

Annual rate of wage increases YoYversus 3.1% consensus forecast |

Wages boosted by competition for staff

This competition for workers helped push wage growth higher in July. A second consecutive 0.3%MoM gain has lifted the annual rate of wage growth up to 3.2%. This is well ahead of the 1.6% consumer price inflation figure so real household disposable incomes are rising at a decent clip, which should underpin support for spending.

Trade remains key for markets and Fed

The latest escalation of trade tensions and the fear that it will hurt confidence, put up costs, damage supply chains and make business less inclined to invest and hire new workers will continue to drive market sentiment. Nonetheless, a strong domestic jobs market helps to mitigate the threat to activity in the near term. With unemployment at such low levels and the competition of staff remaining intense, workers have a sense of job security. With wages rising in a benign inflation environment, they have spending power too.

However, the “uncertainties” that the Federal Reserve worries about – trade and a weaker global growth story – are being ratchetted up and the Fed looks set to follow this week’s rate cut with another 25bp move in September. What happens thereafter depends largely on how trade talks progress.

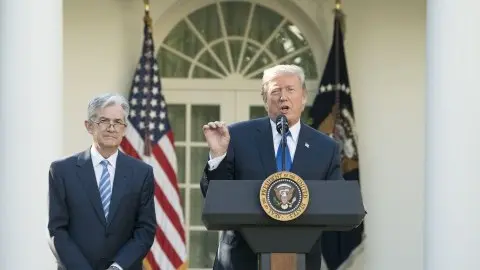

A positive conclusion in the coming months coupled with the US’ strong domestic fundamental (our base case) should mean this concludes the “midcycle adjustment” Jerome Powell described on Wednesday. But if the situation deteriorates and economic weakness spreads then the Fed will respond with more stimulus given the benign inflation backdrop. As such monetary policy, much like trade policy, is firmly in President Trump’s hands.

Download

Download article

2 August 2019

In case you missed it: When trade, markets and the Fed collide This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more